Overall, AvaTrade offers its partners a forex cashback on all trading accounts that their clients register up to 30% of the spread or up to 0.35 pips on forex, indices, crypto, commodities, ETFs, and bonds. However, traders could earn higher rebates depending on their trading volumes.

| 🔎 Market | 📌 AvaTrade MT4 Spread Rebates | 📍 AvaTrade MT4 Pip Rebates |

| 📉 Forex | 30% | 0.35 pips |

| 📈 Indices | 30% | 0.35 pips |

| 🪙 Cryptocurrency | 30% | 0.35 pips |

| 💎 Precious Metals | 30% | 0.35 pips |

| 💡 Energies | 30% | 0.35 pips |

| 📊 Shares | 30% | 0.35 pips |

| 📌 ETFs | 30% | 0.35 pips |

| 🍎 Soft Commodities | 30% | 0.35 pips |

| 📍 Bonds | 30% | 0.35 pips |

| 💷 Payment Frequency | AvaTrade offers a monthly cashback | AvaTrade offers a monthly cashback |

AvaTrade Cashback Rebates – 33 Key Point Quick Overview

- ✅ AvaTrade Rebates Summary

- ✅ How to Open a Forex Cashback Account with AvaTrade (via SAShares)

- ✅ Number of Traders participating in AvaTrade Cashback Rebates

- ✅ AvaTrade Rebate Comparison vs. Notable Other Brokers

- ✅ Detailed Summary of AvaTrade

- ✅ AvaTrade – Advantages over Competitors

- ✅ Geolocation of Traders

- ✅ Trading with AvaTrade – Who Will Benefit

- ✅ AvaTrade Regulation and Safety of Funds

- ✅ AvaTrade Awards and Recognition

- ✅ AvaTrade Account Types and Features

- ✅ How to open an Account with AvaTrade

- ✅ AvaTrade Trading Platforms

- ✅ AvaTrade Investment Programs

- ✅ Which Markets Can You Trade with AvaTrade?

- ✅ Financial Instruments and Leverage offered by AvaTrade

- ✅ AvaTrade Trading and Non-Trading Fees

- ✅ AvaTrade Deposits and Withdrawals

- ✅ AvaTrade Education and Research

- ✅ AvaTrade Bonuses and Current Promotions

- ✅ How to open an Affiliate Account with AvaTrade

- ✅ AvaTrade Affiliate Program Features

- ✅ AvaTrade Corporate Social Responsibility

- ✅ AvaTrade Alternatives

- ✅ AvaTrade VPS Review

- ✅ AvaTrade Web Traffic Report

- ✅ AvaTrade Customer Support

- ✅ AvaTrade vs. Other Notable Brokers

- ✅ Trading with AvaTrade Pros and Cons

- ✅ AvaTrade User Reviews

- ✅ Recommendation for Improving AvaTrade Cashback Rebates

- ✅ Our Verdict on AvaTrade

- ✅ AvaTrade Frequently Asked Questions

AvaTrade Rebates Summary

- ✅ AvaTrade has an overall rating of 4.3 / 5

- ✅ AvaTrade has a Real Customer Rating of 4.2 / 5

AvaTrade Conditions

- ✅ Until the total income generated from all your transactions reaches a threshold greater than any bonus amount, AvaTrade will not release any commission to you.

- ✅ The margin used using bonus funds does not qualify for rebates.

The following traders are not eligible to receive rebates:

- ✅ Persons residing in the European Union, New Zealand, Israel, or Hong Kong.

- ✅ Financial Institutions in Japan FSA and Israel ISA

AvaTrade Additional Notes on Cashback Rebates

- ✅ Clients of AvaTrade get rebates, or a percentage of the transaction cost, for each trade they make, resulting in a smaller spread and a higher win rate.

How to Open a Forex Cashback Account with AvaTrade (via SAShares)

You can follow these steps to register for a Forex Cashback Account with AvaTrade via SAShares.

For New Accounts

If you do not have an existing account with AvaTrade, you can easily obtain a cashback rebate in three simple steps.

✅ Step 1: Visit the AvaTrade Website

Visit the AvaTrade website and click “Open New Account.”

✅ Step 2: Submit Trading ID to SAShares

Submit your Trading ID to us: [SAShares]

For Example:

To: [SAShares]

Subject: New AvaTrade Rebate Application

“Dear SAShares Team,

Please view my AvaTrade Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

✅ Step 3: Await Approval.

Wait for approval, which will be sent within [number of hours]. Once approval is given, you will automatically receive your cashback rebates from the AvaTrade system.

For Existing Accounts

If you have an existing AvaTrade account, you can get a cashback rebate by following these simple steps.

✅ Step1: Contact AvaTrade via Email

Send an email to AvaTrade: [email address for broker]

Request that the broker transfer the trading account under the following SAShares Affiliate ID: [SAShares]

For Example:

To: [SAShares]

Subject: Account Transfer Request

“Dear AvaTrade Partner/Affiliate Team,

I would hereby like to request that my account be transferred to IB/Partner/Affiliate code [SAShares Code]. Furthermore, I would hereby like to request to be assigned under the mentioned IB regardless of whether my account falls under an umbrella or parent IB.”

✅ Step 2: Create an Additional Account

Once you receive confirmation of the transfer from AvaTrade, you can create an additional trading account.

✅ Step 3: Supply Trading/Client ID

Lastly, you can send your Trading or Client ID to [SAShares].

For Example:

To: [SAShares]

Subject: New AvaTrade Rebate Application

“Dear SAShares Team,

Please view my AvaTrade Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

Number of Traders participating in AvaTrade Cashback Rebates

AvaTrade has more than 300,000 registered traders who have active trading accounts. However, it is unclear how many of these clients currently participate in Exness’ Cashback Rebates.

AvaTrade Rebate Comparison vs. Notable Other Brokers

To view AvaTrade’s comprehensive Cashback Rebates Program, we compared it with other notable brokers using the VIP, ECN, or Professional Accounts.

| 🔎 Broker | 🥇 AvaTrade | 🥈 XM | 🥉 OANDA |

| 📈 Forex | 0.35 pips / 20% | Up to $7.50 per lot | $1 per lot per 100K traded |

| 💡 Energies | 0.35 pips / 20% | Up to $6.50 per lot | n/a |

| 🪙 Cryptocurrency | 0.35 pips / 20% | Up to $15 per lot | n/a |

| 💍 Precious Metals | 0.35 pips / 20% | Up to $3 for GoldUp to $7.50 for Silver | n/a |

| 📊 Indices | 0.35 pips / 20% | Up to $2.65 per lot | n/a |

| 📉 Shares | 0.35 pips / 20% | Up to $3.33 per lot | n/a |

| 📌 ETFs | 0.35 pips / 20% | n/a | n/a |

| 🍎 Soft Commodities | 0.35 pips / 20% | Up to $7.50 per lot | n/a |

| 📍 Bonds | 0.35 pips / 20% | n/a | n/a |

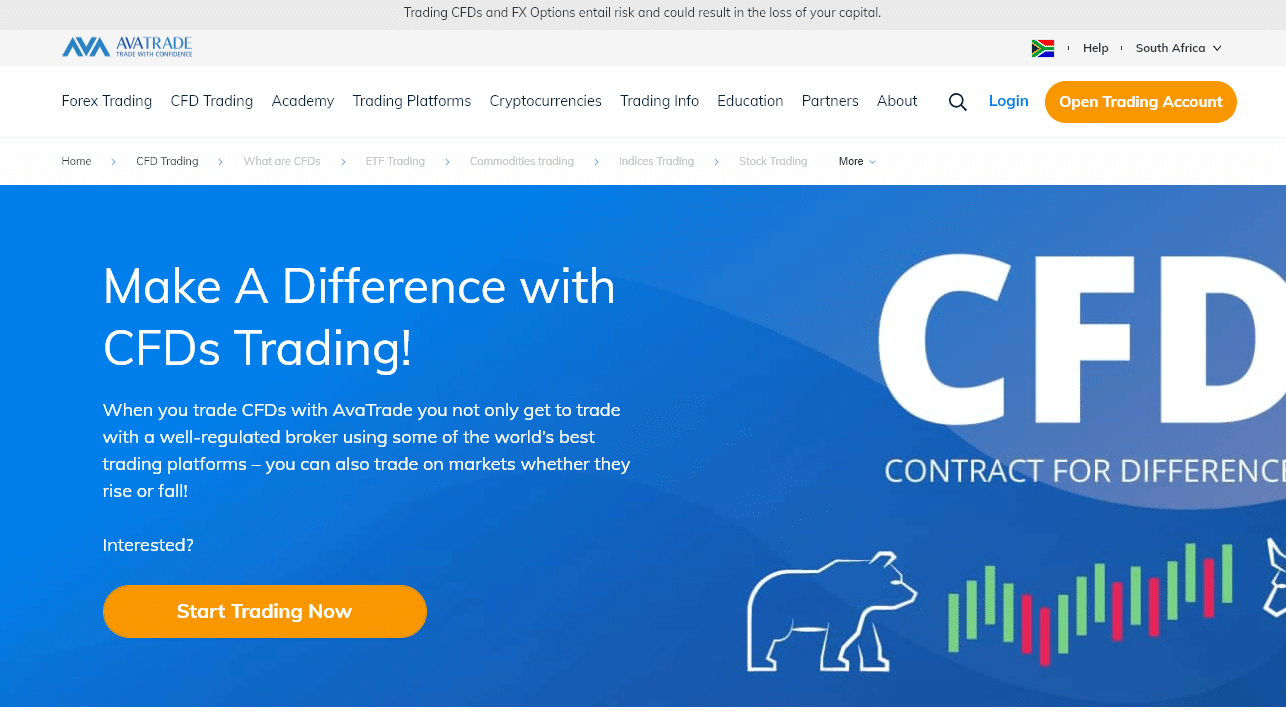

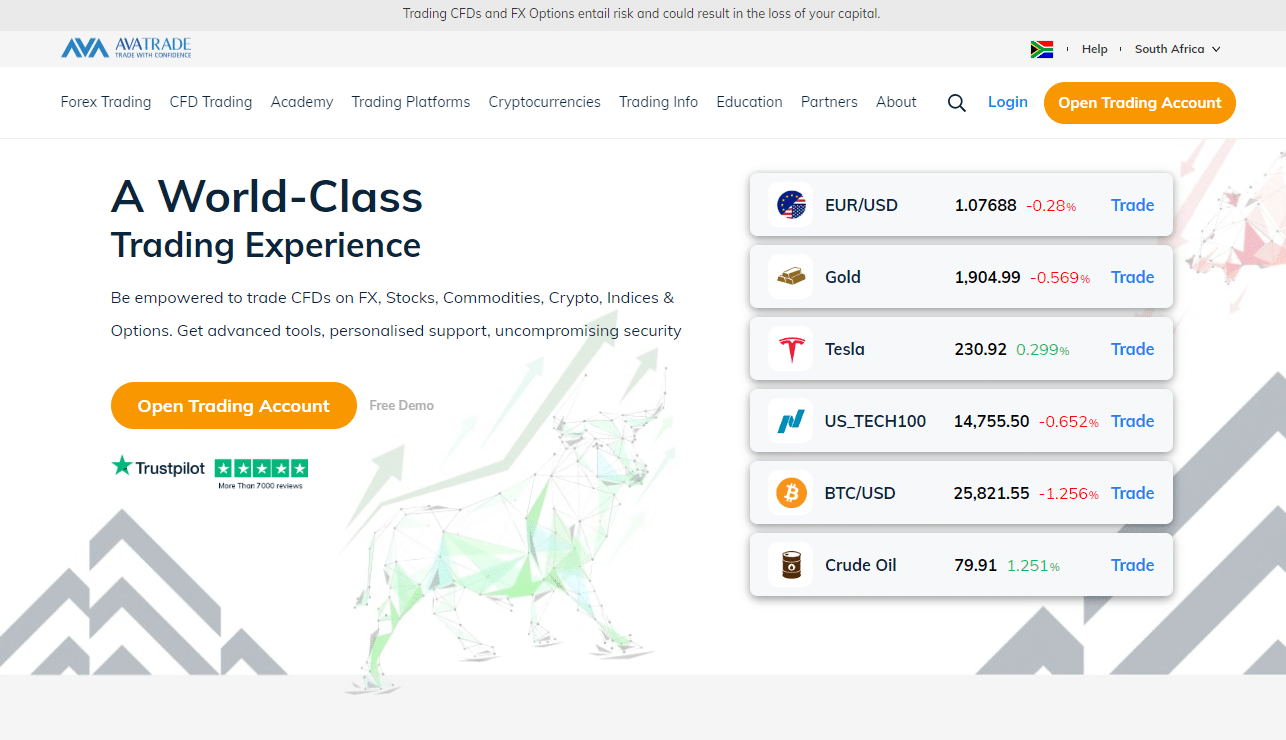

Detailed Summary of AvaTrade

| 🔎 Headquartered | Dublin, Ireland |

| 📉 Global Offices | Australia, Ireland, South Africa, Japan, British Virgin Islands, UAE |

