Overall, OANDA offers a forex cashback according to its Advanced Trader program on the Standard and Core Accounts from $15 per million traded on the Advanced Trader Program. However, traders could earn up to $17 per million on the Elite Trader Program.

| 🔎 Oanda Account | 🥇 MT4 | 🥈 FxTrade |

| 🅰️ Forex | 1 USD per Standard Lot (100,000) USD traded | 1 USD per Standard Lot (100,000) USD traded |

| 🅱️ Payment Frequency | Monthly Cashback | Monthly Cashback |

OANDA Cashback Rebates – 28 Key Point Quick Overview

- ✅ OANDA Rebates Summary

- ✅ How to Open a Forex Cashback Account with OANDA (via SAShares)

- ✅ Number of Traders participating in OANDA Cashback Rebates

- ✅ Detailed Summary of OANDA

- ✅ Geolocation of Traders

- ✅ OANDA – Advantages Over Competitors

- ✅ Who will Benefit from Trading with OANDA?

- ✅ OANDA Regulation and Safety of Funds

- ✅ OANDA Awards and Recognition

- ✅ OANDA Account Types and Features

- ✅ How to open an Account with OANDA

- ✅ OANDA Trading Platforms

- ✅ Which Markets Can You Trade with OANDA?

- ✅ OANDA Trading and Non-Trading Fees

- ✅ OANDA Deposits and Withdrawals

- ✅ OANDA Education and Research

- ✅ OANDA Bonuses and Current Promotions

- ✅ How to open an Affiliate Account with OANDA

- ✅ OANDA Customer Support

- ✅ OANDA Alternatives

- ✅ OANDA VPS Review

- ✅ OANDA Web Traffic Report

- ✅ OANDA vs. Other Notable Brokers

- ✅ OANDA Pros and Cons

- ✅ OANDA Customer Reviews

- ✅ Recommendation for Improving OANDA Cashback Rebates

- ✅ Our Verdict on OANDA

- ✅ OANDA Frequently Asked Questions

OANDA Rebates Summary

- ✅ OANDA has an overall rating of 4.3 / 5

- ✅ OANDA has a Real Customer Rating of 4.1 / 5

OANDA Rebate Conditions

- ✅ Traders on Tiers 1 and 2 must deposit at least $10,000 or have net deposits totaling this amount within a year.

- ✅ On Tier 1, rebates are granted to accounts that have traded at least $10 million.

- ✅ On Tier 2, rebates are granted to accounts with a trading volume of more than $10 million.

- ✅ Traders on Tier 3 must have an account balance of at least $100,000 or net deposits totaling this amount over a year.

- ✅ On Tier 3, rebates are granted to accounts with trading volumes ranging from $10 million to $100 million.

On Tier 4, rebates are granted to accounts with a balance of more than 250,000 USD or net deposits totaling this amount over a year.

OANDA Additional notes on Cashback Rebates

- ✅ There are four stages in the Advanced Trader program according to monthly trading volume and initial deposit.

- ✅ Tier 2 traders can receive a $5 million reimbursement or a commission decrease.

- ✅ Tier 3 traders can receive a $10 million reimbursement or a commission decrease.

Tier 4 traders can receive a $15 million reimbursement or a commission decrease.

How to Open a Forex Cashback Account with OANDA (via SAShares)

You can follow these steps to register for a Forex Cashback Account with OANDA via SAShares.

For New Accounts

If you do not have an existing account with OANDA, you can easily obtain a cashback rebate in three simple steps.

✅ Step 1: Visit the OANDA Website

Visit the OANDA website and click “Open New Account.”

✅ Step 2: Submit a Trading ID

Submit your Trading ID to us: [SAShares]

For Example:

To: [SAShares]

Subject: New OANDA Rebate Application

“Dear SAShares Team,

Please view my OANDA Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

✅ Step 3: Wait for Approval

Wait for approval, which will be sent within [number of hours]. Once approval is given, you will automatically receive your cashback rebates from the OANDA system.

For Existing Accounts

If you have an existing OANDA account, you can get a cashback rebate by following these simple steps.

✅ Step 1: Contact OANDA via Email

Send an email to OANDA: [email protected]. Request that the broker transfer the trading account under the following SAShares Affiliate ID: [SAShares]

For Example:

To: [SAShares]

Subject: Account Transfer Request

“Dear OANDA Partner/Affiliate Team,

I would hereby like to request that my account be transferred to IB/Partner/Affiliate code [SAShares Code]. Furthermore, I would hereby like to request to be assigned under the mentioned IB regardless of whether my account falls under an umbrella or parent IB.”

✅ Step 2: Open an Additional Trading Account

Once you receive confirmation of the transfer from OANDA, you can create an additional trading account.

✅ Step 3: Contact SAShares

Lastly, you can send your Trading or Client ID to [SAShares].

For Example:

To: [SAShares]

Subject: New OANDA Rebate Application

“Dear SAShares Team,

Please view my OANDA Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

Number of Traders participating in OANDA Cashback Rebates

OANDA has thousands of clients globally, but no indication of how many registered clients use OANDA’s cashback rebate program exists.

Understanding Forex Trading Rebates: How They Work with OANDA

Forex trading rebates are a portion of the transaction cost that is paid back to the client on each trade, resulting in a reduced spread and a higher win ratio. Reputable forex trading platform OANDA provides such rebates as part of their services.

Elite Trader is the name of the OANDA rebate program. Traders can earn between $5 and $17 per million in cash rebates, depending on their trading volume. This program is intended to recompense high-volume traders with a rebate bonus, which can significantly reduce trading expenses.

In addition, OANDA offers an Advanced Trader account through which clients can earn up to USD 15 per million in rebates based on their deposits and monthly trading volumes. This is a part of OANDA’s initiative to offer more perks to their customers and encourage increased trading activity.

