CMTrading offers forex cashback commissions of up to $2 per million USD traded to Introducing Brokers when their clients register and use Bronze, Silver, Gold, or Premium accounts. Furthermore, traders can earn on forex, energies, crypto, metals, indices, and shares, according to CMTrading.

How to Open a Forex Cashback Account with CMTrading (via SAShares)

You can follow these steps to register for a Forex Cashback Account with CMTrading via SAShares.

Step 1:

Visit the CMTrading website and click “Open New Account.”

Step 2:

Submit your Trading ID to us: [SAShares]

For Example:

To: [SAShares]

Subject: New CMTrading Rebate Application

“Dear SAShares Team,

Please view my CMTrading Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

Step 3:

Wait for approval, which will be sent within [number of hours]. Once approval is given, you will automatically receive your cashback rebates from the CMTrading system.

How to transfer your existing Forex Cashback Account with CMTrading (via SAShares)

If you have an existing trading account with CMTrading, you can easily transfer your existing Cashback Account to SAShares using these few steps:

Step 1: Send an email to CMTrading: [email protected]

Request that the broker transfer the trading account under the following SAShares Affiliate ID: [SAShares]

For Example:

To: [SAShares]

Subject: Account Transfer Request

“Dear CMTrading Partner/Affiliate Team,

I would hereby like to request that my account be transferred to IB/Partner/Affiliate code [SAShares Code]. Furthermore, I would hereby like to request to be assigned under the mentioned IB regardless of whether my account falls under an umbrella or parent IB.”

Step 2:

Once you receive confirmation of the transfer from CMTrading, you can create an additional trading account.

Step 3:

Lastly, you can send your Trading or Client ID to [SAShares].

For Example:

To: [SAShares]

Subject: New CMTrading Rebate Application

“Dear SAShares Team,

Please view my CMTrading Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.

Understanding Forex Trading Rebates and How They Work with CMTrading

CMTrading rebates, referred to as forex cashback, encompass rewarding programs where brokers or rebate providers grant traders commissions for each transaction executed. These initiatives enable traders to generate additional funds from their forex trading activities, irrespective of whether a position concludes in profit.

Forex brokers generate revenue by imposing spreads or commissions on trades, and a portion of this income is shared with the trader as a rebate.

These cashbacks alleviate some of the expenses linked to trading and present a profitable advantage for traders who engage in frequent trading.

How does CMTrading’s forex trading rebates program work?

CMTrading’s forex trading rebates program rewards traders with commissions for each transaction they execute, regardless of whether it ends in profit.

How can traders benefit from CMTrading’s forex trading rebates program?

By earning extra funds from their trading activities, traders can benefit from CMTrading’s forex trading rebates program.

CMTrading Rebate Comparison vs. Notable Other Brokers

| 🔎 Broker | 🥇 CMTrading | 🥈 Tradeview Markets | 🥉 Tickmill |

| 📈 Forex | Up to $2 per million USD traded | $5/10% commission | $7.75 |

| 💡 Energies | Up to $2 per million USD traded | N/A | N/A |

| 🪙 Cryptocurrency | Up to $2 per million USD traded | $5 per lot | N/A |

| 💎 Precious Metals | Up to $2 per million USD traded | $0.025 for Gold per ounce per unit | $7.75 |

| 💍 Precious Metals | Up to $2 per million USD traded | $0.0025 for Silver per ounce per unit | $7.75 |

| 📉 Indices | Up to $2 per million USD traded | $0.125 per contract | N/A |

| 📊 Shares | Up to $2 per million USD traded | $0.00015 per contract | N/A |

How to Maximise Your Savings/Profits with Forex Trading Rebates at CMTrading

Forex trading rebates can be a beneficial instrument for increasing your profits when trading with CMTrading. Here is how you can use this tool to maximize your savings and profits:

- ✅ Understand the Fundamentals:

- ✅ Forex trading rebates are a percentage of the spread or commission paid to the broker for each trade that is returned to you. This can help you cut trade costs while increasing overall profitability.

- ✅ Choosing the Best Broker:

- ✅ CMTrading is a respected broker with a lucrative rebate program. It is critical to select a broker who gives rebates and has a solid reputation, excellent customer service, and a dependable trading platform.

- ✅ Trade regularly:

- ✅ The more you trade, the more rebates you can receive. However, sticking to your trading plan and avoiding overtrading to earn more rebates is critical.

- ✅ Use Rebates to Make Up for Losses:

- ✅ While trading aims to generate money, losses are unavoidable. Rebates can assist in offsetting these losses and reducing the impact on your trading account.

- ✅ Reinvest Your Rebates:

- ✅ Think about reinvesting your rebates in your trading. This can help you expand your trading capital, which could result in larger returns.

Finally, check your rebate balance frequently to guarantee that it is accurately credited to your account. If there are any discrepancies, please contact CMTrading’s customer support.

How much can I earn with CMTrading’s rebate program?

You can earn up to $2 per million USD traded across instruments and account types.

Why should I document my rebates?

It will help you notice any discrepancies, which you can then report to CMTrading and have rectified.

Number of Traders participating in CMTrading Cashback Rebates with Real-Life Examples

Of CMTrading’s over 1 million clients, it is uncertain how many currently participate in the cashback rebates program. However, here are a few real-world examples of CMTrading cashback that we could find:

🥇 Sarah, a frequent forex trader, gains from CMTrading rebates. She earns a significant refund from her rebate provider for each trade she conducts, which helps to cover her trading costs. Whether her trades are profitable or not, Sarah can count on earning additional dollars through this rewarding program, which will improve her entire trading experience.

🥈 An experienced forex trader, John joins forces with CMTrading to benefit from their attractive rebate program. Regardless of the outcome of the trade, he receives a hefty commission from the broker for each transaction he does. These refunds supplement John’s income and minimize his overall trading expenditures, allowing him to optimize his earnings.

🥉 A passionate forex enthusiast, Lisa uses CMTrading’s cashback program to increase her trading earnings. With each trade she conducts, a percentage of the spreads or commissions the broker charges are refunded to her. This cashback is a great financial incentive, providing Lisa with additional income to reinvest in her trading operations, leading to development and success in the forex market.