| 📈 Year Founded | 2006 |

| 📊 Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| ➡️ Tier-1 Licenses | Central Bank of Ireland (CBI)Australian Securities and Investment Commission (ASIC)Japanese Financial Services Authority (JFSA)Financial Futures Association of Japan (FFAJ)Investment Industry Regulatory Organization of Canada (IIROC) through Friedberg Mercantile |

| ↪️ Tier-2 Licenses | Cyprus Securities and Exchange Commission (CySEC)Financial Sector Conduct Authority (FSCA)Israel Securities Authority (ISA)Abu Dhabi Global Market Financial Services Regulatory Authority (ADGM FRSA)Polish Financial Supervision Authority (KNF) |

| 📌 Tier-3 Licenses | British Virgin Islands Financial Service Commission (BVI FSC) |

| 🔟 License Number | Ireland (C53877)Australia (406684)South Africa (45984)British Virgin Islands (SIBA/L/13/1049)Japan (JFSA 1662, FFAJ 1574)Abu Dhabi (190018)Cyprus (247/17)Israel (514666577)Poland (693023)Canada (Friedberg Mercantile) |

| ⛔ Regional Restrictions | United States, Belgium, Syria, Iran, New Zealand, Cuba |

| ☪️ Islamic Account | ✅ Yes |

| 🆓 Demo Account | ✅ Yes |

| 📌 Non-expiring Demo | None |

| ⏰ Demo Duration | 21 days |

| 1️⃣ Retail Investor Accounts | 1 |

| ➡️ PAMM Accounts | MAM Accounts |

| ↪️ Liquidity Providers | Currenex and other bank and non-bank entities |

| 🤝 Affiliate Program | ✅ Yes |

| 📉 Order Execution | Instant |

| 📈 OCO Orders | None |

| 📊 One-Click Trading | ✅ Yes |

| 🚩 Scalping Allowed | ✅ Yes |

| 🧱 Hedging Allowed | ✅ Yes |

| 📎 News Trading Allowed | ✅ Yes |

| ➡️ Expert Advisors (EAs) | ✅ Yes |

| ↪️ Trading API | ✅ Yes |

| 📉 Starting spread | 0.9 pips EUR/USD |

| 📈 Minimum Commission per Trade | None, only the spread is charged |

| 💹 Decimal Pricing | 5th decimal pricing after the comma |

| ▶️ Margin Call | 50% on Retail25% on AvaOptions Accounts |

| ⛔ Stop-Out | 10% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| 🪙 Crypto trading | ✅ Yes |

| 💴 USD Account | None |

| ❤️ Dedicated Account Manager | None |

| ➕ Maximum Leverage | 1:30 (Retail)1:400 (Pro) |

| ✔️ Leverage Restrictions | None |

| 💵 Minimum Deposit (USD) | $100 |

| 💶 Deposit Currencies | AUD, USD, GBP, EUR, CHF, JPY, ZAR |

| 💷 Account Base Currencies (All) | ZAR, USD, GBP, or AUD |

| 👥 Active AvaTrade customers | 300,000+ |

| 💳 Deposit and Withdrawal Options | Wire TransferElectronic Payment GatewaysCredit CardsDebit Cards |

| *️⃣ Minimum Withdrawal Time | 24 to 48 Hours |

| #️⃣ Maximum Estimated Withdrawal Time | Up to 10 days |

| 🅰️ Instant Deposits and Instant Withdrawals | None |

| 🅱️ Segregated Accounts | ✅ Yes |

| 🖥️ Trading Platforms | AvaTradeGOAvaTrade WebAvaOptionsAvaSocialMetaTrader 4MetaTrader 5DupliTradeZuluTrade |

| 💻 Trading Platform Time | GMT |

| 📉 Observe DST Change | ✅ Yes |

| 📈 DST Change Time zone | Eastern Standard Time (EST) |

| 📊 Tradable Assets | ForexStocksCommoditiesCryptocurrenciesTreasuriesBondsIndicesExchange-Traded Funds (ETFs)OptionsContracts for Difference (CFDs)Precious Metals |

| ➡️ Languages supported on the website | English, Chinese (Simplified), Chinese (Traditional), Turkish, Thai, Slovakian, Russian, Portuguese, Polish, German, Hungarian, French, and several others |

| ↪️ Customer Support Languages | Multilingual |

| ↘️ Copy Trading Support | ✅ Yes |

| ⏰ Customer Service Hours | 24/5 |

| 🎉 Bonuses and Promotions | ✅ Yes |

| 📝 Education for beginners | ✅ Yes |

| 📊 Proprietary trading software | ✅ Yes |

| 💙 Is AvaTrade a safe broker for traders | ✅ Yes |

| ↪️ Rating for AvaTrade | 9/10 |

| 💚 Trust score for AvaTrade | 93% |

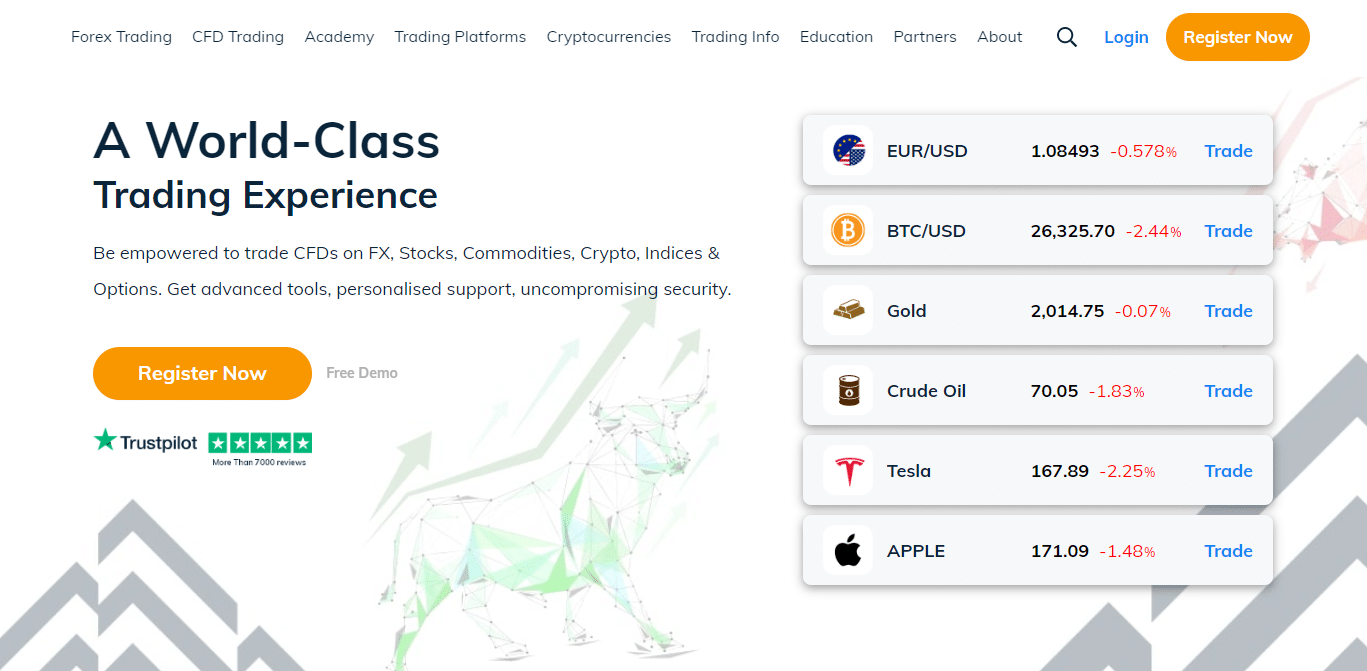

AvaTrade – Advantages over Competitors

AvaTrade has the following advantages over its competitors:

- ☑️ AvaTrade is licensed by five tier-1, five tier-2, and one tier-3 market regulators, making it a low-risk broker for trading CFDs and forex.

- ☑️ A high degree of security for client monies kept in separate accounts.

- ☑️ Through Sharp Trader, AvaTrade delivers outstanding instructional help through unique videos, articles, eBooks, and daily market analysis.

- ☑️ AvaTrade offers its platforms in addition to MetaTrader, including AvaTrade WebTrader and AvaTradeGO. These platforms feature unique tools like AvaProtect.

- ☑️ AvaTrade also provides specific accounts for Islamic traders.

- ☑️ AvaTrade provides the social copy trading platforms AvaSocial, ZuluTrade, and DupliTrade.

- ☑️ The AvaOptions app, powered by Sentry Derivatives, is an excellent mobile trading platform for forex options that is available to AvaTrade clients.

- ☑️ In addition to offering 53 options, AvaTrade also provides access to over 1,200 CFDs

- ☑️ AvaTrade provides protection against negative balances.

Finally, AvaTrade provides a welcome bonus to all traders who register a new account.

What makes AvaTrade so popular?

AvaTrade is popular because of its 1,260 instruments (MetaTrader 5), user-friendly platforms, safe and well-regulated trading environment, global presence, a plethora of educational resources, and more.

Does AvaTrade accept US traders?

No, AvaTrade does not serve clients from the United States.

Geolocation of Traders

Most of AvaTrade’s market share is concentrated in these areas:

- ✅ South Africa – 78.25%

- ✅ India – 9.46%

- ✅ Pakistan – 3.53%

- ✅ Poland – 2.63%

- ✅ Cameroon – 2.34%

AvaTrade’s Current Expansion Focus

AvaTrade has offices around the world and is expanding within these areas:

- ✅ Australia

- ✅ Africa

- ✅ Japan

- ✅ British Virgin Islands

- ✅ UAE

- ✅ Ireland

Countries not accepted by AvaTrade

AvaTrade offers its services worldwide, but the following countries are restricted from service:

- ✅ United States

- ✅ Belgium

- ✅ Syria

- ✅ Iran

- ✅ New Zealand

- ✅ Cuba

Popularity among traders who choose AvaTrade

AvaTrade is a multi-award-winning broker that falls within the Top 5 brokers in the world.