What is the OANDA Elite Trader Program?

The OANDA Elite Trader Program is a rebate program designed for high-volume traders, offering cash rebates ranging from US$5 to US$17 per million traded.

What is the OANDA Advanced Trader Account?

The OANDA Advanced Trader Account is a type of account that offers rebates up to USD 15 per million based on deposits and monthly trading volumes.

Detailed Summary of OANDA

| ✅ Headquartered | United States |

| 🌎 Global Offices | Singapore, Sidney, Tokyo, London, Germany, Poland, Malta, United States, Canada |

| 📈 Year Founded | 1996 |

| 📉 Regional Restrictions | None |

| ☪️ Islamic Account | ✅ Yes |

| 🆓 Demo Account | ✅ Yes |

| ⏰ Non-expiring Demo | ✅ Yes |

| 🕰️ Demo Duration | Unlimited |

| 3️⃣ Retail Investor Accounts | 3 |

| 📌 PAMM Accounts | None |

| 💧 Liquidity Providers | JP Morgan, Deutsche Bank, Royal Bank of Canada |

| 📍 Affiliate Program | ✅ Yes |

| 💻 Order Execution | Market |

| 🖥️ OCO Orders | ✅ Yes |

| 🫰🏻 One-Click Trading | ✅ Yes |

| 🅰️ Scalping Allowed | ✅ Yes |

| 🅱️ Hedging Allowed | ✅ Yes |

| 📰 News Trading Allowed | ✅ Yes |

| 📈 Expert Advisors (EAs) Allowed | ✅ Yes |

| 📉 Trading API | ✅ Yes |

| 💴 Is a cashback Forex Calculator offered | None |

| 💵 Cashback Forex Lot Size Calculator | None |

| 💶 Cashback Forex Compounding Calculator | None |

| 📌 Starting spread | From 0.1 pips |

| 📍 Minimum Commission per Trade | From $40 |

| 💹 Decimal Pricing | 5th decimal pricing after the comma |

| ▶️ Margin Call | 100% |

| ⛔ Stop-Out | 50% |

| ⬇️ Minimum Trade Size | 0.01 lots |

| ⬆️ Maximum Trade Size | 1,000 lots |

| 🪙 Crypto trading offered | ✅ Yes |

| 📈 Maximum Leverage | 1:200 |

| 📉 Leverage Restrictions | None |

| 💴 Minimum Deposit (USD) | $0 |

| 💵 Deposit Currencies | All |

| 💶 Account Base Currencies (All) | USD, EUR, HKD, SGD |

| 👥 Active OANDA customers | Unknown |

| ⏰ Minimum Withdrawal Time | 1 business day |

| 🕰️ Maximum Estimated Withdrawal Time | 7 to 10 business days |

| 💳 Instant Deposits and Instant Withdrawals | None |

| 🔁 Segregated Accounts | ✅ Yes |

| 💻 Trading Platform Time | New York Time |

| 🖥️ Observe DST Change | NY Time |

| 💭 Languages supported on the website | English, Chinese (Traditional), Spanish, Portuguese |

| 🔊 Customer Support Languages | Multilingual |

| 📌 Copy Trading Support | ✅ Yes |

| 📍 Customer Service Hours | 24/5 |

| 🎁 Bonuses and Promotions | ✅ Yes |

| 🖍️ Education for beginners | ✅ Yes |

| ↪️ Proprietary trading software | ✅ Yes |

| ❤️ Is OANDA a safe broker for traders | ✅ Yes |

| 🔟 Rating for OANDA | 8/10 |

| 💯 Trust score for OANDA | 92% |

Tips for Choosing OANDA for Forex Trading Rebates / Key Factors to Consider When Evaluating OANDA’s Forex Trading Rebate Program

There are numerous crucial elements to consider while selecting OANDA for Forex Trading Rebates:

- ✅ Consider the amount of rebate OANDA gives every million exchanged. According to the most recent information, OANDA gives cash rebates ranging from $5 to $17 per million, depending on trading volume. Make certain that this sum is competitive in comparison to other brokers.

- ✅ Realize that the rebate amount is often linked to your trading volume. bigger trade volumes usually imply bigger rebates. Examine your trading habits and check whether your trade volume is sufficient to obtain the maximum rebate.

- ✅ Based on deposits and monthly trading volumes, OANDA’s Advanced Trader account gives rebates of up to USD 15 per million. Examine if this account type is appropriate for your trading style and financial circumstances.

- ✅ While rebates might lower your trading expenses, keep in mind that OANDA may impose other fees, including financing fees and business bank fees. These costs may cancel out the rebate advantages.

- ✅ In forex trading, good customer service is essential. Examine customer service reviews and testimonies for OANDA. You want a broker who can give timely and useful assistance when you want it.

- ✅ OANDA is well-known for being upfront about its pricing. This is a good quality in a broker since it helps you to completely grasp the expenses of your trade.

- ✅ OANDA is a well-established broker with a positive industry reputation. Check their current regulatory status, however, to guarantee they meet the appropriate financial criteria for your protection.

- ✅ Examine the simplicity with which you can withdraw your rebates and earnings. Some brokers can have difficult withdrawal procedures or lengthy wait periods.

Assess the trading platform and tools provided by OANDA. A user-friendly platform that includes powerful trading tools may improve your trading experience and efficiency. Educational materials, particularly for beginning traders, will be useful. Check to see whether OANDA offers tools such as seminars, articles, and tutorials to assist you in better understanding forex trading and their cashback program.

How long does it take OANDA to process withdrawals?

OANDA processes withdrawals during business hours as they are received. It can take between one and ten business days for withdrawals to receive their funds.