CMTrading – Advantages over Competitors and the Benefits of Forex Trading Rebates with CMTrading

CMTrading has the following advantages over its competitors:

- ✅ State-of-the-art trading platforms and supreme liquidity allow traders to trade Forex, Index, and Commodities, including Cryptocurrencies, in a highly safe and regulated environment.

- ✅ Strong client support, including Live Chat, email, and numerous international phone numbers.

- ✅ A wide variety of training videos, webinars, technical analysis tools, and e-books for free and available to any trader.

- ✅ High security for trading with their own SSL security systems and segregated accounts for client funds.

- ✅ A range of trading systems, including MT4 with cutting-edge technology, Sirix, the copy trading platform CopyKat, and a 1 to 1 trading feature.

- ✅ Unique features like the “Smart Communication System” and the “Guardian Angel” system provide direct messages from CMTrading regarding signals on market trends and automated feedback on how users trade.

- ✅ Promotions and bonuses to enhance trading power, including a first deposit bonus and an Intercash international debit card for deposits of $1,000 or more.

- ✅ Secure funding methods include Wire Bank Transfers, Debit/ Credit Cards, Neteller, Skrill, OZOW, AstroPay, and more.

Various account types are tailored to different trading experience needs and levels, with features divided by balance maintenance. Each account type offers unique features and services like daily and weekly market reviews, free signing to webinars, risk-free trades, access to advanced webinars, understanding of technical and fundamental analysis, same-day withdrawals, and trading strategies.

Who will Benefit from Trading with CMTrading?

CMTrading’s services are suitable for many traders, from beginners to professionals. For beginners, they offer educational resources, support, and tools like the CopyKat system that allows users to copy the trades of the top 100 traders.

For more experienced traders, they offer advanced features like MetaTrader, various account types with different features and benefits, and a range of trading systems and platforms.

In addition, CMTrading’s unique features like the “Smart Communication System”, the “Guardian Angel” system, and the 1 to 1 trading feature can benefit all kinds of traders by providing them with up-to-date information, feedback on their trading, and opportunities to learn the best practices, respectively.

The CMTrading platform also offers features such as a fast newsfeed, keyword search, custom filters, sentiment indicators, and exclusive stories, which can benefit traders who need to stay up-to-date with the latest market news and trends.

What are the advantages of trading with CMTrading compared to its competitors?

CMTrading offers state-of-the-art trading platforms, supreme liquidity, and a highly safe and regulated trading environment.

What are the benefits of forex trading rebates with CMTrading?

Forex trading rebates with CMTrading provide traders with a range of benefits. These include earning commissions for each transaction, reducing trading expenses, and accessing various account types tailored to different trading experience levels.

Tips for Choosing CMTrading for Forex Trading Rebates and Key Factors to Consider When Evaluating CMTrading’s Forex Trading Rebate Program

Before selecting a rebate service provider, it is critical to conduct extensive research. Look for testimonials and reviews from other traders who have utilized the service. This will offer you a good notion of the service’s quality and the provider’s dependability. Rebate rates vary between brokers and rebate services. Compare these prices to guarantee you are receiving the greatest value.

To participate in a Forex rebate program, you must first link your trading account, whether new or existing, to a Forex rebate provider. Ensure that you understand this method and that it is simple and secure. Earning forex cashback should not be your primary focus. Whatever the magnitude of the rebate, it should not detract from your primary trading plan. Always put generating winning trades ahead of getting rebates.

Exploring CMTrading’s Forex Trading Rebate Program – Key Features and Highlights

| 🔎 Live Account | 💵 Minimum Dep. | 📈 Average Spread | 💴 Commissions | 💶 Average Trading Cost |

| 🥉 Bronze | $100 | 1.7 pips | None | 17 USD |

| 🥈 Silver | $1,000 | 1.2 pips | None | 12 USD |

| 🥇 Gold | $10,000 | 0.9 pips | None | 15 USD |

| 💎 Premium | $100,000 | 0.9 pips | None | 9 USD |

Successful Traders Benefiting from CMTrading’s Rebates – CMTrading’s Forex Trading Rebates Empowering Retail Traders for Success

The forex trading rebates program at CMTrading is specifically created to empower retail traders by providing them with a valuable instrument for success in the currency market. By participating in this effort, traders can earn commissions on every transaction they do, regardless of whether it is profitable.

These rebates are a financial boost, allowing traders to earn more money from their trading activity. This additional money can be used to offset some of the trading costs, such as spreads and commissions, lessening the overall financial load. One of the primary benefits of CMTrading’s rebate program is its broad scope. It caters to seasoned and new traders, leveling the playing field and providing everyone an equal opportunity to benefit.

Because of the democratization of forex trading, retail traders can compete on an equal footing with institutional investors and expert traders.

CMTrading Regulation and Safety of Funds

CMTrading Global Regulations

| 🔎 Registered Entity | 🌎 Country of Registration | 📌 Registration Number | 📍 Regulatory Entity | 📉 Tier | ↪️ License Number/Ref |

| 🅰️ GCMT Limited T/a CMTrading | Seychelles | 8425982-1 | FSA | 3 | SD070 |

| 🅱️ GCMT South Africa PTY LTD T/a CMTrading | South Africa | 2013/045335/07 | FSCA | 2 | FSP 38782 |

How CMTrading Protects Traders and Client Funds

| 🔎 Security Measure | 📌 Information |

| 🔒 Segregated Accounts | ✅ Yes |

| 🔏 Compensation Fund Member | None |

| 🔐 Compensation Amount | None |

| 🔓 SSL Certificate | ✅ Yes |

| 🔒 2FA (Where Applicable) | ✅ Yes |

| 🔏 Privacy Policy in Place | ✅ Yes |

| 🔐 Risk Warning Provided | ✅ Yes |

| 🔓 Negative Balance Protection | ✅ Yes |

| 🔒 Guaranteed Stop-Loss Orders | None |

What regulatory entities oversee CMTrading’s operations?

CMTrading is licensed by the FSA in Seychelles and the FSCA in South Africa.

Does CMTrading have measures in place to protect traders and client funds?

Yes, CMTrading has several security measures to protect traders and client funds.