Trading with AvaTrade – Who Will Benefit

Both beginners and professional traders will benefit from using AvaTrade, attributable to the range of educational materials and advanced tools offered. Furthermore, AvaTrade accommodates all trading styles and strategies, making it a flexible broker for all traders.

How to Maximise Your Savings/Profits with Forex Trading Rebates at AvaTrade

- ✅ Frequent Trading: The more frequently you trade, the more rebates you can earn. AvaTrade calculates rebates for each transaction, so trading frequently can result in substantial cashback over time.

- ✅ Trade Greater Volumes: Rebates are frequently calculated based on trade volume. Consequently, volume trading can result in increased rebates.

- ✅ Select Currency pairings with High Rebates: Some currency pairings may offer higher rebates than others. Research and trade those currency pairings with the most advantageous rebate rates.

- ✅ Consider Reinvesting the Cashback: Rather than withdrawing it, consider reinvesting it in your trading. This could increase your trading capital and lead to increased profits.

- ✅ Observe Your Trading Costs: Maintain a close watch on your trading costs. The rebate program aims to reduce these costs, ensuring that your trading strategy does not result in excessive costs that outweigh the rebates’ benefits.

AvaTrade will occasionally offer unique promotions or increased rebate rates. Keep abreast of AvaTrade’s news and seize these opportunities when they present themselves.

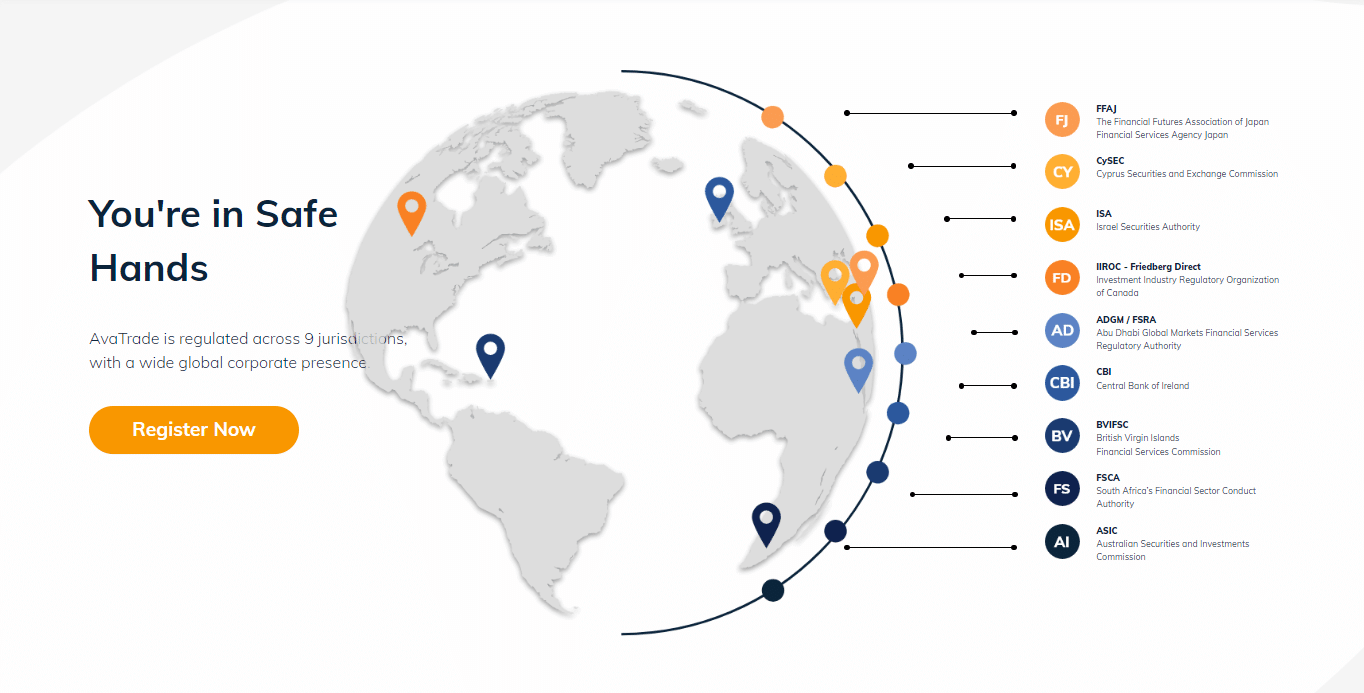

AvaTrade Regulation and Safety of Funds

AvaTrade Global Regulations

| 🔎 Registered Entity | 🌎 Country of Registration | 📌 Regulatory Entity | 📍 Tier | 📈 License Number/Ref |

| 1️⃣ AVA Trade EU Ltd | Ireland | CBI | 1 | C53877 |

| 2️⃣ DT Direct Investment Hub Ltd. | Cyprus | CySEC | 2 | 247/17 |

| 3️⃣ AVA Trade EU Ltd | Poland | KNF | 2 | 693023 |

| 4️⃣ AVA Trade Ltd | British Virgin Islands | BVI | 3 | SIBA/L/13/1049 |

| 5️⃣ Ava Capital Markets Australia Pty Ltd | Australia | ASIC | 1 | 406684 |

| 6️⃣ Ava Capital Markets Pty | South Africa | FSCA | 2 | FSP 45984 |

| 7️⃣ Ava Trade Japan K.K. | Japan | JFSA, FFAJ | 1 | JFSA 1662 FFAJ 1574 |

| 8️⃣ Ava Trade Middle East Ltd | UAE | ADGM | 2 | 190018 |

| 9️⃣ ATrade Ltd | Israel | ISA | 2 | 514666577 |

| 🔟 Friedberg Direct | Canada | IIROC | 1 | Friedberg Mercantile |

How AvaTrade Protects Traders and Client Funds

| 🔎 Security Measure | ➡️ Information |

| 🔒 Segregated Accounts | ✅ Yes |

| 🔏 Compensation Fund Member | ✅ Yes |

| 🔐 Compensation Amount | 20,000 EUR |

| 🔓 SSL Certificate | ✅ Yes |

| 🔒 2FA (Where Applicable) | ✅ Yes |

| 🔏 Privacy Policy in Place | ✅ Yes |

| 🔐 Risk Warning Provided | ✅ Yes |

| 🔓 Negative Balance Protection | ✅ Yes |

| 🔒 Guaranteed Stop-Loss Orders | None |

How does AvaTrade guarantee client fund safety?

AvaTrade uses segregated bank accounts, offers compensation to eligible clients, applies for negative balance protection, and is multi-regulated.

Is AvaTrade regulated in the UK by the FCA?

No, AvaTrade is not regulated by the Financial Conduct Authority in the United Kingdom. However, the broker has several other licenses globally.

AvaTrade Awards and Recognition

According to AvaTrade’s website, the company has been recognized for the following honors in recent years as a broker:

- Best Mobile Trading Platform in UAE (2022)

- Most Trusted Trading Platform in Europe (2022)

- Most Innovative CFD Broker in the United Kingdom (2022)

- Best Educational Broker in the United Kingdom (2022)

- Best Mobile Trading Platform Overall (2022)

- Best Fixed Spread Broker (2022)

- Most Innovative CFD Broker UAE (2022)

- CEO Reviews’ Top Brand Award (2021)

- Best Forex Broker Ireland (2021)

Finally, Avatrade was awarded the title of Best Retail Broker UAE (2021).

Where can I find AvaTrade’s Awards?

You can visit the official website, click “About”, and go to “Awards” to view the comprehensive list AvaTrade has collected over the years.

AvaTrade Account Types and Features

AvaTrade provides retail traders with a single basic account with assorted options and the possibility of obtaining a professional account if they meet the qualifications for professional status. The type of account traders can establish is subject to the regulatory requirements in their district. AvaTrade offers the following options for retail investor accounts, which may vary depending on the region in which the company operates:

- ✅ Europe (Ava Trade EU Ltd) – Retail, Professional, Options, and Spread Betting account.

- ✅ Europe (DT Direct Investment Hub Ltd) – Retail, Professional, and Options account.

- ✅ British Virgin Islands – Standard, Options

- ✅ Australia – Standard, Options

- ✅ South Africa – Standard, Options

- ✅ Japan – Retail, Options

- ✅ Abu Dhabi – Retail, Professional, Options

- ✅ Israel – Standard, Options

AvaTrade Retail Investor Account

AvaTrade offers a Standard Retail Account suitable for traders and intermediate investors seeking access to global markets. The features on this account are as follows:

| 🔎 Account Features | Value |

| 💶 Minimum Deposit Requirement | 100 units in ZAR, USD, GBP, or AUD |

| 🪙 Base Account Currency Options | ZAR, USD, GBP, or AUD |

| 📊 Maximum Leverage | 1:30 (Retail)1:400 (Professional) |

| 📈 Range of Markets Offered | More than 1,260 tradable instruments |

| 💻 Trading Platforms | AvaTradeGOAvaOptionsAvaSocialMetaTrader 4MetaTrader 5DupliTradeZuluTrade |

| 💵 Commissions on trades | None |

| 📉 Average spreads | From 0.9 pips EUR/USD |

| ➡️ Margin Requirements | From 0.25% when using the leverage of 1:400 |

| ❤️ Customer Support Channels | Social Platforms Email Request Telephone WhatsApp Live Chat |

| 📍 Trading Strategies Allowed | All |

AvaTrade Demo Account

Traders may evaluate AvaTrade’s market pricing and trading platform functionality with a free demo account. For those just getting started in the forex market, an AvaTrade demo account is a wonderful way to evaluate the waters without putting their money on the line.

Traders may access the AvaTrade demo account by filling out a quick registration form with their personal information or by signing in with one of their social media accounts (Facebook or Google). When opening a live trading account with AvaTrade, traders are not required to provide identification or verification documents.

There is no risk involved in trying out AvaTrade’s services with a demo account since the virtual funds (up to $100,000) in the demo account are purely educational.

However, with a demo account, traders have access to all the markets AvaTrade offers, allowing them to hone their skills and try out innovative approaches risk-free.

AvaTrade Islamic Account

| 🅰️ Account | 💴 Minimum Dep. | 📊 Average Spread | 💵 Commissions | 💷 Average Trading Cost |

| 🅱️ Islamic Account | $100 | 0.9 pips | None | 9 USD |

Muslim traders can open an Islamic account with AvaTrade, which offers the same trading conditions as a standard account but without interest or fees. If you open an AvaTrade Islamic account, you will have access to even more features:

With regards to financial activities offered by AvaTrade on the Swap-Free Account, the following are all acceptable under Islamic law:

- ✅ Halal Gold and Silver Trading

- ✅ Halal Oil Trading

- ✅ Halal Indices Trading

Finally, Islamic Forex Trading is offered by AvaTrade on the Swap-Free Account.

AvaTrade Professional Account

| 🔎 Account | 💴 Minimum Dep. | 📉 Average Spread | 💶 Commissions | 🪙 Average Trading Cost |

| 🥇 Professional Account | $100 | 0.6 pips | None | 12 USD |

In addition to a more favorable spread and the absence of trading costs, the Pro account’s unique target audience consists only of accredited investors.

Compared to the Standard account’s regular spread of 0.9 pips, the Pro account’s average EUR/USD spread of 0.6 is more attractive. Furthermore, traders can also connect their real accounts with DupliTrade or ZuluTrade.

Furthermore, to qualify for the AvaTrade Professional Account, traders must fulfill these criteria:

- ✅ At least twelve months of continuous market activity in the appropriate financial market. The average number of CFD, FX, or spread betting trades has been ten for the last four quarters.

- ✅ Traders need to have worked in the financial services industry for at least a year

Lastly, traders must have a minimum investment portfolio of €500,000 (or its equivalent in any other currency) consisting of cash and financial instruments.