Is OANDA regulated in the United Kingdom?

Yes, OANDA is regulated by the FCA in the United Kingdom under license reference number 542574.

Geolocation of Traders

Most of OANDA’s market share is concentrated in these areas:

- ✅ United States – 19.23%

- ✅ Germany – 6.68%

- ✅ United Kingdom – 6.4%

- ✅ Canada – 4.1%

- ✅ Japan – 3.1%

- ✅ Others – 59.8%

OANDA Current Expansion Focus

OANDA is currently expanding across Asia, Europe, and North America, more specifically in these regions:

- ✅ Asia – Singapore and Japan

- ✅ Oceania – Sydney

- ✅ Europe – London, Germany, Poland, and Malta

- ✅ North America – United States (New York) and Canada

Countries not accepted by OANDA

- ✅ There are currently no restrictions as OANDA has offices around the globe with multiple regulations in each district.

Popularity among traders who choose OANDA

OANDA is ranked among the world’s Top 100 forex and CFD brokers.

OANDA – Advantages Over Competitors

OANDA has the following advantages over its competitors:

- ✅ OANDA is renowned for its inexpensive exchange rates, which may help you save money when making overseas payments or transferring money between currencies.

- ✅ OANDA provides a wide variety of currency pairings, including major, minor, and exotic currencies, so that you may trade the currency you require.

- ✅ OANDA has created various unique tools and technologies to assist you in making educated choices about your currency exchange and international payments. The OANDA fxTrade platform, for instance, provides extensive charting and analytical tools, real-time trade execution, and various risk management measures.

- ✅ OANDA has offices and activities in several locations throughout the globe, giving them a worldwide footprint. This might be useful if you need to make overseas payments or have account-related queries.

OANDA is a financially secure organization with a long history of success in the currency exchange and international payments industries.

Number of Traders participating in OANDA Cashback Rebates / Real-Life Examples:

OANDA has thousands of clients globally who participate in its cashback rebates. Here are a few examples of this in action.

✅ Abubakar Carson

Abubakar is an Elite Trader in OANDA’s high-volume trading program. In a month, he performs deals with a total volume of $10 million.

According to the rebate scheme, Abubakar is entitled to a cash reimbursement of $10 per million. As a result, his total monthly rebate would be 10 million * $10 = $100.

✅ Steve Clayton

Steve is an Elite Trader in OANDA’s high-volume trading program. In a month, he performs deals with a total volume of $20 million.

Assuming Steve’s trading activity qualifies him for a rebate rate of $12 per million, the rebate amount varies from $5 to $17 per million. As a result, his total monthly rebate would be 20 million * $12 = $240.

✅ Florence Bentley

Florence has an Advanced Trader account with OANDA. She has a $50,000 deposit and performs transactions with a total volume of $5 million every month.

She could earn up to $15 per million in rebates under the Advanced Trader rebate scheme. As a result, her total monthly rebate would be 5 million * $15 = $75.

How much can I earn in rebates with the OANDA Elite Trader Program?

With the OANDA Elite Trader Program, you can earn cash rebates ranging from US$5 to US$17 per million traded, depending on your trading volume.

How is the rebate amount determined in the OANDA Rebate Program?

The rebate amount in the OANDA Rebate Program is determined based on your trading volume, with higher trading volumes typically resulting in higher rebates.

Successful Traders Benefiting from OANDA’s Rebates – OANDA’s Forex Trading Rebates Empowering Retail Traders for Success

Many successful traders have benefited from OANDA’s Forex Trading Rebates program. Based on deposits and monthly trading volumes, the program, which comprises the Advanced Trader and Elite Trader accounts, gives rebates of up to USD 15 per million. This could drastically lower trading costs, particularly for high-volume traders.

Clients with the Advanced Trader account could receive rebates of up to $15 per million depending on their deposits and monthly trading volumes. This can be a substantial benefit for high-volume traders since the rebates can cover trading expenses and enhance overall profitability.

The bonuses and reward levels for large-volume traders have been updated under OANDA’s Elite Trader program, which is a renamed version of the Advanced Trader program.

This program is intended to reward traders who trade in big quantities with OANDA by delivering cash rebates that can help them improve their trading outcomes.

Many traders and industry professionals have given these rebate schemes favorable reviews. They are seen as a means for OANDA to give value to its customers and stimulate increased trading activity.

The rebates will be useful for retail traders, as they can assist in cutting trading costs while increasing profit potential.

Is OANDA suitable for beginners?

Yes, OANDA is suitable for beginners and offers introductory guides and webinars to novices.

Does OANDA offer sophisticated tools for experienced traders?

Yes, OANDA offers VPS, an economic calendar, and several other tools for more experienced traders.

Who will Benefit from Trading with OANDA?

OANDA is a leading provider of financial instruments for clients seeking a comprehensive desktop trading experience. With fast and reliable trade execution, exceptional research resources, and user-friendly interfaces, this broker is particularly well-suited for experienced traders.

It should be noted that product offerings may vary by region, with U.S. clients currently limited to trading in foreign exchange. However, OANDA has a proven record of accomplishing in terms of regulatory oversight and maintains ambitious standards of compliance.