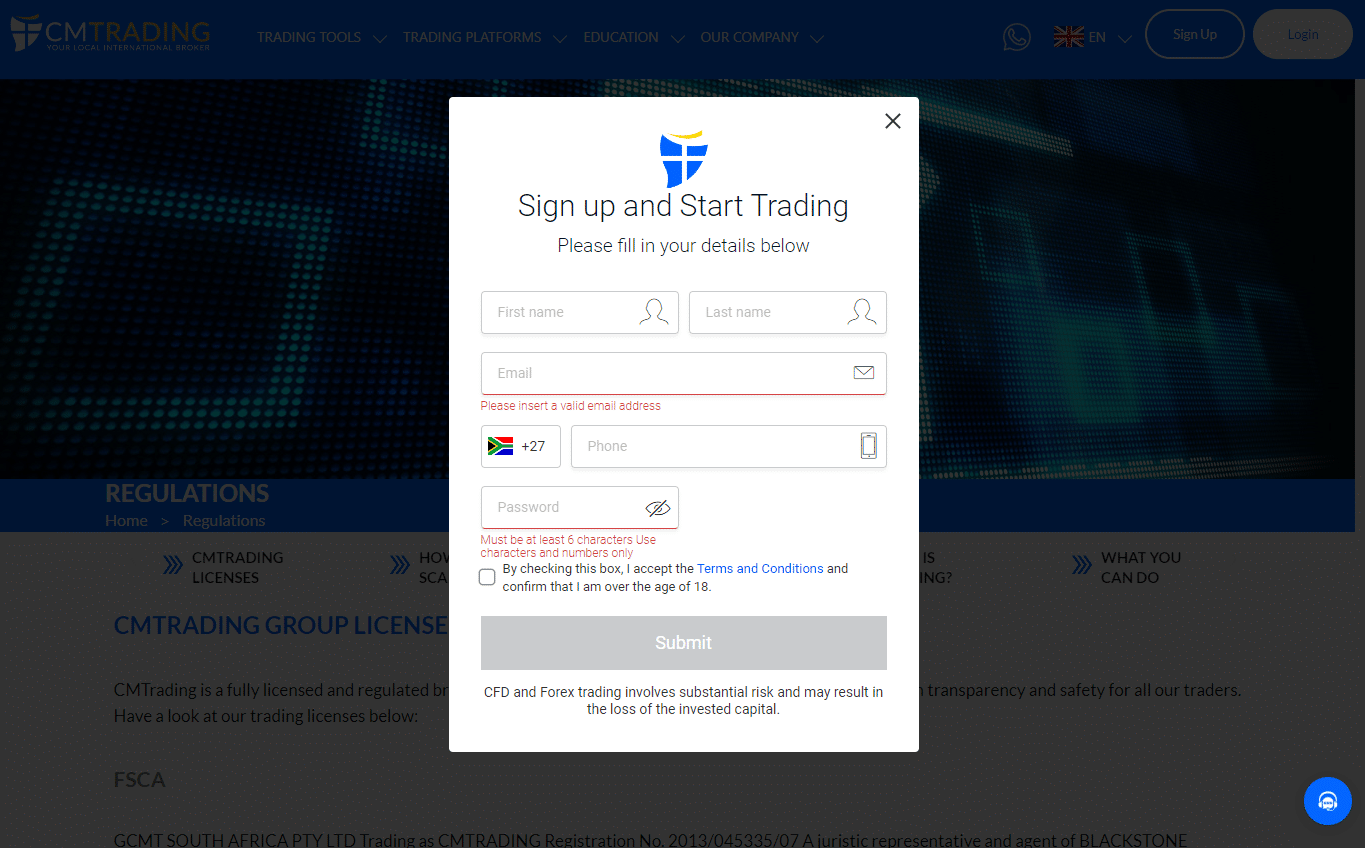

How to Open a Trading Account with CMTrading

To register a live trading account with CMTrading, you can follow these steps:

- ✅ Sign up on the CMTrading website by clicking the “Open Account” banner.

- ✅ Complete the registration form by filling in the required fields.

- ✅ Click the “Accept Terms & Conditions box and then “Submit”.

- ✅ This will bring you to the CMTrading portal and WebTrader Platform.

- ✅ Click on “Add Account”.

- ✅ Provide the necessary details by completing the required fields.

- ✅ Click on ‘Next’.

Verify your identity and residential address by uploading/emailing the required documents. Once approved, pay the minimum deposit for the account registered and start trading.