AvaTrade PAMM/MAM Accounts

MAM (Multi-Account Manager) is a software application provided by AvaTrade that enables you to manage several accounts from a single interface. The program interfaces flawlessly with the MetaTrader (MT4) platform, allowing investment businesses and experienced traders to execute bulk transactions with as many customer sub-accounts as desired to utilize a single MT4 interface.

This makes bulk orders with infinite accounts easy, quick, and effective. Making life simpler and account management easier. The MAM software communicates all allocation parameters to AvaTrade’s MT4 server, allowing it to manage the remaining process components efficiently.

Enables money managers to execute block orders involving potentially hundreds of accounts with a single click on the Master Account and no delay in the data transfer after the instruction for such a transfer. In addition to real-time monitoring of performance and commissions, you may manage customers’ funds using a variety of allocation approaches, such as Proportional by Balance Allocation and Proportional by Equity Allocation.

As a professional trader, you cannot be concerned with the other accounts for whom you are executing deals. You must be able to concentrate only on trading so that you can make the finest investment and trading choices for your customers. Through the MT4 Master Account, you can trade effortlessly while AvaTrade’s MAM software takes care of the rest automatically.

Therefore, regardless of the number of client orders executed, you must be concerned with trading through your genuine MT4 Master Account.

Some additional features on the AvaTrade MT4 MAM Account include:

- ☑️ Execution of trade orders on several accounts concurrently: With a MAM account, the money manager may simultaneously execute trade orders on many accounts using a single set of trading parameters. This may save time and lessen the possibility of making mistakes while managing many accounts.

- ☑️ Customized risk management: AvaTrade’s MAM account enables money managers to create bespoke risk management settings for each account, allowing them the freedom to customize their risk management approach to the requirements of each client.

- ☑️ Sophisticated reporting and analysis tools: AvaTrade’s MAM account includes access to advanced reporting and analysis capabilities, which may assist money managers in monitoring the performance of their accounts and identifying improvement opportunities.

- ☑️ AvaTrade’s MAM account comes with a dedicated account manager who may support and help the money manager as required.

- ☑️ Reasonable spreads and commissions: AvaTrade’s MAM account provides competitive spreads and commissions, making it an excellent choice for professional money managers seeking to manage several accounts efficiently and cost-effectively.

✅ Options Trading with AvaTrade

AvaTrade lets options traders engage in buying or selling a specified quantity of an asset at a predetermined price and time, referred to as options trading.

Retail traders have full control over the product, the amount of capital invested in options trading, and the ability to set their own pricing and trading hours.

Options trading can take place over a single trading day, week, month, or even year, depending on the trader’s strategy and objectives.

AvaTrade offers both Call and Put options. Moreover, Call options offer the buyer the opportunity to purchase an instrument at a specified price and are typically traded by investors who believe the market is heading in a positive direction.

✅ Spread Betting with AvaTrade (UK Clients Only)

More than two hundred currency pairings, commodities, stocks, bonds, and exchange-traded funds (ETFs) are available for spread betting at AvaTrade.

Trading traders on AvaTrade are denominated in British pounds sterling (GBP), and the platform’s minimum trade size is 0.10 lots.

Spread betting clients of AvaTrade have access to many trading platforms, but only MetaTrader 4 is available for use with either a retail or professional account. Nevertheless, many UK traders choose AvaTrade because of the company’s tax-free spread betting, another reason for the latter’s popularity.

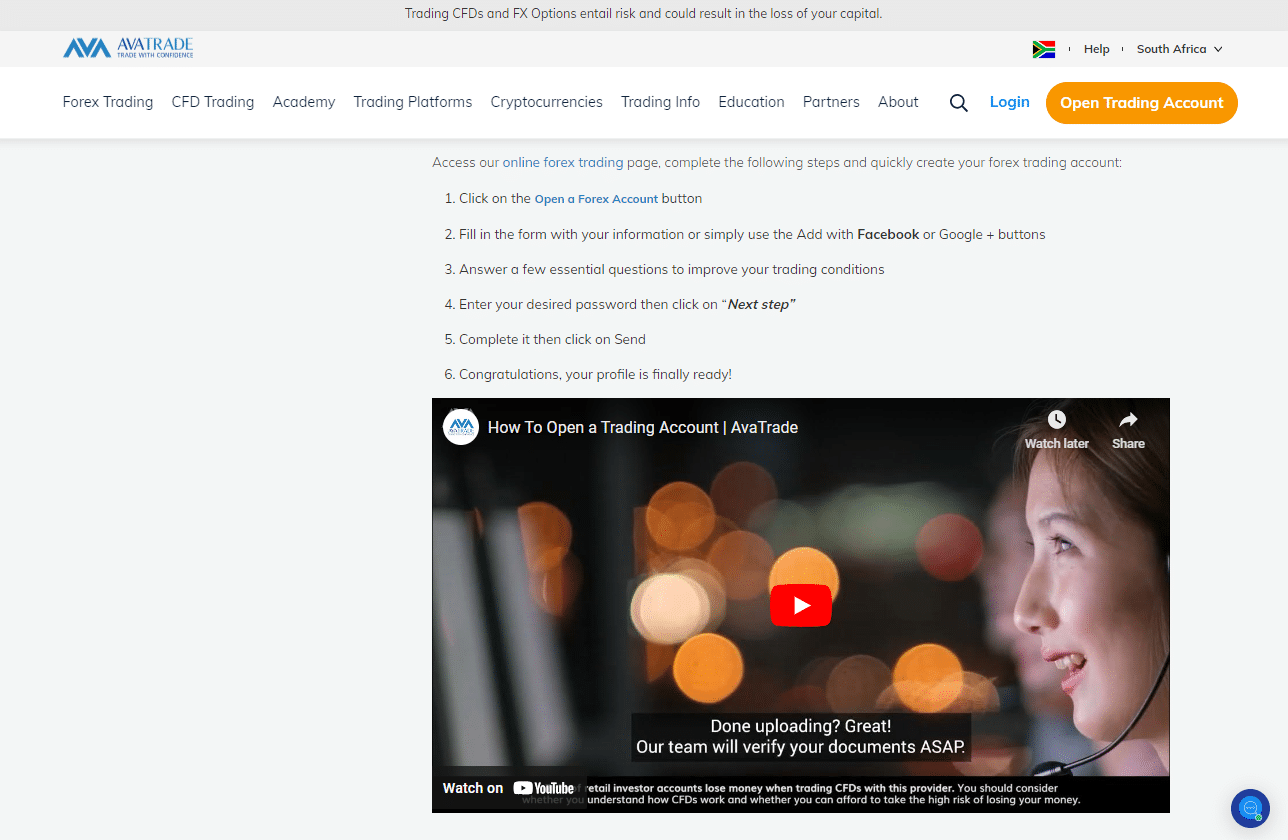

How to open an Account with AvaTrade

To register a live trading account with AvaTrade, you can follow these steps:

- ☑️ Click on the “Open an Account” option on the AvaTrade website.

- ☑️ Include your name, email address, and phone number in the online registration form.

- ☑️ Choose the account you want to establish, such as a real trading or demo account.

- ☑️ Choose your desired base currency and leverage.

- ☑️ Accept the conditions and then click “Continue.”

- ☑️ Click the verification link given to your email to verify your email address.

- ☑️ Upload the appropriate forms of identification and evidence of residency. These may consist of a copy of your passport or national identification card and a utility bill or bank statement.

- ☑️ To fund your account, utilize one of the various deposit options, such as a credit card, bank transfer, or e-wallet.

After successfully registering and funding your AvaTrade account, you may begin trading. However, before opting to trade, you should carefully examine your investing goals and degree of expertise since trading involves risk.

Does AvaTrade have a Swap-Free Option for Muslim traders?

Yes, AvaTrade offers Muslim traders who follow the Shariah law the option of converting their retail trading account into an Islamic Account at no extra charge.

Does AvaTrade charge account management fees?

No, AvaTrade does not charge fees for retail account management.