OANDA Regulation and Safety of Funds

OANDA Global Regulations

| 🔎 Registered Entity | 🌎 Country of Registration | 📌 Registration Number | 📍 Regulatory Entity | 📈 Tier | 📉 License Number/Ref |

| 1️⃣ OANDA Corporation | United States | N/A | NFA | 1 | NFA ID 0325821 |

| 2️⃣ OANDA (Canada) Corporation ULC | Canada | N/A | IIROC | 1 | IIROC |

| 3️⃣ OANDA Europe Limited | United Kingdom | 7110087 | FCA | 1 | 542574 |

| 4️⃣ OANDA Asia Pacific Pte Ltd | Singapore | 200704926K | CMA | 1 | 200704926K |

| 5️⃣ OANDA Australia Pty Ltd | Australia | ABN 26 152 088 349 | ASIC | 1 | AFSL No. 412981 |

| 6️⃣ OANDA Japan Co. Ltd | Japan | 2137 | FFAJ | 1 | 1571 FIBO 2137 |

| 7️⃣ OANDA Europe Markets Limited | Malta | C95813 | MFSA | 2 | VLT1455 |

| 8️⃣ OANDA Global Markets Ltd | British Virgin Islands | BVI 2026433 | BFI FSC | 3 | 2026433 |

How OANDA Protects Traders and Client Funds

| 🔎 Security Measure | ℹ️ Information |

| 🔒 Segregated Accounts | ✅ Yes |

| 🔏 Compensation Fund Member | None |

| 🔐 Compensation Amount | None |

| 🔓 SSL Certificate | ✅ Yes |

| 🔒 2FA (Where Applicable) | ✅ Yes |

| 🔏 Privacy Policy in Place | ✅ Yes |

| 🔐 Risk Warning Provided | ✅ Yes |

| 🔓 Negative Balance Protection | ✅ Yes |

| 🔒 Guaranteed Stop-Loss Orders | ✅ Yes, but not for UK or US clients |

Does OANDA accept US Traders?

Yes, OANDA is one of a few brokers that accept traders from the United States through OANDA Corporation.

Does OANDA protect the privacy of customers?

Yes, OANDA protects its customers’ privacy and has a transparent privacy policy that can be accessed from the official website.

OANDA Awards and Recognition

According to OANDA’s website, the company has been recognized for the following honors in recent years as a broker:

- ✅ Broker Named by Industry as Best in 2021 (TradingView Broker Awards 2021).

- ✅ In 2021, this company was voted the best place to open an account with a CFD or Forex broker (TradingView Broker Awards 2021).

- ✅ Winner of the Best Trading Software (Online Personal Wealth Awards 2021).

Finally, OANDA was awarded Best Mobile Platform/App and received the highest customer satisfaction award (Investment Trends 2021 US Leverage Trading Report, Margin Forex).

How to Maximize Your Savings/Profits with Forex Trading Rebates at OANDA

The quantity of rebate you earn is related to the amount of trading volume you have. The more you trade, the more rebates you may receive. If you trade often, this may drastically minimize your trading expenses.

- ✅ Use the cash rebates you receive to offset your trading costs. This may significantly reduce your cost per transaction while increasing your total profitability.

- ✅ OANDA’s rebate program may be updated from time to time. Keep up to date on any changes to ensure you’re getting the most out of your potential savings.

- ✅ OANDA has flexible account types with differing perks. For example, the Advanced Trader account gives rewards of up to USD 15 per million depending on deposits and monthly trading volumes. Select the account type that corresponds to your trading habits and financial position.

- ✅ Make certain that you completely understand how the rebate program operates. This includes understanding when the rebates are issued, how they are calculated, and whether any criteria or requirements must be satisfied.

- ✅ Maintain a record of your trading expenses, including spreads, commissions, and financing fees. The aim is to guarantee that the rebate savings exceed the expenditures.

Your trading approach might affect your rebate eligibility. For example, if you are a scalper who makes a lot of trades for tiny gains, you may have a high trading volume and qualify for greater rebates. If you are unclear on how to get the most out of the rebate program, talk to a financial expert. They can give tailored advice based on your financial objectives and trading behavior.

OANDA Account Types and Features

OANDA offers three different retail investor accounts designed to cater to the varying needs of diverse types of traders. These accounts allow you to trade complex instruments and provide negative balance protection, access to OANDA’s Market Pulse, and other benefits.

These are the accounts:

- ✅ Standard Account

- ✅ Core Account

- ✅ Swap-Free Account

| 🔎 Live Account | 💵 Minimum Dep. | 📊 Average Spread | 💴 Commissions | 💷 Average Trading Cost |

| 🥇 Standard | $0 | 1 pip | None - spread | 10 USD |

| 🥈 Core | $0 | 0.1 pip | $40 per million | 6 USD |

| 🥉 Swap-Free | $0 | 1.6 pips | None - spread | 16 USD |

OANDA Standard Account

The OANDA Standard Account is typical for most traders, regardless of their strategies and styles. Traders need not worry about a minimum deposit; they can transfer any funds to start trading.

| 🔎 Account Feature | ℹ️ Value |

| 📈 Full Account Verification Needed | No, not for account deposits under $9,000 |

| 📉 Average Spreads | Variable, from 1 pip |

| 📊 Commissions (Per 1 mil traded) | None |

| 📌 Maximum Leverage | 1:200 |

| 📍 Minimum lot size | 0.01 lots |

| ↪️ Instruments | 81 |

| ⛔ Stop-Out | 50% |

| 🫰🏻 One-Click Trading offered | ✅ Yes |

| 💹 Strategies allowed | All |

| 💴 Base Account Currency | USD, EUR, HKD, SGD |

OANDA Core Account

The Core Account is suitable for more experienced traders who need tighter spreads to execute fast-paced trading strategies such as scalping, day trading, algorithmic trading, and more.