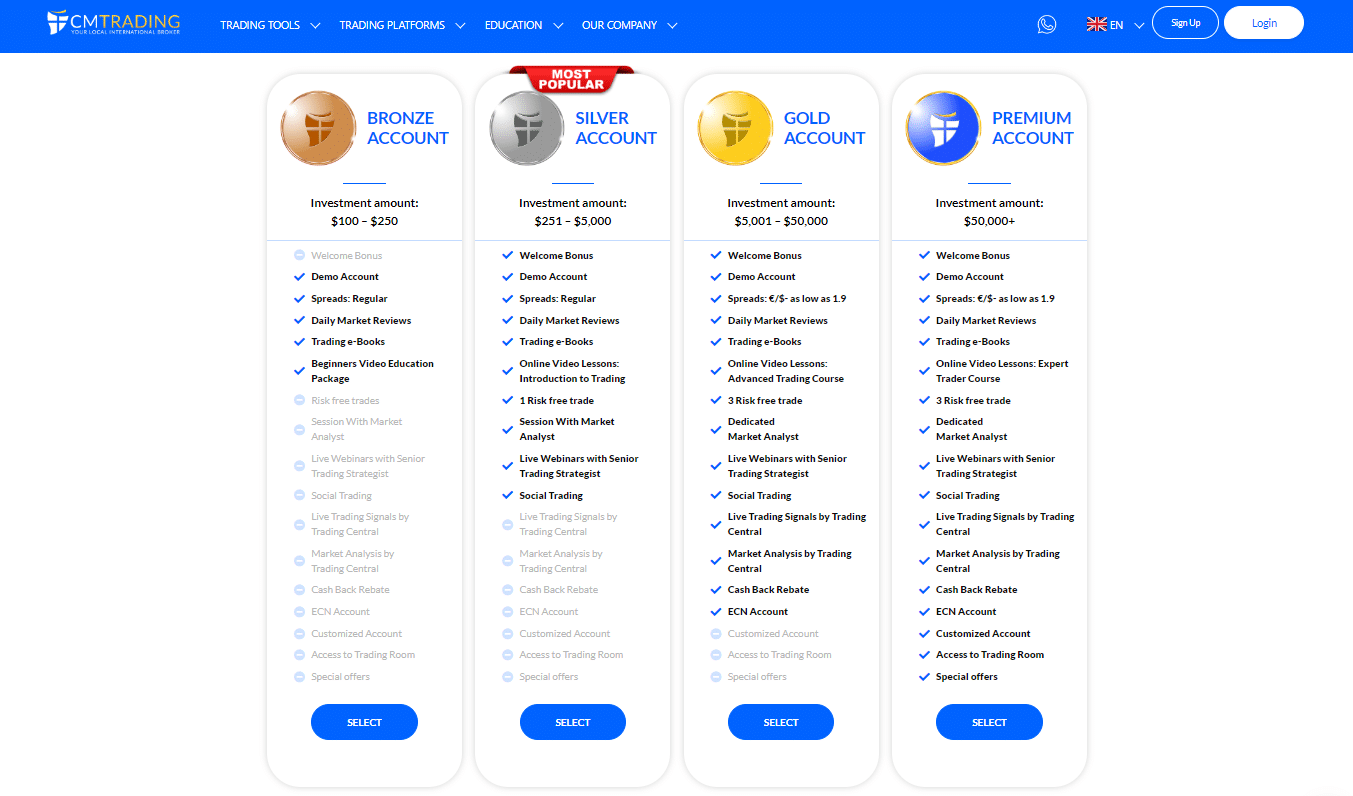

What is CMTrading’s minimum deposit?

The minimum deposit requirements for CMTrading’s live trading accounts are as follows: Bronze Account – $100, Silver Account – $1,000, Gold Account – $10,000, and Premium Account – $100,000+.

What spreads can I expect from CMTrading?

The available spreads for each live trading account at CMTrading are as follows: Bronze Account – 1.7 pips, Silver Account – 1.2 pips EUR/USD, Gold Account – 0.9 pips, and Premium Account – 0.9 pips.

CMTrading Account Types

The various CMTrading account types are tailored to different trading experience needs and levels, with features divided by balance maintenance. Each account type offers unique features and services like daily and weekly market reviews, free signing to webinars, risk-free trades, access to advanced webinars, understanding of technical and fundamental analysis, same-day withdrawals, and trading strategies.

CMTrading Bronze Account

The CMTrading Bronze account is designed for new traders looking to enter the forex market. It provides basic features and tools to get started, including access to the CMTrading platform, educational resources, and customer support. Some features include the following:

| 🔎 Account Feature | 📍 Value |

| 💴 Minimum Deposit | $100 |

| 💵 Maximum Deposit | $999 |

| 🆓 Demo Account | ✅ Yes |

| 🖍️ Educational materials | ✅ Yes |

| 📊 Market Reviews | ✅ Yes |

| 📉 Spreads from | 1.7 pips |

CMTrading Silver Account

The CMTrading Silver account is a step up from the Bronze account and offers additional features and benefits. Traders with a Silver account can access market reviews, Trading Central Live Trading Signals, personal assistance, and lower spreads.

| 🔎 Account Feature | 📌 Value |

| 💴 Minimum Deposit | $1,000 |

| 💵 Maximum Deposit | $9,999 |

| 🆓 Demo Account | ✅ Yes |

| 🖍️ Educational materials | ✅ Yes |

| 📊 Market Reviews | Yes |

| 📉 Spreads from | 1.2 pips EUR/USD |

| 📍 Live Trading Signals | ✅ Yes |

| 💹 Risk-Free Trades offered | 1 Risk-Free Trade |

| ❤️ Personal Assistant offered | ✅ Yes |

| ↪️ Trading Central Trading Signals | ✅ Yes |

| ⏩ Trading Central Live Trading Signals | ✅ Yes |

CMTrading Gold Account

The CMTrading Gold account is aimed at more experienced traders who require enhanced trading capabilities. With a Gold account, traders may enjoy tighter spreads, faster execution, access to cashback rebates, and other advanced features.

| 🔎 Account Feature | 📌 Value |

| 💴 Minimum Deposit | $10,000 |

| 💵 Maximum Deposit | $99,999 |

| 🆓 Demo Account | Yes |

| 🖍️ Educational materials | Yes, Trading eBooks, Webinars |

| 📊 Market Reviews | ✅ Yes |

| 📈 Spreads from | 0.9 pips |

| 📉 Live Trading Signals | ✅ Yes |

| ↪️ Risk-Free Trades offered | 3 Risk-Free Trades |

| 🥰 Personal Assistant offered | ✅ Yes |

| ✴️ Trading Central Trading Signals | ✅ Yes |

| 📍 Trading Central Live Trading Signals | ✅ Yes |

| 🎁 Cashback Rebates | ✅ Yes |

| 💹 Access to ECN | ✅ Yes |

CMTrading Premium Account

The CMTrading Premium account is the highest tier offered by CM Trading, catering to professional and institutional traders. This account type typically includes premium features like personalized trading strategies, a dedicated trading room, customized trading conditions, and other tailored services.

| 🔎 Account Feature | 📌 Value |

| 💴 Minimum Deposit | $100,000> |

| 💵 Maximum Deposit | None |

| 🆓 Demo Account | ✅ Yes |

| 🖍️ Educational materials | Yes, Trading eBooks, Webinars |

| 📰 Market Reviews | ✅ Yes |

| 📈 Spreads from | 0.9 pips |

| 📉 Live Trading Signals | ✅ Yes |

| 📊 Risk-Free Trades offered | 3 Risk-Free Trades |

| 📍 Personal Assistant offered | ✅ Yes |

| 🅰️ Trading Central Trading Signals | ✅ Yes |

| 🅱️ Trading Central Live Trading Signals | ✅ Yes |

| 💴 Cashback Rebates | ✅ Yes |

| 🚩 Access to ECN | ✅ Yes |

| 💹 Market News and Analysis for Fundamental Analysis | ✅ Yes |

| 🎁 Special Offers | ✅ Yes |

| 💻 Dedicated Trading Room | ✅ Yes |

| 🖥️ Trading specialist offering investment advice | ✅ Yes |

CMTrading Demo Account

At CMTrading, opening an account is straightforward, ensuring that traders can quickly become trading-ready within minutes. It is important to note that creating a demo account is only possible once a real account has been established, which may be disappointing for some traders.