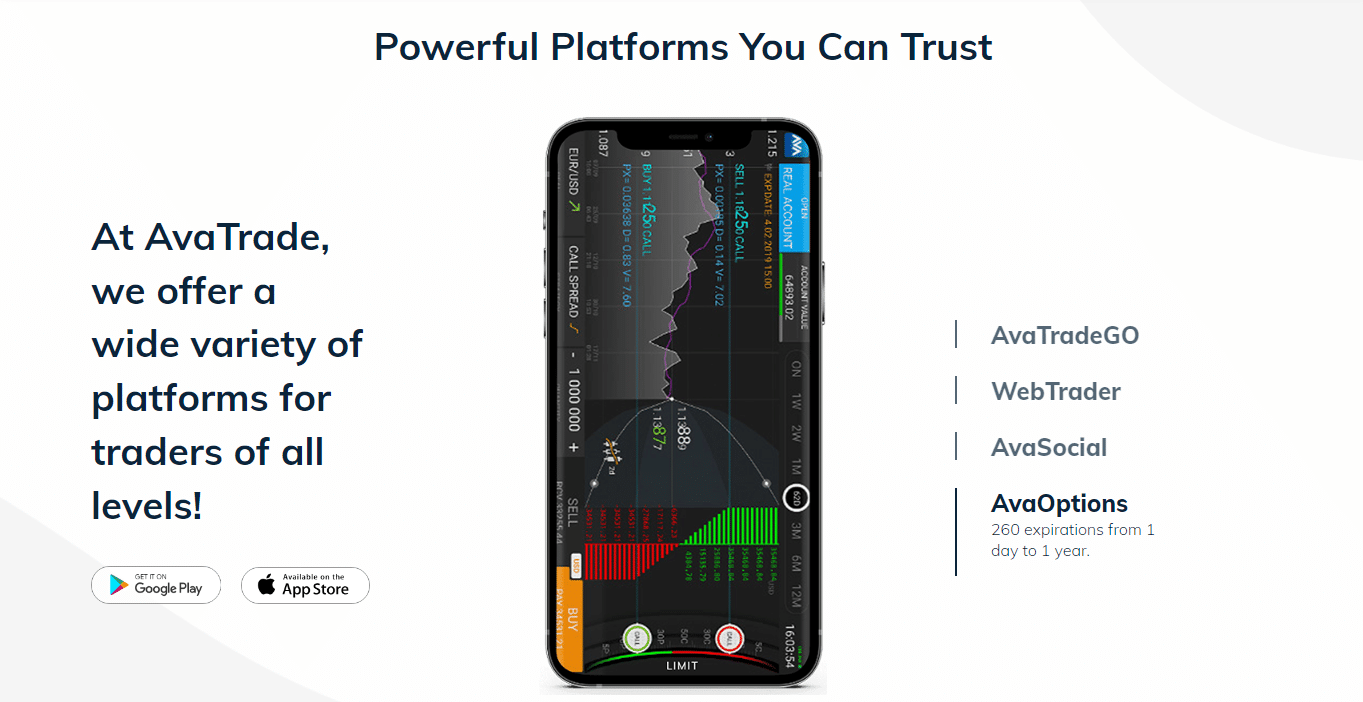

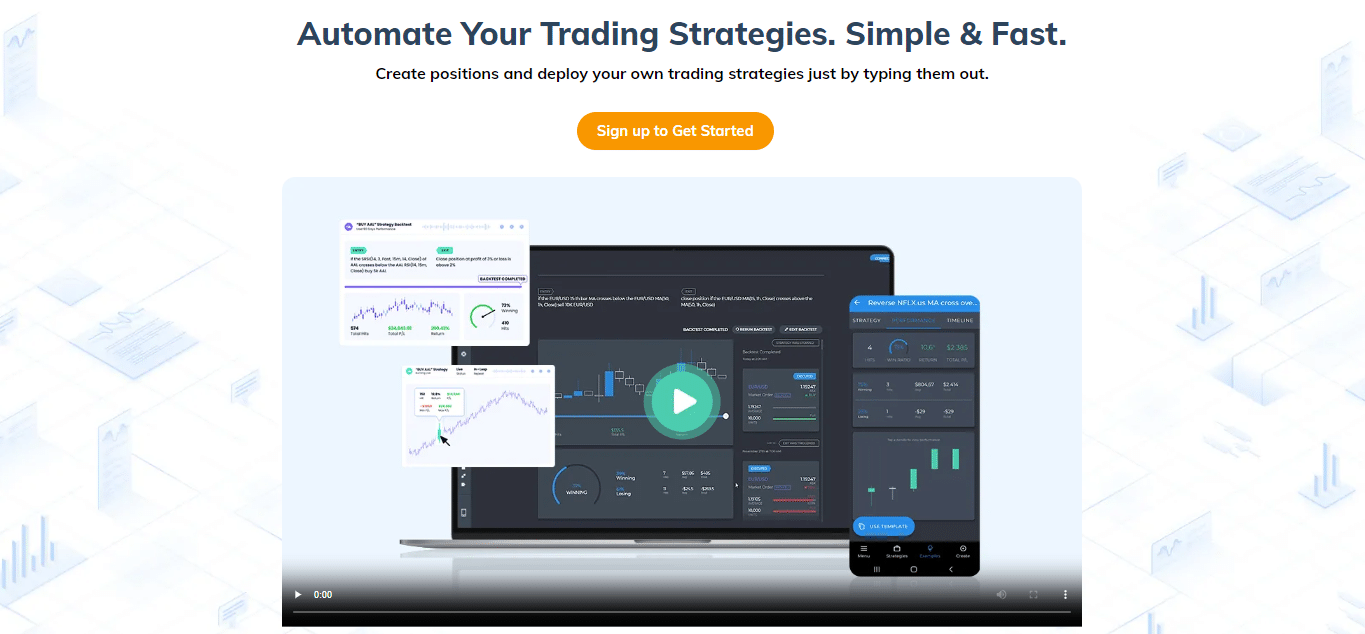

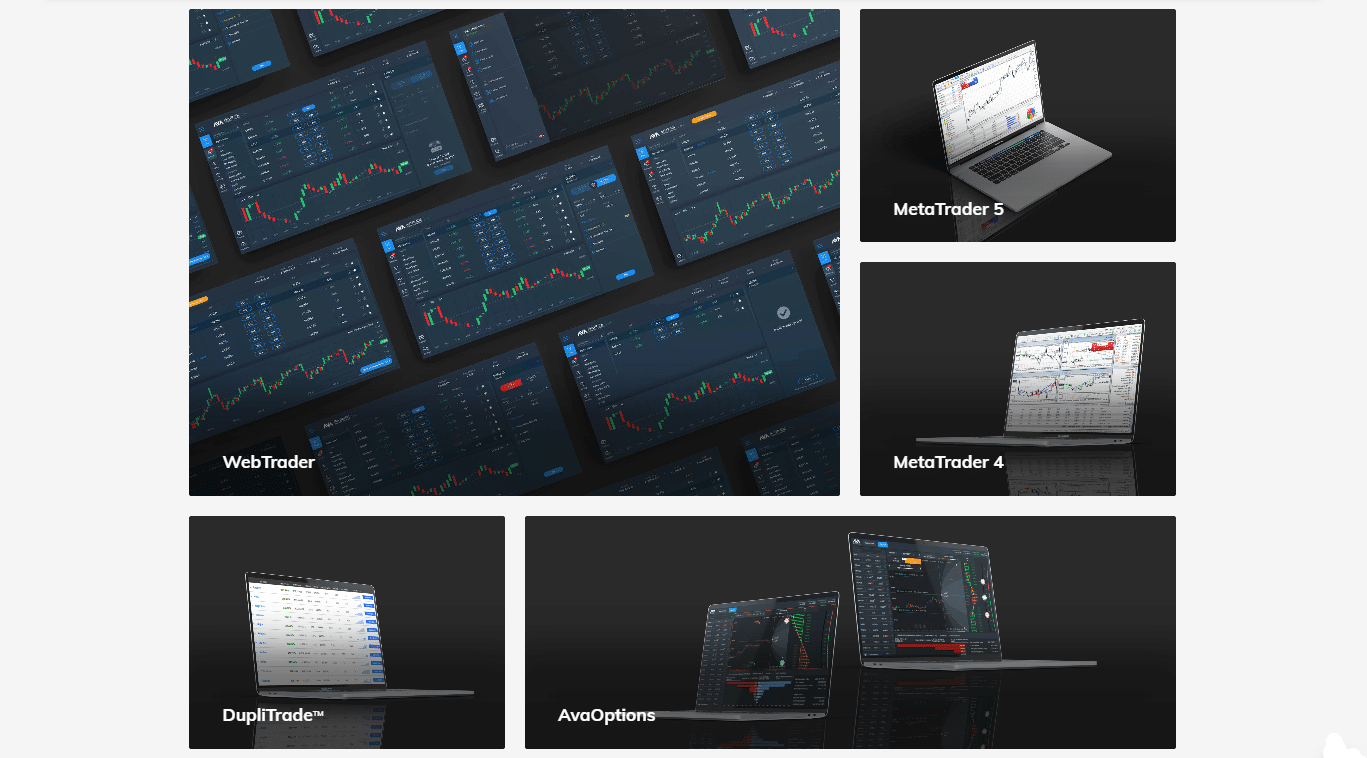

AvaTrade Trading Platforms

AvaTrade offers traders a choice between these trading platforms:

- ☑️ AvaTradeGO

- ☑️ AvaTrade Web

- ☑️ AvaOptions

- ☑️ AvaSocial

- ☑️ MetaTrader 4

- ☑️ MetaTrader 5

- ☑️ DupliTrade

- ☑️ ZuluTrade

AvaTradeGO

The AvaTradeGO app allows you to trade from any location with its user-friendly interface and various features that facilitate quick and easy online trading. This app allows you to trade on the go with convenience and efficiency.

Using this straightforward mobile trading software, you may connect to global markets with live feeds and social trends to identify fresh trade possibilities.

AvaTrade Web

The intuitive interface and current design of the AvaTrade WebTrader platform make this trading platform suited for both novice and experienced traders.

AvaOptions

The AvaOptions platform promises to facilitate mobile and desktop option trading. You may express your market outlook with calls and puts and utilize the built-in tools to maximize your return.

There are over 40 forex options and more for any combination of call and put options in a single account, allowing you to construct the ideal portfolio.

AvaSocial

Before entering the markets, you can easily use the AvaSocial app to learn from some of the world’s leading specialists. In addition, it facilitates communication with peers and automates the trading process. This makes it a popular option among both novice and experienced traders.

MetaTrader 4

MT4 is one of the world’s most widely used trading platforms today, used by millions of traders. MT4 provides a robust and adaptable trading environment. It is easy enough for novice traders to use while yet offering enough complex features for professionals.

MetaTrader 4 is available for free download on desktops and mobile devices and through web browsers without the need to download or install extra software.

MetaTrader 5

MetaTrader 5 is the latest edition of the MetaTrader platform, with state-of-the-art trading tools, order types, timeframes, graphical elements, enhanced auto-trading systems, and copy trading signals.

Despite the new tools and functions of MT5, most traders still choose to utilize MT4, in part because there is already an abundance of free online lessons and tools for it.

DupliTrade

DupliTrade is an MT4-compatible software that enables traders to duplicate trading techniques in real time based on risk tolerance and trading style.

It offers an intuitive UI that makes it simple to construct and maintain a trading portfolio while receiving important insights about different trading techniques.

ZuluTrade

ZuluTrade is one of today’s leading social networks. It highlights the trading methods of other traders, allowing you to copy their trading signals into your AvaTrade account instantly.

You can easily explore and filter the different trading methods to find the ones that best fit your risk choices and trading requirements.

Where can I download AvaTrade’s mobile apps?

You can download AvaTrade’s apps from the Google Play Store for Android and the App Store for iOS.

How much do AvaTrade’s trading platforms cost?

It is free to download and use AvaTrade’s platforms. However, additional or special services might come at an additional fee.

AvaTrade Investment Programs

AvaTrade does not currently have a designated, separate investment program for retail traders or investors. All trading and investment can be managed from the account options offered by AvaTrade.

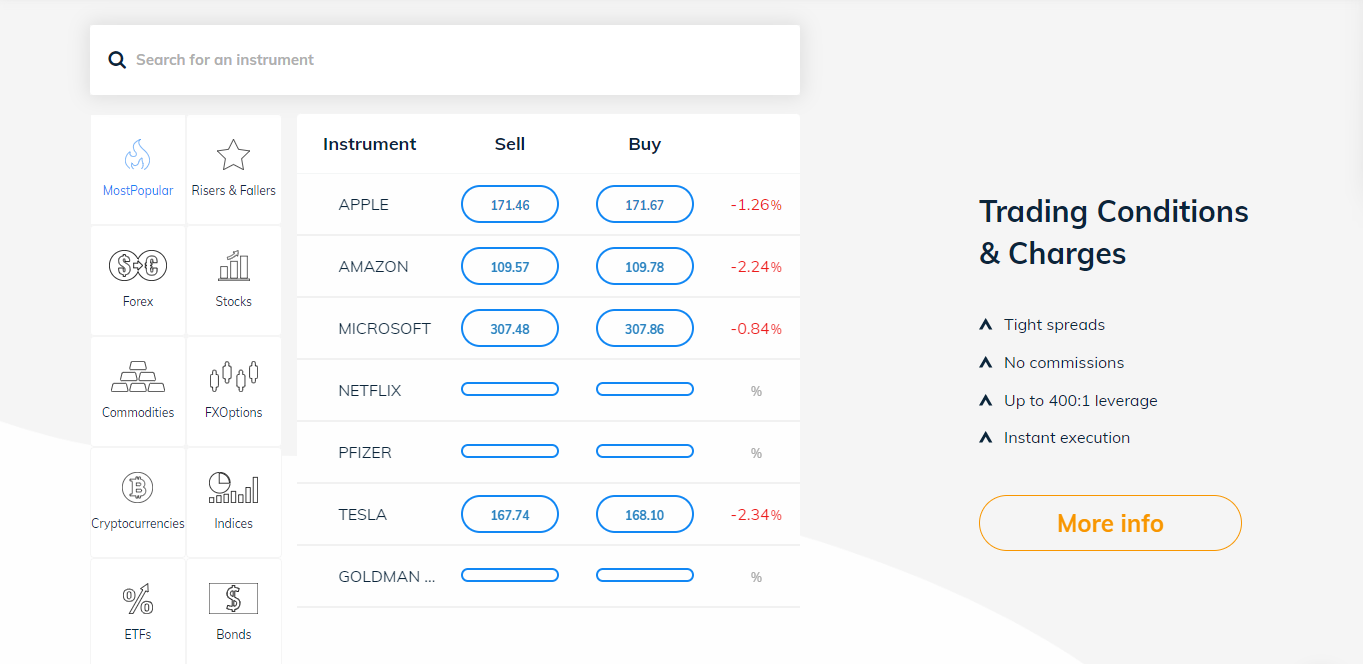

Which Markets Can You Trade with AvaTrade?