| 🔎 Account Feature | ℹ️ Value |

| 📈 Full Account Verification Needed | No, not for account deposits under $9,000 |

| 📉 Average Spreads | Variable, from 0.1 pips |

| 📊 Commissions (Per 1 mil traded) | 40 USD |

| 🅰️ Maximum Leverage | 1:200 |

| 🅱️ Minimum lot size | 0.01 lots |

| 📌 Instruments | 81 |

| ⛔ Stop-Out | 50% |

| 📍 One-Click Trading offered | Yes |

| ▶️ Strategies allowed | All |

| 💵 Base Account Currency | USD, EUR, HKD, SGD |

OANDA Swap-Free Account

OANDA offers the Swap-Free Account to those who do not want to be subject to overnight fees, especially Muslim traders who follow Sharia law prohibiting interest. The spreads on this account are much higher to offset the absence of overnight fees, and traders have access to fewer instruments.

| 🔎 Account Feature | ℹ️ Value |

| 📈 Full Account Verification Needed | No, not for account deposits under $9,000 |

| 📉 Average Spreads | Variable, from 1.6 pips |

| 📊 Commissions (Per 1 mil traded) | None |

| 🅰️ Maximum Leverage | 1:200 |

| 🅱️ Minimum lot size | 0.01 lots |

| 📌 Instruments | 26 |

| ⛔ Stop-Out | 50% |

| 🫰🏻 One-Click Trading offered | ✅ Yes |

| 📍 Strategies allowed | All |

| 💷 Base Account Currency | USD |

OANDA Demo Account

OANDA offers a demo trading account called the OANDA Demo Account. It is like a risk-free account with virtual money, allowing you to try different trading techniques without real-world repercussions. The OANDA Demo Account should not be utilized for real-money trading but is dedicated to practice and education.

Features of the OANDA demo account include:

- ☑️ Real-time rates on forex, metal crosses, commodities, energies, stock market indices, etc.

- ☑️ Access to mobile trading apps on iOS and Android.

- ☑️ Access to a powerful desktop platform.

- ☑️ Leverage up to 1:50 on forex majors.

- ☑️ Unlimited virtual funds.

Unlimited demo account (which means that it never expires).

OANDA Islamic Account

OANDA caters to Muslim traders by providing a Swap-Free live trading account with unique enhancements and trading limitations. Among the benefits that Islamic accounts provide Muslim traders are the following:

- ☑️ Spreads as low as 1.6 pips on the EUR/USD pair, with the added benefit of commission-free trading thanks to the broker’s fee, are included in the spread.

- ☑️ Get maximum leverage of up to 1:200.

- ☑️ Access to more than 26 different assets on which to speculate.

- ☑️ Access to one-click trading.

Leaps of faith in trying new trading methods with complete independence.

OANDA Professional Account

If you are a professional trader, you can open a trading account with OANDA that gives you more leverage when trading forex and CFDs. When you trade indices, foreign currency, gold, silver, or crude oil and use a guaranteed stop-loss order, stop-loss order, or trailing stop loss, OANDA will provide a volume rebate and reduce your margin requirement.

A GSLO allows a professional trader to increase their leverage and get a competitive advantage. With OANDA, you can utilize a GSLO, stop-loss order, or trailing stop-loss order and get extra margin relief equal to fifty percent of your regular margin plus the amount at risk.

To trade utilizing a Professional Trading account, traders must meet particular qualifications as either a “wholesale client” or a “sophisticated investor.”

To qualify as a wholesale investor, you must:

- ☑️ Have at least $2.5 million in assets or $250,000 in gross income for the last two fiscal years.

- ☑️ Have a certified public accountant who can attest that the customer fulfills one of the aforementioned financial requirements.

- ☑️ Have excellent financial literacy and product expertise.

To be considered a sophisticated investor, you must possess the following:

- ☑️ At least one year of experience trading derivatives with OANDA or another regulated broker.

- ☑️ At least 150 derivatives deals were executed in the last year.

- ☑️ Executed derivatives deal with a total notional value of at least $10 million.

- ☑️ A representative of OANDA has determined that you have a suitable degree of knowledge and expertise in derivatives.

Furthermore, as a professional client, traders will face some of the following risks:

- ☑️ You renounce your entitlement to get a copy of the Financial Services Guide (FSG).

- ☑️ You renounce your entitlement to be provided with a Product Disclosure Statement (PDS).

You risk having your entitlement to compensation and other complaint management methods taken away from you. This is something that will be decided by the Australian Financial Complaints Authority (AFCA) at a later date.

Can I use cTrader with OANDA?

No, you cannot. OANDA only supports MetaTrader 4, MetaTrader 5 (BVI), OANDA, and TradingView.

Does OANDA offer a proprietary app for iPhone?

Yes, OANDA’s platform can be used on iOS devices, including iPhones and iPads.

How to open an Account with OANDA

OANDA Global Markets, a company based in the British Virgin Islands, has enhanced its client onboarding procedure by enabling most traders to begin trading without submitting paperwork for identity verification if their deposits are less than $9,000. In exceptional instances, OANDA may seek comprehensive account verification, which is patterned after the practices of the leading international Bitcoin exchanges.

Traders can easily register for an OANDA account by following the below steps.

- ✅ To access the account registration page, click the “Start Trading” button at the top of the OANDA website.

- ✅ Complete the OANDA registration form with your name, country of residence, and telephone number.

- ✅ Provide identification or a tax number to verify your citizenship.

- ✅ Verify your residence address.

- ✅ Provide your employment and financial details.

- ✅ If you deposit less than $9,000, verification papers are not needed.

- ✅ However, if you deposit more than $9,000, OANDA will request at least two papers, including confirmation of identification and proof of residence, for individual client clearance.

- ✅ The acceptable forms of identification are passports, national identity cards, and driver’s licenses.

- ✅ The address verification document must have been issued in your name within the last three months and indicate your current address.

After your application is approved, you can fund your account and begin trading. Review OANDA’s risk disclosure, client agreement, and operation conditions before beginning.

How do I sign up for OANDA’s Rebate Program?