This approach deviates from the common practice among brokers and may not be ideal for novice traders who prefer to engage in risk-free trading before committing to a genuine account. The demo account provided by CMTrading comes pre-funded with USD 10,000, and, if desired, traders can request additional virtual funds from CMTrading.

With this demo account, traders can fully evaluate the capabilities of the MT4 and MT5 platforms, experience real-time pricing, and gain first-hand exposure to the authentic volatility of the forex market.

CMTrading Islamic Account

CMTrading prides itself on being a fully Sharia-compliant Islamic forex broker, meticulously adhering to all Islamic finance and law standards. The provision of swap-free trading accounts by CMTrading empowers Muslim investors to engage in trading activities without incurring any swap fees or interest on overnight holdings.

It is worth noting that traders who opt for an Islamic swap-free account at CMTrading are limited to financial instruments and products that comply with Sharia principles. Consequently, trading in cryptocurrency and stocks is unavailable within the context of this account type.

CMTrading Trading Platforms

CMTrading makes a wide selection of trading platforms available, including MetaTrader4, WebTrader, and, CopyKat. CMTrading’s MetaTrader 4 platform supports diverse trading strategies, including Expert Advisors (EAs), hedging, and scalping.

CMTrading MetaTrader 4

CMTrading provides traders with a robust platform powered by MetaTrader 4, enriched with exclusive CMTrading features. Recognized as a popular choice among traders, this platform offers a comprehensive set of tools for trading and technical analysis.

With its customizable and automated features and a wealth of valuable information, CMTrading’s MetaTrader 4 seamlessly integrates into our service portfolio, allowing clients to enjoy trading with tight spreads and “Market Execution” without requotes.

The MetaTrader 4 platform from CMTrading is designed to cater to diverse trading strategies, accommodating techniques such as Expert Advisors (EAs), hedging, and scalping.

CMTrading WebTrader

CMTrading’s WebTrader represents a significant advancement in currency trading, offering the convenience of executing trades from various devices, such as cell phones, computers, and tablets, without the need for software downloads or installations.

WebTrader seamlessly connects you to a diverse range of currencies and markets. Compatible with Mac OS and Windows operating systems, WebTrader’s growing user base is a testament to its success.

Here are some reasons why traders prefer it:

- ✅ Availability of 24/7 user updates

- ✅ Backup options for added security

- ✅ A secure interface to protect your transactions

- ✅ Continuous availability of the software

- ✅ Encrypted services to ensure data privacy

- ✅ Capability to manage multiple accounts

- ✅ Hassle-free transactions

- ✅ Real-time online trading tips

- ✅ Access to forecasts, graphical representations, and more.

Furthermore, WebTrader is a versatile investment/trading platform that seamlessly synchronizes with other trading platforms. It allows you to manage all your transactions through a web browser, eliminating the need for additional software downloads.

CMTrading CopyKat

CMTrading also offers traders access to CopyKat, an exceptional platform that allows traders to observe, learn, and replicate sophisticated strategies that successful traders employ. Even novice traders can trade like professionals with a simple click.

CopyKat is designed to ensure beginner investors a safe and regulated investment experience, providing the necessary tools and guidance for improved outcomes.

What are the key features of CMTrading’s MetaTrader 4 platform?

CMTrading’s MetaTrader 4 platform supports diverse trading strategies, including Expert Advisors (EAs), hedging, and scalping. Traders can create and customize EAs, indicators, and charting tools using the MetaTrader MQL4 programming language.

What are the advantages of using CMTrading’s WebTrader platform?

CMTrading’s WebTrader platform offers features such as 24/7 user updates, backup options for added security, a secure interface to protect transactions, continuous availability, encrypted services for data privacy, and the capability to manage multiple accounts.

Which Markets Can You Trade with CMTrading?

Traders can expect to have access to the following markets via CMTrading; Currency Trading, Stocks, Indices, Cryptocurrencies, Commodities, and CFDs.

Financial Instruments and Leverage offered by CMTrading

| 🔎 Instrument | 📌 Number of Assets Offered | 📍 Max Leverage Offered |

| 📈 Forex | 50 | 1:200 |

| 💎 Precious Metals | 7 | 1:50 |

| 📉 Share CFDs | 69 | 1:20 |

| 📊 Indices | 17 | 1:50 |

| 🪙 Cryptocurrency | 23 | 1:2 to 1:5 |

| 🍎 Commodities | 8 | 1:100 |

Which markets can I trade with CMTrading?

CMTrading offers a range of markets for trading, including currency trading, stocks, indices, cryptocurrencies, commodities, and CFDs.

What is the maximum leverage offered by CMTrading?

CMTrading offers different maximum leverage ratios for various financial instruments. For example, the maximum leverage offered for forex is 1:200, for precious metals is 1:50, for share CFDs, is 1:20, for indices is 1:50, for cryptocurrencies is 1:2 to 1:5, and for commodities is 1:100.

CMTrading Trading and Non-Trading Fees

CMTrading Spreads

The spreads offered by CMTrading are subject to variation based on traders’ overall trading activity, the type of retail investor account they utilize, and the prevailing market conditions on the trading day.

- 🥉 Bronze Account – 1.7 pips EUR/USD

- 🥈 Silver Account – 1.2 pips EUR/USD

- 🥇 Gold Account – from 0.9 pips EUR/USD

- 💎 Premium Account – from 0.9 pips EUR/USD

Some typical spreads from popular instruments are as follows:

| 📌 Instrument | 📍 Average Spreads in Points |

| 💴 EUR/USD | 17 points |

| 🛢️ Crude Oil | 6 points |

| 💧 Brent Oil | 12 points |

| ↪️ USTECH | 375 points |

| ✴️ VIX | 280 points |

| 🍎 Apple | 231 points |

| 💶 BTC/USD | 11847 points |

CMTrading Commissions

CMTrading incorporates its broker expenses within the spreads that traders pay, eliminating the need for separate transaction commission fees.

CMTrading Overnight Fees, Rollovers, or Swaps

To avoid incurring overnight fees, traders are advised to close their positions promptly at the end of the trading day. The calculation of overnight fees considers factors such as the trader’s current position size, the specific financial instrument being traded, and the duration of the position.

CMTrading typically calculates overnight costs by dividing the position’s length by the number of nights and multiplying it by the swap (buy or sell), the number of lots (or position size), and the financial instrument’s point value.