Traders can expect the following range of markets from AvaTrade:

- ✅ Forex

- ✅ Stocks

- ✅ Commodities

- ✅ Cryptocurrencies

- ✅ Treasuries

- ✅ Bonds

- ✅ Indices

- ✅ Exchange-traded funds (ETFs)

- ✅ Options

- ✅ Contracts for Difference (CFDs)

- ✅ Precious Metals

Financial Instruments and Leverage offered by AvaTrade

| 🔎 Instrument | 🅰️ Number of Assets Offered | 🅱️ Maximum Leverage Offered |

| 📉 Forex | 55 | 1:400 |

| 💎 Precious Metals | 5 | 1:200 |

| 📈 ETFs | 59 | 1:20 |

| 📊 Indices | 33 | 1:200 |

| ➡️ Stocks | 625 | 1:10 |

| 🪙 Cryptocurrency | 20 | 1:25 |

| ↪️ Options | 53 | 1:100 |

| 💡 Energies | 5 | 1:200 |

| ▶️ Bonds | 2 | 1:20 |

| ⏩ FXOptions | 24 | 1:100 |

Are there leverage restrictions with AvaTrade?

Yes, retail traders can use a maximum of 1:30 leverage, while professionals can use leverage up to 1:400.

Can I trade exotic forex pairs with AvaTrade?

Yes, AvaTrade offers major, minor, and exotic forex pairs.

AvaTrade Trading and Non-Trading Fees

✅ Spreads

As a leading market maker in the global financial industry, AvaTrade offers fixed spreads to its retail clients. This allows the company to create market liquidity and facilitate the completion of trades for its customers.

AvaTrade serves as a bridge between individual traders and the interbank market, obtaining large positions from various liquidity providers and reselling them to retail traders. In addition, the firm executes orders internally, ensuring fast and fee-free transactions.

AvaTrade provides single-price quotes and deducts its service fee from the spread paid. The average spread on the EUR/USD currency pair, the most traded in the forex market, is 0.9 pips at AvaTrade.

✅ Commissions

AvaTrade does not charge commissions, as the broker fee is already included in the spreads.

✅ Overnight Fees, Rollovers, or Swaps

These costs are credited or debited by AvaTrade based on the size of the position, duration, the financial instrument traded, and other variables.

Additionally, the overnight interest rate for each asset is shown on the official AvaTrade website and trading interface. Typical overnight costs for traders include some of the following:

- ☑️ EUR/USD – a short swap of -0.0015% and a long swap of -0.0060%.

- ☑️ Stocks (Apple) – a short swap of -0.0165% and a long swap of -0.0168%.

- ☑️ Gold – a short swap of -0.0082% and a long swap of -0.0085%.

- ☑️ Silver – a short swap of -0.0082% and a long swap of -0.0085%.

✅ Deposit and Withdrawal Fees

AvaTrade does not charge any fees on deposits or commissions.

✅ Inactivity Fees

Three straight months of inactivity incur a $50 inactivity charge from AvaTrade. This amount is deducted monthly from the account until the trade balance reaches zero.

However, a $100 administrative charge will be levied if the trading account is inactive for twelve consecutive months.

✅ Currency Conversion Fees

Currency conversion fees may apply if traders deposit funds in an unsupported currency and those monies are converted to one of the acceptable base account currencies.

How do I calculate spreads with AvaTrade?

AvaTrade’s platforms automatically calculate the spreads. However, the typical formula is Spread Cost Formula: Spread x Trade Size = Spread Charge in Secondary Currency.

How do I avoid currency conversion fees with AvaTrade?

Currency conversion fees apply when you deposit/withdraw funds in a currency other than your trading account’s base currency. Furthermore, when you trade forex and other instruments, and they are denominated in currencies other than your base currency, you will pay for the conversion.

To avoid these fees, ensure that your deposit/withdrawal currencies are the same as your account-based currency.

Calculating Forex Trading Rebates with AvaTrade

AvaTrade does not currently offer a straightforward method for calculating forex trading rebates, as their rebate program is tailored to the specific conditions of each trader and can be subject to changes over time.

However, forex trading rebates are typically calculated based on the trading volume (the amount of currency traded). The specific formula would be provided by AvaTrade or a third-party rebate service with which you have partnered.

Here is a general idea of how forex rebates might work:

- ✅ A rebate service (such as SAShares) forms a partnership with a broker (in this case, AvaTrade).

- ✅ The broker pays a portion of the spread or commission to the rebate service for each referred client’s trade.

- ✅ The rebate service then shares a portion of these earnings with the client (you). This effectively reduces the cost of the spread or commission you pay.

For example, the potential formula for calculating your rebate could look something like this:

- ✅ Trading Volume x AvaTrade’s Spread or Commission Rebate x Rebate Service’s Sharing Rate

Does AvaTrade offer a Forex rebate calculator?

No, AvaTrade does not offer a Forex rebate calculator. However, there are several other tools that you can use, or you can contact AvaTrade customer support for assistance.

Does AvaTrade publish a calendar for Forex rebate payments?

No, there is no calendar for payments. However, AvaTrade settles payouts promptly.

Claiming and Withdrawing Forex Rebates at AvaTrade

The rebate withdrawal process from AvaTrade will depend on the affiliate’s agreement with the broker and several other factors. However, some typical steps regarding withdrawing rebates from AvaTrade could be as follows:

- ✅ Verify Eligibility: First, check your eligibility for forex trading rebates. This usually depends on your trading volume and the agreement between the broker and the rebate service.

- ✅ Claim Rebates: Depending on the terms of your agreement, rebates may be automatically credited to your trading account, or you may need to claim them manually. Check with AvaTrade or your third-party rebate service for the exact procedure.

- ✅ Transfer to Main Account: If the rebates are credited to your trading account, you might need to transfer them to your main account (the withdrawal account) in AvaTrade.

- ✅ Withdraw Rebates: You can withdraw the rebates from your AvaTrade account.

However, remember that you must meet certain conditions before withdrawing, like reaching a certain trading volume or waiting a specific time.

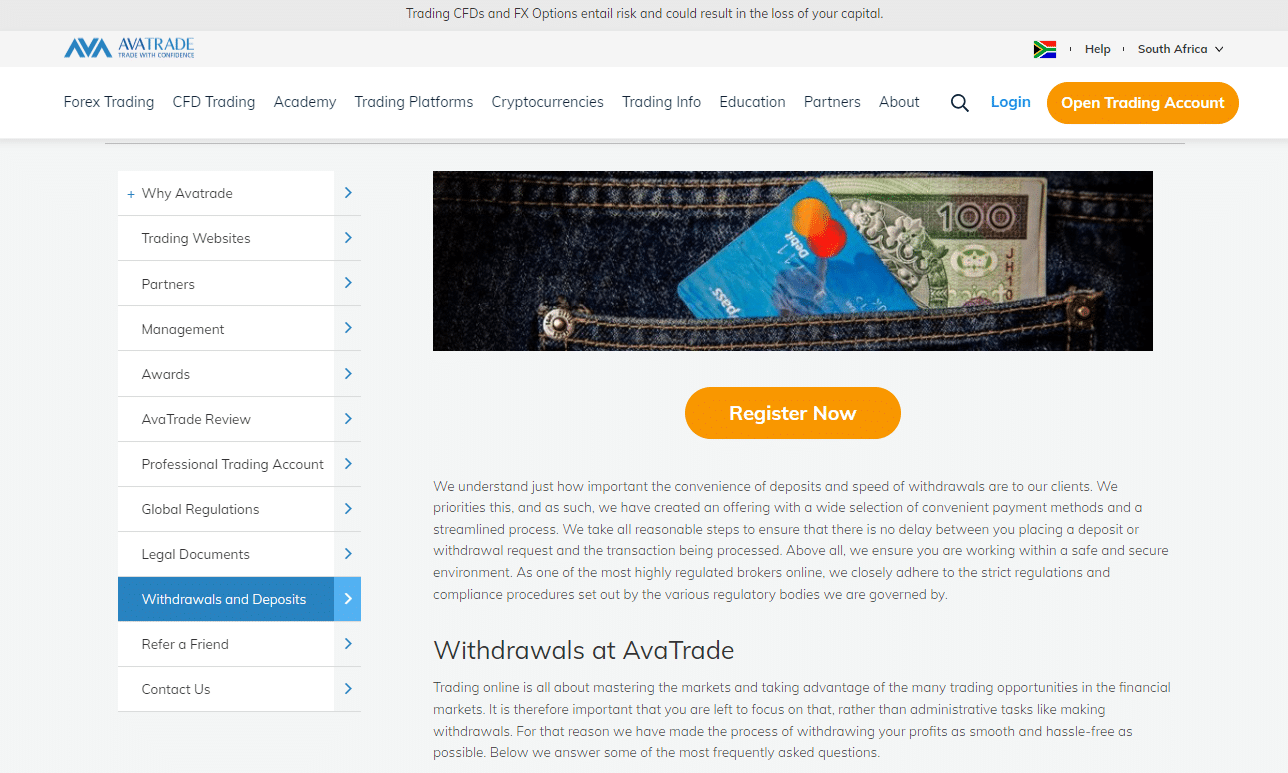

AvaTrade Deposits and Withdrawals

AvaTrade offers the following deposit and withdrawal methods:

- ✅ Bank Wire Transfer

- ✅ Credit/Debit Card

- ✅ PayPal

- ✅ WebMoney

- ✅ Neteller

- ✅ Skrill

How to Deposit Funds with AvaTrade

To deposit funds to an account with AvaTrade, traders can follow these steps:

- ✅ Click the “Deposit Funds” option in the “My Account” section after logging into your AvaTrade account.

- ✅ Choose your preferred mode of deposit. AvaTrade provides a variety of deposit options, such as bank transfer, credit/debit card, and online payment services like PayPal and Skrill.

- ✅ Follow the on-screen instructions to finalize the deposit. Be sure to examine and confirm the specifics of your deposit, including the amount and applicable fees.

- ✅ Once the deposit has been completed, the monies will be shown in your account balance. The money may then be used for trading on the AvaTrade platform.

In addition, traders must note that AvaTrade may have varying restrictions and procedures for different deposit types; thus, it is essential to follow the broker’s instructions carefully.

AvaTrade Fund Withdrawal Process

To withdraw funds from an account with AvaTrade, traders can follow these steps:

- ✅ To withdraw money from your AvaTrade account, go to the My Account page and select the “Withdraw Funds” option.

- ✅ The mode of withdrawal is up to you. Withdrawal options from AvaTrade include wire transfers, credit/debit cards, and e-wallet services like PayPal and Skrill.

- ✅ To withdraw funds, follow the on-screen instructions. Always double-check the withdrawal amount and any associated costs before submitting the request.

Your withdrawal will be processed, and the money will be sent to the withdrawal method you specified. Depending on the chosen withdrawal method and your bank’s processing period, it might be several days before you get access to your money.

How much do I pay when I deposit and withdraw with AvaTrade?

AvaTrade does not charge any deposit or withdrawal fees. However, your bank might apply processing fees that you must pay.

Are there terms involved in withdrawing bonus funds?

Yes, terms and conditions are involved when you want to withdraw bonus funds. Often, you must satisfy the trading volume requirement before you can withdraw.