To sign up for OANDA’s Rebate Program, you typically need to open an eligible account and meet any necessary trading volume requirements.

Can Muslim traders register an Islamic Swap-Free Account with OANDA?

Yes, OANDA offers a dedicated Swap-Free account for traders in Islamic regions who follow Sharia law.

OANDA Trading Platforms

OANDA’s technology and software offerings are intended to evolve around the optimal approach to protect the client and his transactions. Consequently, the corporation sticks to tighter spreads, specialized platforms for premium services, and automated trading strategies.

OANDA provides traders with a choice of the following trading platforms:

- ✅ MetaTrader 4

- ✅ MetaTrader 5 (BVI Website)

- ✅ OANDA Platform

- ✅ TradingView

OANDA offers an extensive array of platform options. There are platforms for all your devices, making it easy to access your account and monitor the markets whenever necessary. You can select between the completely customizable web-based and desktop OANDA Trade platforms and applications for mobile devices and tablets. Furthermore, you can also speculate on worldwide markets using the prominent MetaTrader platforms.

OANDA also supports TradingView, which offers limitless charting options and a social dimension to your online trading activity. Institutional traders who want the finest access to the markets at all times may also use their robust API solutions. The OANDA and MetaTrader trading platforms enable mobile trading via iOS and Android applications. The various app shops allow the download and installation of these mobile applications.

Furthermore, OANDA smoothly preserves the same features and functionality as the desktop programs and interface.

Which Markets Can You Trade with OANDA?

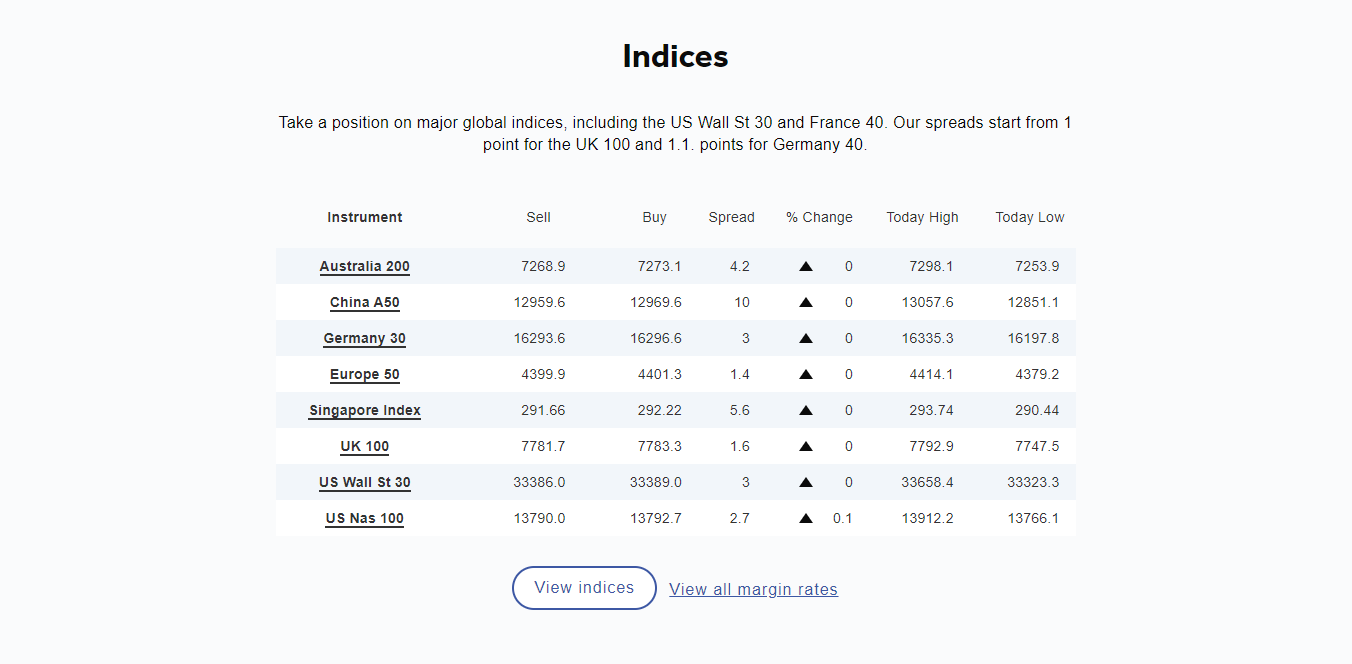

Traders can expect the following range of markets from OANDA:

- ✅ Forex

- ✅ Indices

- ✅ Metals

- ✅ Shares

- ✅ Commodities

- ✅ Cryptocurrencies

Financial Instruments and Leverage offered by OANDA

| 🔎 Instrument | ➡️ Number of Assets Offered | ↪️ Max Leverage Offered |

| 📈 Forex | 70+ | 1:200 |

| 💎 Precious Metals | 5 | 1:200 |

| 📉 Indices | 16 | 1:200 |

| 💡 Energies | 3 | 1:200 |

| 📌 Bonds | 5 | N/A |

| 🍎 Agricultural Commodities | 5 | 1:100 |

Does OANDA have restrictions on leverage?

OANDA offers leverage ratios according to the different regulatory entities through which it is licensed. For instance, UK traders are restricted to leverage of up to 1:30 while traders in other regions can use leverage of up to 1:200.

Why can I not trade crypto with OANDA?

OANDA does not offer crypto CFDs and the reason for this is not stated. However, because of its partnership with Paxos Trust Company, you can open an account and trade crypto.