Traders can expect to encounter the following examples of typical overnight fees on popular instruments:

| 🔎 Instrument | ↪️ Swap Long | ➡️ Swap Short |

| 💴 EUR/USD | -14.56 points | -2 points |

| 🛢️ Crude Oil | -4 points | -3.6 points |

| 💧 Brent Oil | -2.121 points | -1.9888 points |

| 📌 USTECH | -137.551948 points | -83.849328 points |

| 📍 VIX | -10 points | -10 points |

| 🍎 Apple | -20.34 points | -17.41115 points |

| 💶 BTC/USD | -6200 points | -6200 points |

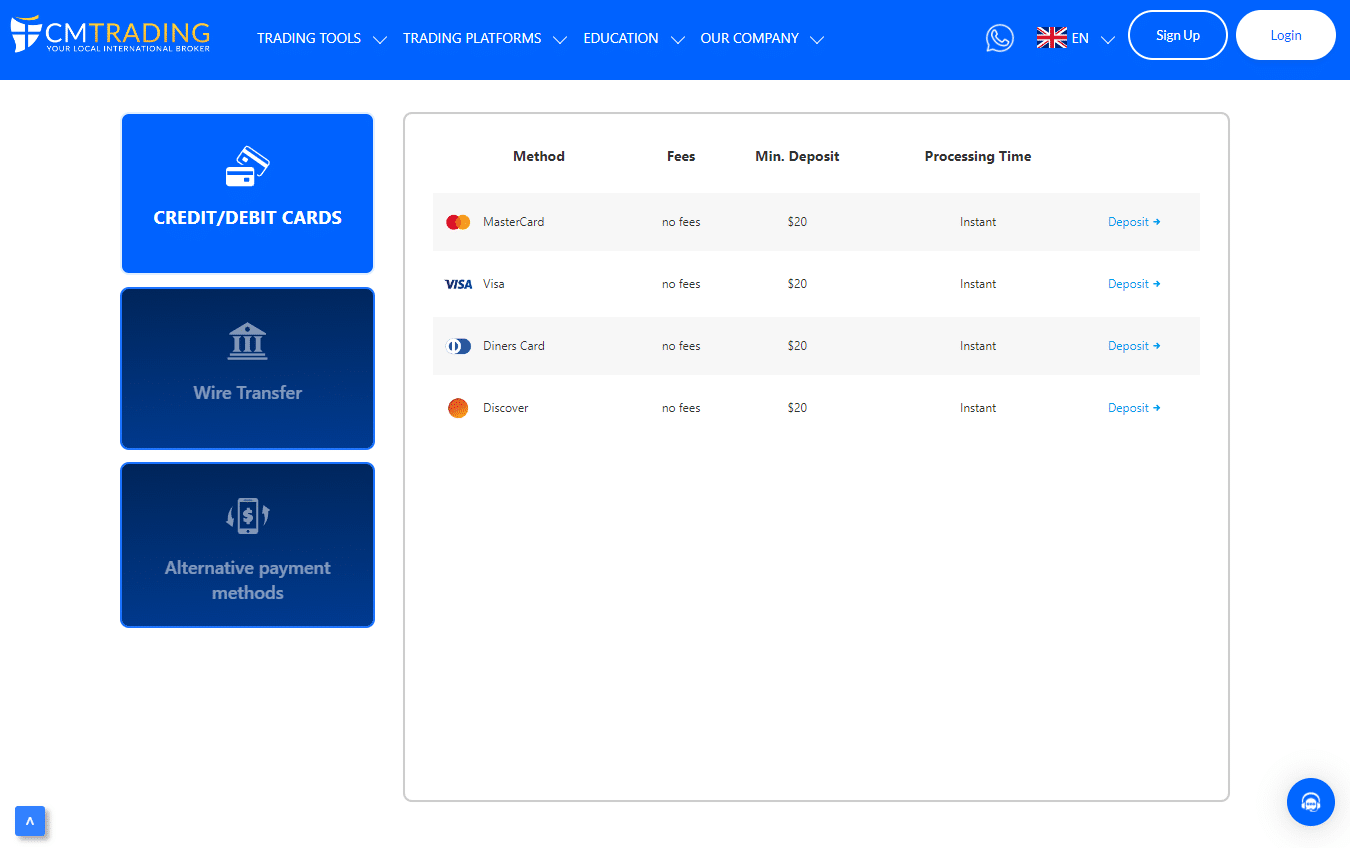

CMTrading Deposit and Withdrawal Fees

Traders can anticipate paying the following fees when they withdraw money:

- ✅ Bank Wire Transfer – 2%

- ✅ Bank Transfer – 2%

- ✅ OZOW – 2%

- ✅ Electronic Fund Transfer (EFT) – 2%

- ✅ Skrill – 2%

- ✅ Neteller – 2%

- ✅ Credit Card – 2%

- ✅ Debit Card – 2%

- ✅ M-PESA – 2%

- ✅ Local Mobile Money – 2%

- ✅ Cryptocurrencies – 4%

Traders who deposit money using cryptocurrency wallets will be subject to a fee.

CM Trading Inactivity and Currency Conversion Fees

CMTrading imposes a $15 inactivity fee on inactive trading accounts for three consecutive months. This fee, utilized for account management and upkeep, is charged monthly for each subsequent month of inactivity. Traders who deposit and withdraw funds in currencies other than EUR or USD could incur currency conversion costs.

What are the CMTrading deposit and withdrawal fees?

CMTrading charges a fee of 2% for various deposit and withdrawal methods, including bank wire transfers, bank transfers, Skrill, Neteller, credit cards, and more.

What spreads does CMTrading charge?

You can expect spreads from 0.9 pips EUR/USD.

Calculating Forex Trading Rebates with CMTrading

The broker typically determines the rebate rate, which might vary depending on the kind of account and trading volume. This rate is commonly represented as a fixed sum per lot transacted. Your transaction volume is important in establishing your rebates. This is normally done in lots. For instance, if you trade ten lots at a rebate rate of $2 per lot, your total rebate would be $20.

A Forex rebate calculator will help you calculate how much cashback you can receive from your trading positions. Simply enter your trade volume and the rebate rate, and the calculator will calculate your potential rebates.

Some brokers calculate rebates based on trading activity over a period, such as a month. The more you trade during this time, the greater your potential rebates. Check your account frequently to guarantee that your rebates are accurately credited. If there are any discrepancies, please contact CMTrading’s customer support.