AvaTrade Education and Research

Education

AvaTrade offers the following Educational Materials:

- ☑️ Educational Videos

- ☑️ Trading guides

- ☑️ Trading Rules

- ☑️ Market Terms

- ☑️ Order Types

- ☑️ Trading Strategies

- ☑️ Trading Ideas

- ☑️ Blog

- ☑️ A demo account with virtual funds

- ☑️ Articles

Research

AvaTrade offers traders the following Research and Trading Tools:

- ☑️ Technical Analysis Indicators

- ☑️ Economic Indicators

- ☑️ Economic calendar

- ☑️ Trading Strategies

- ☑️ AvaProtect Risk Management

- ☑️ Trading Central

- ☑️ Trading Calculators

- ☑️ Earnings Releases

- ☑️ Fundamental Analysis

- ☑️ Technical Analysis

AvaTrade Bonuses and Current Promotions

As a newly registered trader, upon depositing a minimum of $200 into your trading account for the first time, you will be eligible to receive a sign-up bonus of $40. If you choose to deposit up to a maximum of $10,000, you can potentially contact your account manager to receive a sign-up bonus of $2,000.

Additionally, through our Refer a Friend bonus program, you can earn between $50 and $250 for each referral who opens a live account and deposits between $500 and $20,000 or more. The earning potential for this bonus is determined by the first investment made on the referral’s suggestion

Does AvaTrade have a no-deposit bonus?

No, AvaTrade does not have a no-deposit bonus but offers a welcome bonus for all newly registered accounts when traders deposit at least $200 into their trading account.

Can I participate in AvaTrade bonuses with my demo account?

No, AvaTrade does not consider demo accounts eligible for bonuses.

Legal and Tax Implications Understanding Forex Trading Rebates with AvaTrade

Forex trading rebates can have tax implications depending on the jurisdiction in which you reside. In some countries, these rebates might be considered income and subject to income tax.

It is important to consult with a tax professional or financial advisor to understand your country’s tax implications. For instance, in the UK, investors are liable to capital gains tax, with a 50% discount. In the US, forex traders are subject to income tax.

How much tax will I pay on my Forex trading rebates?

The amount of tax will depend on your trading volume and the tax regulations of the country in which you reside.

Are Forex trading rebates considered capital gains?

Forex trading rebates are typically considered to reduce trading costs rather than capital gains. They return a portion of the spread or commission you pay to your broker for each trade.

However, tax laws can vary by country, and in some jurisdictions, forex trading rebates might be considered income.

Risks and Limitations of Forex Trading Rebates at AvaTrade

While forex rebates can benefit traders, risks and disadvantages exist. AvaTrade reserves the right to cancel any excess trades or exposures that exceed the outlined threshold limits.

Forex trading involves a high risk of losing money rapidly due to leverage. Also, AvaTrade does not accept US traders. Understanding these risks and limitations is important before forex trading with AvaTrade.

How can I mitigate my risks when I participate in trading rebates trading with AvaTrade?

To mitigate risks when participating in trading rebates with AvaTrade, use risk management tools like stop loss and take profit orders, use leverage wisely, educate yourself using AvaTrade’s resources, stay updated, practice with a demo account, and consider seeking professional advice.

Which trading strategies can protect me from loss when I trade with AvaTrade?

Trading strategies that can protect you from loss when trading with AvaTrade include diversifying your portfolio, using risk management tools to limit losses and secure profits, using leverage carefully, and practicing your strategies on a demo account before trading with real money.

Strategies to Maximise Rebates with AvaTrade

To maximize your rebates with AvaTrade, consider the following strategies:

- ✅ Trade currencies with the highest interest rates as they tend to perform best against rivals with smaller interest rates.

- ✅ Take advantage of AvaTrade bonuses. Matching goes up to $40,000 starting with a deposit of $100, with a maximum of $16,000 possible.

- ✅ Experienced traders can qualify for a “professional” account which would allow them to increase their maximum leverage from 30:1 to 400:1. This could potentially lead to higher profits and, consequently, higher rebates.

- ✅ Utilise AvaTrade’s trading strategies to maximize profit with expert insights and proven methods.

Does AvaTrade accept scalping strategies?

Yes, AvaTrade welcomes all trading strategies, including scalping.

Does AvaTrade offer guidance on trading strategies to maximize my rebates?

Yes, AvaTrade offers a large portfolio of educational resources and guides.

AvaTrade User Reviews / AvaTrade’s Forex Trading Rebates – Real-Life Case Studies and Success Stories

- 🥇 I’ve discovered that AvaTrade is a true trailblazer in online forex and CFD trading! Their remarkable bonuses, generous leverage, lightning-fast execution, and tight spreads have significantly enhanced my trading experience. The added perk of 24/5 support is invaluable, and I am thrilled that they do not charge any commissions. – Livia Donnelly

- 🥈 AvaTrade excels in copy trading, delivers competitive mobile trading capabilities, and maintains pricing and research that aligns with industry standards. Including rebates in my trading strategy has proven a fantastic addition. – Kaine Doyle

- 🥉 AvaTrade’s approach to forex trading fees, seamlessly integrated into the spreads, is truly transparent. The availability of a user-friendly Forex Calculator further facilitates informed decision-making. As a result, the rebates offered by AvaTrade have been instrumental in reducing my trading costs, ultimately benefiting my overall trading performance. – Dalton Alvarez

How to open an Affiliate Account with AvaTrade

To register an Affiliate Account with AvaTrade, traders can follow these steps:

- ✅ To become an affiliate, go over to the AvaTrade website.

- ✅ Please click the “Sign Up” link to register as an affiliate.

- ✅ Provide your name and email address in the box provided.

- ✅ Read the affiliate program agreement carefully.

- ✅ Submit the registration form and wait for approval.

You will be given access to the affiliate dashboard when your affiliate account is authorized. After that, you can begin referring customers to AvaTrade in exchange for commission payments whenever one of your referred customers opens and funds an AvaTrade trading account.

AvaTrade Affiliate Program Features

As an AvaTrade associate, you may anticipate the following characteristics:

- ✅ AvaTrade offers affiliates personalized tracking links that enable them to monitor the success of their referrals. These connections enable AvaTrade to appropriately attribute referrals to the appropriate affiliates and guarantee that affiliates are rewarded for their efforts.

- ✅ AvaTrade offers affiliates various marketing resources, including banners, landing pages, and other promotional materials, to assist them in promoting the AvaTrade brand and attracting new customers.

- ✅ AvaTrade’s affiliate dashboard offers affiliates advanced reporting and analytics tools that enable them to monitor the efficacy of their marketing campaigns and improve their marketing efforts.

- ✅ AvaTrade provides affiliates with many payment choices, including bank transfer, cheque, and online payment methods such as PayPal and Skrill.

- ✅ AvaTrade’s affiliate support staff is ready to help with any queries or concerns affiliates may have.

Traders must note that specific features and rewards of the AvaTrade affiliate program are subject to change and could vary.

AvaTrade Corporate Social Responsibility

AvaTrade is a renowned online brokerage business that provides its customers with various financial services. AvaTrade is dedicated to working in a socially responsible and ethical way as a business, and it has a variety of programs in place to demonstrate this commitment.

Sustainability and environmental responsibility are two of AvaTrade’s core corporate social responsibility (CSR) objectives. This includes attempts to encourage renewable energy and environmental conservation and efforts to decrease its carbon impact.

AvaTrade is also devoted to diversity and inclusion, and it has a variety of programs in place to encourage and promote diversity both inside the firm and within the community. This involves encouraging diversity and inclusion within its staff and supporting diversity and inclusion efforts across the financial sector.

Finally, AvaTrade is engaged in charity and community-focused projects and supports various charitable causes and organizations worldwide. This involves financial and material assistance and donating time and skills to these projects.

Overall, AvaTrade is dedicated to becoming a socially responsible and ethical corporation, and it has implemented a variety of efforts to that end.

AvaTrade Alternatives

- eToro is a well-known online brokerage that provides a variety of financial goods such as FX, stocks, and cryptocurrencies. It is well-known for its user-friendly interface and social trading function, which enables users to mimic successful investors’ moves.

- Plus500 is a UK-based online brokerage that provides various financial products such as FX, stocks, and CFDs. It is well-known for its simple platform and low costs.

- CMC Markets is a UK-based online brokerage business that provides various financial products such as FX, stocks, and CFDs. It is well-known for its sophisticated trading platform and vast research resources.

AvaTrade VPS Review

It is conceivable that AvaTrade might provide certain customers with a free virtual private server (VPS). However, it is crucial to remember that the availability and functionality of this service could vary.

A VPS is a virtualized server that enables traders to remotely execute their trading software and algorithms without requiring a physical computer.

The following are some of the features that an AvaTrade VPS could include:

- ✅ As it is housed on a robust and secure server, a VPS from AvaTrade is likely to be a trustworthy and stable platform for operating trading applications.

- ✅ A VPS is expected to provide quicker trade execution times than a physical computer since it is particularly intended for executing trading software.

- ✅ A VPS enables traders to use their trading software from any Internet-connected location, which may be advantageous for individuals who travel often or do not have a dedicated trading setup at home.

Finally, a VPS from AvaTrade is likely to have rigorous security measures in place to safeguard the data and assets of traders.

AvaTrade Web Traffic Report

| 🌎 Global Rank | 56,154 |

| 🚩 Country Rank | 13,282 |

| 📌 Category Rank | 95 |

| 📉 Total Visits | 817.6k |

| 📈 Bounce Rate | 45.22% |

| 📊 Pages per Visit | 5.80 |

| ↪️ Average Duration of Visit | 00:05:32 |

| ➡️ Total Visits in the last three months | September – 715.8KOctober – 680.9KNovember – 817.6K |

AvaTrade Customer Support

| 🥰 Customer Support | ❤️ AvaTrade Customer Support |

| ⏰ Operating Hours | 24/5 |

| 📌 Support Languages | Multilingual |

| 📍 Live Chat | ✅ Yes |

| ☎️ Telephonic Support | ✅ Yes |

| 🚩 The overall quality of AvaTrade Support | 3/5 |

AvaTrade offers customer service through many methods, including:

- ✅ AvaTrade features phone help lines devoted to several countries and languages. Customers may dial these numbers to talk with a customer service agent.

- ✅ Customers can email AvaTrade’s customer support staff and get a response within a certain time.

- ✅ AvaTrade provides live chat help on their website, enabling users to converse with a customer service agent in real time.

- ✅ AvaTrade has a knowledge base on its website with various information and articles pertaining to trading, account administration, and other issues. Customers may utilize this resource to discover answers to frequently asked questions and resolve problems.

- ✅ AvaTrade’s social media presence includes Facebook, Twitter, and LinkedIn, where clients may communicate with the firm and get help.

Depending on the area and language, the channels and hours of operation for AvaTrade’s customer service may differ. Therefore, checking the AvaTrade website for the most recent details on customer support choices and availability is essential.

Can I contact AvaTrade over weekends?

No, you cannot contact AvaTrade over weekends. Any messages will only be tended to during the week.

How do I know whether AvaTrade has an office in my area?

You can view AvaTrade’s office locations on the official website.

Tips for Choosing AvaTrade for Forex Trading Rebates / Key Factors to Consider When Evaluating AvaTrade’s Forex Trading Rebate Program

When choosing AvaTrade for Forex trading rebates, there are several key factors to consider:

- ✅ Rebate Rates: AvaTrade offers competitive cashback rates. It is important to compare these rates with other brokers to ensure you are getting the best deal. The higher the rebate rate, the more money you will get back on each trade.

- ✅ Broker Reputation: AvaTrade has been a top Forex cashback rebate provider since 2011, indicating a strong reputation in the industry. Always consider the reputation and reliability of the broker.

- ✅ Trading Conditions: Look at the spreads, fees, and leverage offered by AvaTrade. Lower spreads and fees can significantly increase your net profit, especially if you are a high-volume trader. Also, consider the leverage offered by the broker, as it can amplify your profits (but also your losses).

- ✅ Trading Platforms: AvaTrade offers multiple trading platforms. Ensure the platform suits your trading style and has all the necessary features and tools.