OANDA Trading and Non-Trading Fees

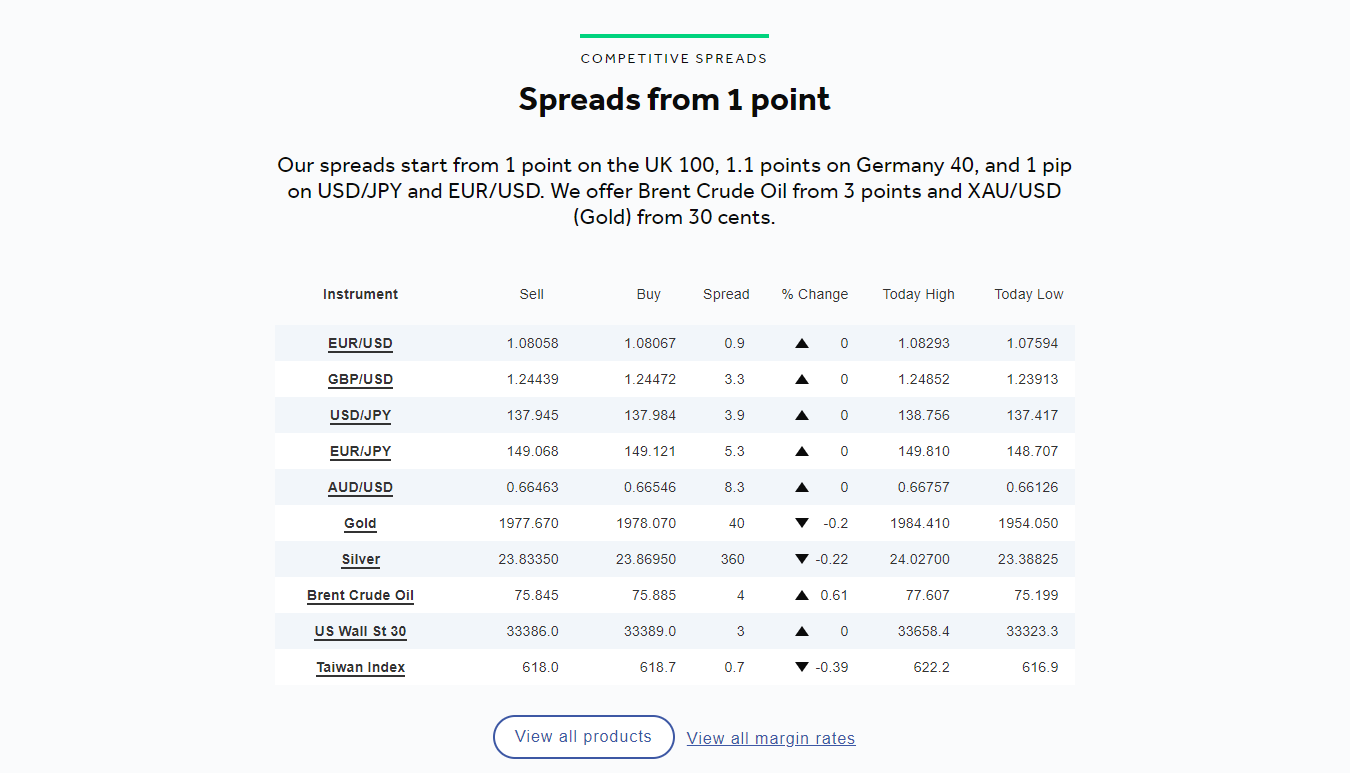

OANDA Spreads

OANDA’s favorable spreads on all financial instruments are well-known. However, according to OANDA, there are times when spreads are likely to be wider, such as when markets open and close and when significant international or geopolitical events occur.

OANDA provides two pricing alternatives to traders: spread-only pricing with a charge and spread pricing. With spread-only pricing, the charge that would typically be paid is incorporated in the spread, making it the only trading cost for the trader.

Traders can expect the following typical spreads:

- ✅ Standard Account – from 1 pip

- ✅ Core Account – from 0.1 pips

- ✅ Swap-Free Account – from 1.6 pips

Traders can benefit from reduced spreads with spread-only accounts. Traders will only be charged a transaction fee, with the overall trading cost comprising the appropriate spread plus commission.

OANDA Commissions

- ✅ Traders who utilize the Standard or Swap-Free Account pay no fees on their transactions since the broker cost is already included in the spread. However, because the Core Account has narrower spreads, a commission charge of $40 is levied on each 1 million of the base currency exchanged.

OANDA Overnight Fees, Rollovers, or Swaps

Traders using the Swap-free account have access to 26 popular products, except for the Japan 225 Index, which incurs fees of $4 to $7 per 100 lots traded. These fees are paid to Muslim traders with positions open for more than five days. Overnight costs for forex pairs are calculated by averaging the underlying liquidity providers’ next SWAP rates, factoring in an instrument-specific administrative charge, and annualizing the results.

This includes a 2.5% administrative fee and the appropriate yearly financing rate for indices, representing a negative rate, meaning the fees are deducted. The average overnight cost for popular products such as EUR/USD is a long rate of -2.03% and a short rate of -0.03%. This equates to a long position costing $6.36 and a short position costing $0.09.

OANDA Deposit and Withdrawal Fees

- ✅ Deposit fees are not charged, but traders face a $20 fee on bank wire transfers.

OANDA Inactivity Fees

- ✅ A monthly inactivity charge is applied to trading accounts that have been inactive for 12 consecutive months. Inactivity fees of up to $10 a month are deducted from the account balance until it hits zero when the account is deleted.

OANDA Currency Conversion Fees

When traders deposit or withdraw funds from their trading account in a currency other than the permitted account currencies, they are liable to a currency conversion charge.

Can I use my rebates to offset trading costs at OANDA?

Yes, the cash rebates you earn at OANDA can be used to offset your trading costs, effectively lowering your cost per trade.