Claiming and Withdrawing Forex Rebates at CMTrading

CMTrading offers the following deposit and withdrawal methods:

- ✅ MasterCard

- ✅ Visa

- ✅ Diners Card

- ✅ Discover

- ✅ Bank Wire Transfer

- ✅ EFTs

- ✅ AstroPay

- ✅ Finrax Crypto

- ✅ Skrill

- ✅ Neteller

- ✅ Swiffy

- ✅ OZOW

and many, MANY more!

How to Deposit Funds with CMTrading

To deposit funds to an account with CMTrading, traders can follow these steps:

- ✅ Click on the “Deposit” tab next to your name from within the Client Portal.

- ✅ Choose your preferred deposit method.

- ✅ Fill out the required fields.

After these steps, your live trading account should be successfully funded. Please note that bank wire transfers could take 1-3 business days for funds to reflect in your live trading account. You can speed up this process by providing your proof of payment to CMTrading.

CMTrading Fund and Rebate Withdrawal Process

To withdraw funds from an account with CMTrading, traders can follow these steps:

- ✅ Go to the CMTrading website and click on “Login”.

- ✅ Add your email address and password.

- ✅ Once logged into the portal, click on your name on the top right and “Withdraw”.

- ✅ Choose your funded account and the amount you want to withdraw.

- ✅ Click on “Withdraw Funds”.

- ✅ The preferred payment method must remain as “Other”.

- ✅ In the second field, please add any payment method and some details with the last 4 digits showing.

- ✅ Once you have added the details, click on “Submit”.

After these steps, you should receive an email confirmation that your withdrawal request was successful. Traders should note that additional documents could be required, and failure to provide them in due time may result in the request being canceled by CMTrading.

How quickly does CMTrading process my withdrawal?

CMTrading typically processes withdrawals within one working day. However, certain payment methods have long processes, and your funds might take a few days to reflect in your bank account.

How much do CMTrading withdrawals cost?

Withdrawal fees are between 2% and 4%, depending on the method used.

CMTrading Awards and Recognition

Here are some of the recent prestigious recognitions received by CMTrading:

- ✅ In 2022, CMTrading was honored as the Best-Performing Broker by the Global Business Review.

- ✅ The Ultimate Fintech Awards acknowledged CMTrading as Africa’s Best Financial Brokerage Firm in 2021.

- ✅ The Global Business Review designated CMTrading as the Best-Performing Broker in 2021.

Furthermore, in 2020, CMTrading won the International Business Magazine’s esteemed award for Best Financial Broker in Africa.

Is there a record of CMTrading’s awards on the website?

Yes, you can find CMTrading’s awards on the official website under “Our Company” and then “Our Awards.”

What do these awards mean for CMTrading?

These awards and recognition highlight CMTrading’s commitment to providing exceptional services and reinforce its dedication to delivering high-quality trading experiences to its clients.

CMTrading Customer Support

| 🔎 Customer Support | 🥰 CMTrading Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🔊 Support Languages | Multilingual |

| 👤 Live Chat | Yes |

| 💌 Email Address | [email protected] |

| ☎️ Telephonic Support | +44 161 388 3321 |

| 🔟 The overall quality of CMTrading Support | 3/5 |

Customer Support – Live Chat Questions and Answers

We tested CMTrading’s live chat by asking them some of the most common FAQs prospective traders might have, and we have recorded their answers below. Answers are verbatim but edited for spelling and grammar.

How quickly will I receive my sign-up bonus?

“We have bonuses if you make a deposit which you can get almost instantly.”

How can I manage my trading risk when I sign up?

“You will be allocated a Market Analyst to explain to you.”

Do you recommend leverage?

“The standard is 1:200. If you want to change it, you speak with your Market Analyst, who will arrange it for you.”

Which Forex Rebate Trading Strategy should I try as a beginner?

“This is something to speak with your Market Analyst after you fund your account with at least $250, for which you will be assigned to a Market Analyst. Otherwise, you will not have a Market Analyst.”

Do you provide compensation to eligible clients?

Yes, CMTrading does provide compensation to eligible clients.

What is your requote policy?

“We strive to ensure that our quoted prices result in the best possible execution for you when the quote is provided. However, in fast-moving markets, a transaction can be executed at a price that is no longer the best market price.

Significant market movements can also occur after news announcements, economic events, or between closures and re-openings. These movements may significantly impact the execution of pending orders.”

How do you protect client data and information?

“We acknowledge the importance of your personal information and your concerns about sharing it. Rest assured, we prioritize your privacy and are dedicated to lawfully handling and processing your information.

We aim to be transparent about how we process your information and for what purpose. If you believe that your information is not being processed correctly or is being used for unintended purposes, you have the option to contact our Information Officer.

At any time, you can request access to the information we hold about you, and if you believe that any of the information is outdated, you can request updates or corrections.”

What execution speeds can I expect, and what is your execution policy?

“While we treat you as the principal and provide two-way price quotes, we acknowledge that if you are a Retail Client, you rely on us to consistently offer the best available bid and prices for retail investors.

Your Orders will be handled according to our Order Execution Policy, which can be found in the Trading Handbook on the CMTrading website.

While we strive to display competitive prices, we cannot guarantee that our bid and offer prices always represent the best prevailing market prices for retail investors.

Market volatility and additional costs may result in increased spreads and commissions. We may combine your Order with others, but we will ensure a fair allocation of investments across those Orders. However, there may be instances where aggregation leads to a less favorable price.”

How do you handle customer complaints?

“Each matter will be sent to the relevant department for investigation, and actions will apply depending on the issue and the Client Service Agreement Terms and Conditions.”

What is the recommended initial deposit?

“We do not recommend anything. This is your decision. We have several Account types, each one with its own minimum deposit. We invite you to look and choose the one that best suits your needs.

Legal and Tax Implications of Forex Trading Rebates with CMTrading

Forex trading commissions are often seen as a kind of revenue. As a result, depending on your local tax regulations, they may be taxed. Keeping track of your rebates and correctly declaring them on your tax return is critical.

In terms of legal concerns, make certain that the broker you are dealing with, in this example, CMTrading, is regulated by a respected financial body. This protects your assets while ensuring the broker adheres to tight regulatory rules.