- ✅ Customer Reviews: Check out reviews by verified customers to get an idea of the user experience. This can provide insights into the broker’s customer service, ease of use, and overall reliability.

- ✅ Demo Accounts: AvaTrade offers demo accounts, which allow you to test their platform and trading conditions without risking real money. This can be a great way to see if AvaTrade is the right broker for you.

- ✅ Education and Resources: AvaTrade provides educational resources for beginners. If you are new to Forex trading, these resources can be extremely helpful.

Is AvaTrade suitable for all types of traders?

Yes, AvaTrade offers trading solutions for all types of traders.

Can I register a demo account with AvaTrade?

Yes, you can. However, you should note that the demo account expires after 21 days.

Number of Traders participating in AvaTrade Cashback Rebates / Real-Life Examples:

AvaTrade has more than 400,000 registered traders who have active trading accounts. However, it is unclear how many of these clients currently participate in AvaTrade’s Cashback Rebates.

Real-Life Examples

🥇 Louise Paul

Louise Paul, a part-time trader with AvaTrade, recognizes the significance of their reimbursements program. She earns cashback on her Forex trades by actively partaking, providing her with an additional source of income.

This additional capital helps her achieve her financial objectives. It enables her to investigate and pursue additional investment opportunities to diversify her portfolio and potentially increase her overall returns.

🥈 Myles Benton

Myles, a swing trader, similarly recognizes the value of AvaTrade’s rebate program in mitigating his transaction costs. Each time he executes a transaction, he receives cashback, effectively lowering his expenses.

This additional income can be reinvested in the market, allowing him to improve his trading strategies, investigate new trading instruments, or increase the size of his transactions. Therefore, Myles’ profit potential increases, contributing to his overall trading success.

🥉 Anya Harmon

Participation in AvaTrade’s rebates program makes ideal sense for Anya Harmon, a long-term investor committed to her financial goals. She reduces the overall cost of administering her investment portfolio by doing so.

The cashback she earns on each trade helps to counterbalance her trading fees, allowing her to retain a greater share of her investment gains. This financial advantage strengthens her long-term objectives, potentially allowing her to accomplish greater long-term returns and financial stability.

Successful Traders Benefiting from AvaTrade’s Rebates – AvaTrade’s Forex Trading Rebates Empowering Retail Traders for Success

- ✅ AvaTrade’s forex trading rebates program has leveled the playing field for retail traders. By earning cashback on their transactions, these traders can reduce their costs, increase their profitability, and compete with institutional investors on an equal footing.

- ✅ Retail traders all over the world are utilizing AvaTrade’s forex trading rebates. This program enables them to optimize their trading strategies, accumulate wealth over time, and confidently attain their financial objectives.

- ✅ With AvaTrade’s forex trading rebates, retail traders take charge of their financial futures. They gain a financial advantage by earning commissions on their trades, enabling them to trade more flexibly and capitalize on market opportunities.

AvaTrade vs. Other Notable Brokers

| 🔎 Broker | 🥇 AvaTrade | 🥈 OctaFX | 🥉 FBS |

| 📌 Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | CySEC, SVG FSA | IFSC, CySEC, ASIC, FSCA |

| 💻 Trading Platforms | AvaTradeGOAvaOptionsAvaSocialMetaTrader 4MetaTrader 5DupliTradeZuluTrade | MetaTrader 4MetaTrader 5OctaFX AppCopyTrade App | MetaTrader 4MetaTrader 5FBS TraderCopyTrade |

| 💴 Withdrawal Fee | None | None | ✅ Yes |

| 🆓 Demo Account | ✅ Yes | ✅ Yes | ✅ Yes |

| 💵 Min Deposit | $100 | $100 | $1 |

| 📉 Leverage | 1:30 (Retail)1:400 (Pro) | 1:500 | Up to 1:3000 |

| 📈 Spread | Fixed, from 0.9 pips | 0.6 pips | From 0.0 pips |

| 📊 Commissions | None | None | From $6 |

| ⛔ Margin Call/Stop-Out | 25% - 50% (M)10% (S/O) | 25%/15% | 40%/ 20% |

| 📍 Order Execution | Instant | Market | Market |

| 🎁 No-Deposit Bonus | None | ✅ Yes | ✅ Yes |

| ▶️ Cent Accounts | None | None | ✅ Yes |

| ⏩ Account Types | Standard Live Account | MetaTrader 4 Habitual TraderMetaTrader 5 Smart Trader | Cent AccountMicro AccountStandard AccountZero AccountECN AccountCrypto Account |

| ⏰ Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 🔟 Retail Investor Accounts | 1 | 2 | 6 |

| ☪️ Islamic Account | ✅ Yes | ✅ Yes | ✅ Yes |

| ⬇️ Minimum Trade Size | 0.01 pips | 0.01 lots | 0.01 lots |

| ⬆️ Maximum Trade Size | Unlimited | 500 lots | 500 lots |

| 🕰️ Min. Withdrawal Time | 24 to 48 Hours | 30 minutes | 15 to 20 minutes (maximum 48 hours) |

| ⏰ Max. Withdrawal Time | Up to 10 days | 3 hours | Up to 7 days |

| 📌 Instant Withdrawals | None | None | Instant Deposits |

Trading with AvaTrade Pros and Cons

| ✅ Pros | ❎ Cons |

| AvaTrade offers a comprehensive affiliate program and cashback rebates for traders | Inactivity fees apply to dormant accounts |

AvaTrade User Reviews

Positive Experience.

My initial experience with AvaTrade has been positive. Customer support was helpful and guided me through account setup quickly. – Tony Hawkings

Honest Broker.

AvaTrade has pleasantly surprised me. I have never encountered a more honest broker who cares about its traders. The tools and analysis available are superb, and AvaTrade has one of the best rebate programs. – Blade Sherman

Excellent.

I love the AvaTrade trading app. The app is simple and dependable, and AvaTrade’s customer support is the best. The agent helped me register and verify my account within a few minutes. The updates on my trading activity are in real-time, and I can quickly open and close trades without any issues. – Sweenie Torteli

Recommendation for Improving AvaTrade Cashback Rebates

AvaTrade offers competitive rebates across all asset classes, but they are the same across the board, while other brokers have a more tailored approach to every financial class. Therefore, it could attract more traders if AvaTrade customized rebates according to the asset class.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. This evaluation comprises positives, disadvantages, and an overall score based on our findings. We want to assist you in locating the ideal broker for your requirements. Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Our Verdict on AvaTrade

AvaTrade is distinguished by its stringent regulations covering entities on four continents, its excellent range of proprietary trading platforms, namely AvaTradeGo™, AvaOptions, and AvaSocial, and its risk management tool, AvaProtect™.

AvaProtect™ is ideal for traders and investors seeking extra protection of their trading positions in exchange for a reduced fee added to the trade’s cost.

AvaTrade provides a market-making trading environment with fixed spreads for most daily trading sessions. Furthermore, another advantage of AvaTrade, is that traders are permitted to hedge, scalp, swing, and position trade without limits.

AvaTrade Frequently Asked Questions

How quickly will I receive my sign-up bonus?

“The bonus will be automatically credited once your account is verified that you have deposited and opened the first trade.”

How can I manage my trading risk when I sign up?

“We offer stop loss, take profit, and trailing stops on MT4 or MT5. You can also use AvaProtect, which is an insurance per trade. AvaProtect is available on the app AvaTradeGo or WebTrader accounts.”

Do you recommend leverage?

“We offer only leveraged standard trading accounts.”

Which trading strategy should I try as a beginner?

“Apologies, I am restricted by Management and our Regulatory body from answering questions or advising regarding trading or market moves. However, we offer an educational site to review trading strategies.”

Do you provide compensation to eligible clients?

“You can check this in our Terms and Conditions.” AvaTrade has different Ts and Cs according to each trader’s region.

What is the recommended initial deposit?

“Kindly note that the minimum deposit amount is USD$100 / ZAR1,750 depending on the base currency of your trading account.”

What are Forex Cashback Rebates?

Forex cashback rebates are a way for traders in the foreign exchange market to get paid for their trades. Most of the time, brokers or other third-party companies give these rebates to encourage traders to use their services.

Does AvaTrade offer Forex Cashback Rebates?

AvaTrade offers Forex Cashback Rebates of up to 30% of the spread or 0.35 pips.

How does the Forex Cashback Rebate process work?

You can sign up for a cashback rebate program with a trusted provider, register a trading account with a broker or transfer an existing one, start trading in the forex market, and receive your rebates according to the financial instruments you trade and your trading volume.

I’m an existing trader, how can I transfer my account to earn rebates via AvaTrade?

Suppose you are an existing trader with a trading account at a different broker and want to transfer your account to AvaTrade to earn rebates. In that case, you will need to follow the steps AvaTrade outlines for transferring an existing account. These steps include registering a live account, requesting a transfer, filling out the transfer form, and waiting for AvaTrade to complete the transfer.

How many traders with AvaTrade use the Cashback Rebate feature?

Of AvaTrade’s 300,000+ customers, there is no indication of how many use AvaTrade’s Cashback rebate feature.

What are the maximum rebates I could earn with AvaTrade?

You can earn up to 30% or 0.35 pips on the MetaTrader 4 platform.

Will my AvaTrade fees and spreads increase when I use the Cashback Rebate feature?

Neither your trading fees nor spreads will increase when you use the Cashback Rebate from AvaTrade.

Why should I work through the SA Shares Cashback?

You can expect some of the highest commissions if you work through SA Shares to earn Cashback Rebates from AvaTrade. This is because SA Shares aims to negotiate the most competitive commission rates with brokers such as AvaTrade to ensure you get the most back from your trading activities.

What is AvaPartners?

AvaPartners is the affiliate program of AvaTrade, offering partners the opportunity to earn commissions by referring new traders to AvaTrade.

How can I join the AvaPartners affiliate program?

To join the AvaPartners affiliate program, visit the AvaPartners website, fill out the registration form, and await approval.

What are forex trading rebates?

Forex trading rebates at AvaTrade are a portion of the transaction cost paid back to the trader for each trade they make, effectively reducing the spread or transaction cost.

How do forex trading rebates work with AvaTrade?

AvaTrade provides rebates for each trade made by a trader, computed for one round turn lot (100,000 units) for currencies and other particular amounts for various commodities.

Are forex trading rebates taxable?

Yes, Forex trading rebates may be taxable based on your country’s tax regulations.

Are there any limitations or restrictions on using forex trading rebates?

Forex trading rebates may include limitations or restrictions, such as minimum trading volumes or certain trading pairs.

Are there any requirements to be eligible for forex trading rebates with AvaTrade?

Yes, there may be. The requirements for AvaTrade forex trading refunds vary but often involve maintaining a certain level of trading activity.

Can I combine forex trading rebates with other promotions or bonuses AvaTrade offers?

AvaTrade does not specifically state whether this is possible. Often, brokers only allow traders to apply one promotion to their accounts at a time.

How are forex trading rebates credited to my account with AvaTrade?

Forex trading rebates are usually credited to your trading account immediately after each trade or at the end of a specified term.

How can I sign up for forex trading rebates with AvaTrade?

To sign up for forex trading rebates with AvaTrade, you must first open an account directly with AvaTrade, and sign up with a rebates program, or you can have an existing account transferred.

How can I track and monitor my forex trading rebates with AvaTrade?

With AvaTrade, you can manage and monitor your forex trading rebates via your account dashboard, which should provide extensive information on your rebates.

How much can I earn through forex trading rebates with AvaTrade?

You can earn between 30% and up to 0.35 pips across markets with AvaTrade.