Risks and Limitations of Forex Trading Rebates at CMTrading

While forex trading rebates can provide an additional source of revenue, they should not be the only consideration when selecting a broker or a trading strategy. Always emphasize profitable trading and effective risk management.

Also, remember that rebates are often calculated depending on trading volume, which may encourage overtrading, increasing your risk. It is also critical to note that rebates will not turn bad deals profitable. They can assist in lowering your trading costs but will not increase your trading performance.

Strategies to Maximise Rebates with CMTrading

The more you trade, the more rebates you can receive. However, sticking to your trading plan and avoiding overtrading to earn more rebates is critical. A Forex rebate calculator will assist you in calculating how much cashback you can receive from your trading positions. Simply enter your trade volume and the rebate rate, and the calculator will calculate your potential rebates.

Think about reinvesting your rebates in your trading. This can help you expand your trading capital, which could result in larger returns. Check your rebate balance frequently to guarantee that it is accurately credited to your account. If there are any discrepancies, please contact CMTrading’s customer support.

CMTrading User Reviews

🥇 Disappointed.

I sought assistance from your company to complete the registration process, clearly expressing my status as a beginner in this industry to your agent. Although I had limited funds, your agent assured me that a mere $100 would suffice for registration and even went further to provide an additional $150 to commence trading. However, despite a week has elapsed, I have regrettably been unable to engage in any trading activity, as the promised amount has yet to be credited to my account. – Isabella Costa

🥈 Pleasantly Surprised.

To test the reliability of CM Trading, I deposited $44 into my account and withdrew it after two days. The company exceeded my expectations and allayed any suspicions I may have had. I am confident in their capabilities and regard them highly. – Liam O’Connor

🥉 Room for improvement.

While I appreciate the assistance in the registration and funding processes, I believe there is room for improvement in the introductory guidance offered to first-time traders. The current approach falls short of providing new traders with the necessary support and clarity. – Mia Kim

Trading with CMTrading Pros and Cons

| ✅ Pros | ❎ Cons |

| CMTrading caters for beginner and professional traders | Withdrawals can be expensive |

| CMTrading is well-regulated and has a high trust rating | Customer support agents can be rude and impatient at times |

| There are copy-trading features offered | The spread list and other fees are not transparent on the website |

Recommendation for Improving CMTrading Cashback Rebates

Firstly, the broker’s market reach is limited, with trading services unavailable in regions such as the United States, Hong Kong, and the EU Regions. Expanding into these markets could significantly increase CMTrading’s client base and global presence. Additionally, introducing bonuses and promotions could be an attractive incentive for potential and existing traders.

Transparency is another area where CMTrading could improve. For instance, the number of clients participating in the cashback rebates program is undisclosed. Providing this information could help potential clients make more informed decisions. CMTrading could enhance its trading tools by introducing a Cashback Forex Calculator, Lot Size Calculator, or Compounding Calculator.

Lastly, while CMTrading offers a maximum leverage of 1:200, some traders might prefer higher leverage for certain trades.

Our Verdict on CMTrading

CMTrading has established itself as a reputable player in the global trading landscape, particularly excelling in the African market. As a well-regulated entity, it ranks among the top Forex and CFD Brokers worldwide, demonstrating its commitment to providing a secure and reliable trading environment.

Furthermore, our findings show that CMTrading offers diverse trading options, including currency trading, stocks, indices, cryptocurrencies, commodities, and CFDs. CMTrading’s cashback rebate program is another notable feature.

Available to new and existing accounts, these rebates return a portion of trading costs to the trader. Importantly, these rebates do not inflate the standard fees and spreads charged by CMTrading, making them a genuine user benefit.

Frequently Asked Questions about Forex Trading Rebates at CMTrading

What are forex trading rebates?

Forex Cashback Rebates are incentives provided to traders by brokers or third-party services. They function as a form of cashback, returning the trader a portion of the spread or commission charged by the broker. They are usually calculated using trading volume.

What are the benefits of the CMTrading Rebate Program?

The CMTrading Rebate Program can help reduce trading costs and increase overall profitability by returning a portion of the spread or commission to the trader.

How can I sign up for CMTrading Rebates?

To sign up for CMTrading rebates, you need to open a trading account with CMTrading on their website.

How do forex trading rebates work with CMTrading?

The Forex Cashback Rebate method normally entails signing up for a Cashback Rebate program with CMTrading or a rebate provider, attaching your trading account to the program, making trades as usual, and earning a percentage of your trading expenses back as rebates.

Rebates are typically generated based on trading volume and other defined characteristics and are paid back to your account regularly.

Are forex trading rebates taxable?

Yes, Forex trading rebates are generally considered a form of income and may be subject to tax depending on your local tax laws.

How are CMTrading Rebates calculated?

CMTrading rebates are typically calculated based on your trading volume.

Are there any limitations or restrictions on using forex trading rebates?

Yes, there might be limitations or restrictions on using forex trading rebates, such as minimum trading volume requirements or restrictions on withdrawal.

Are there any requirements to be eligible for forex trading rebates with CMTrading?

To be eligible for forex trading rebates with CMTrading, clients can make a request to their Market Analyst for a Cash Back Rebate, available once per month, calculated as $2 per million USD traded.

How can I maximize profits with CMTrading Rebates?

Profits can be maximized by trading regularly, reinvesting your rebates into trading, and using a Forex rebate calculator to estimate potential rebates.

Can I combine forex trading rebates with other promotions or bonuses offered by CMTrading?

You might be able to combine forex trading rebates with other promotions or bonuses offered by CMTrading, but this would depend on the terms and conditions of each specific promotion or bonus.

How are forex trading rebates credited to my account with CMTrading?

Forex trading rebates are typically credited to your trading account, but the exact process may vary with CMTrading. To sign up for forex trading rebates with CMTrading, you would likely need to open a trading account and opt into their rebate program.

How can I sign up for forex trading rebates with CMTrading?

You can register an account with CMTrading or use a rebates program such as SAShares to register an account and start earning rebates.

How can I track and monitor my forex trading rebates with CMTrading?

To track and monitor your forex trading rebates with CMTrading, you would likely need to check your account balance and transaction history regularly or use any tracking tools provided by CMTrading.

How much can I earn through forex trading rebates with CMTrading?

With CMTrading, you could earn up to $2 per million USD traded.