Are there any fees associated with OANDA’s Rebate Program?

While the rebates themselves do not have associated fees, there may be other fees associated with trading at OANDA, such as financing fees and company bank fees.

OANDA Deposits and Withdrawals

OANDA offers the following deposit and withdrawal methods:

- ✅ Local Transfers

- ✅ Debit Card

- ✅ Credit Card

- ✅ Bank Wire

- ✅ Bank Transfers

- ✅ Skrill

- ✅ Neteller

- ✅ Mobile Bank Transfers

- ✅ International e-Wallets

How to Deposit Funds with OANDA

To deposit funds to an account with OANDA, traders can follow these steps:

- ✅ Log in to the OANDA site and choose “Fund Account” from the dashboard.

- ✅ A new menu will appear, allowing you to choose your chosen deposit method.

From here, you can continue by inputting your deposit amount and completing any extra steps that your selected payment provider demands, enabling you to confirm and complete the deposit.

OANDA Fund Withdrawal Process

To withdraw funds from an account with OANDA, traders can follow these steps:

- ✅ Log in to your OANDA portal to access your trading account.

- ✅ Select “Withdrawal” or “Withdraw money” from the appropriate drop-down box.

- ✅ Select the method of withdrawal and the account to which the monies will be sent (if more than one option is available)

- ✅ Enter the amount you want to withdraw, as well as a short reason or explanation if one is needed.

Send your withdrawal request to OANDA.

Can I withdraw my rebates from OANDA?

Yes, you can withdraw your rebates from OANDA via debit card and bank wire transfer by logging in to ‘manage funds’ using your OANDA account.

Does OANDA charge any withdrawal fees?

Yes, if you use bank wire transfers, there is a $20 fee.

Calculating Forex Trading Rebates with OANDA

The Forex Trading Rebates offered by OANDA are computed depending on your trading volume. Through its Elite Trader program, the corporation gives cash rebates ranging from $5 to $17 for each million transacted.

This indicates that for every million dollars traded, you may get a cash rebate in this range.

The actual amount you earn for every million exchanged varies depending on your account type and trading activity. Clients with an OANDA Advanced Trader account, for example, may receive rebates of up to USD 15 per million depending on deposits and monthly trading volumes.

It is vital to remember that these rebates are a percentage of the transaction cost returned to the customer on each trade, which may result in a reduced spread and higher win ratio.

Does OANDA have a rebate calculator?

No, OANDA does not have a rebate calculator. However, you can consult external resources to calculate your rebates, or you can contact OANDA customer support.

Is there a rebate schedule on the OANDA website?

No, OANDA does not have a schedule for its rebates on the official website. However, OANDA customer support can assist if you have any queries regarding rebates.

Claiming and Withdrawing Forex Rebates at OANDA

Claim and withdraw your Forex Trading Rebates at OANDA is a simple procedure, which is as follows:

- ✅ You can withdraw money from your OANDA account using your debit card or a bank wire transfer.

- ✅ To accomplish this, log in to ‘manage money’ using your OANDA account.

- ✅ When you are ready to withdraw, go to ‘OANDA Trade accounts’ and choose the account you want to withdraw from.

- ✅ Then, under ‘withdraw,’ choose bank transfers as the withdrawal option.

It is crucial to note that OANDA maintains the right to cancel and remove the Bonus if the 30-day notice period expires. The Bonus will be deleted within 60 seconds of this message expiring.

OANDA Education and Research

Education

OANDA offers the following Educational Materials:

- ✅ Introduction to Trading Analysis

- ✅ Introduction to the trading platforms

- ✅ Introduction to Capital Management

- ✅ Live and Recorded Webinars

and much more.

Research

OANDA offers traders the following Research and Trading Tools:

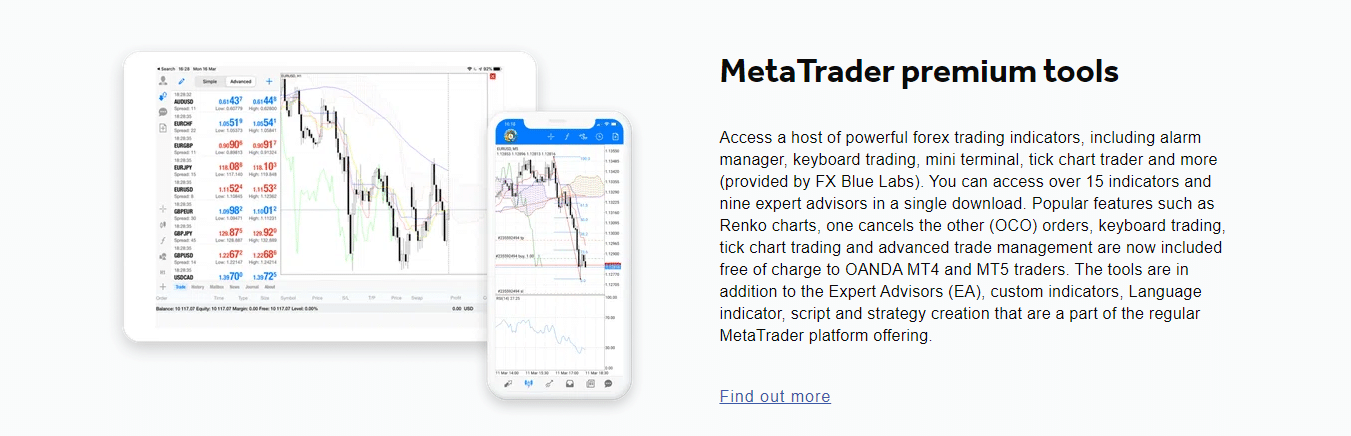

- ✅ MetaTrader Premium Tools

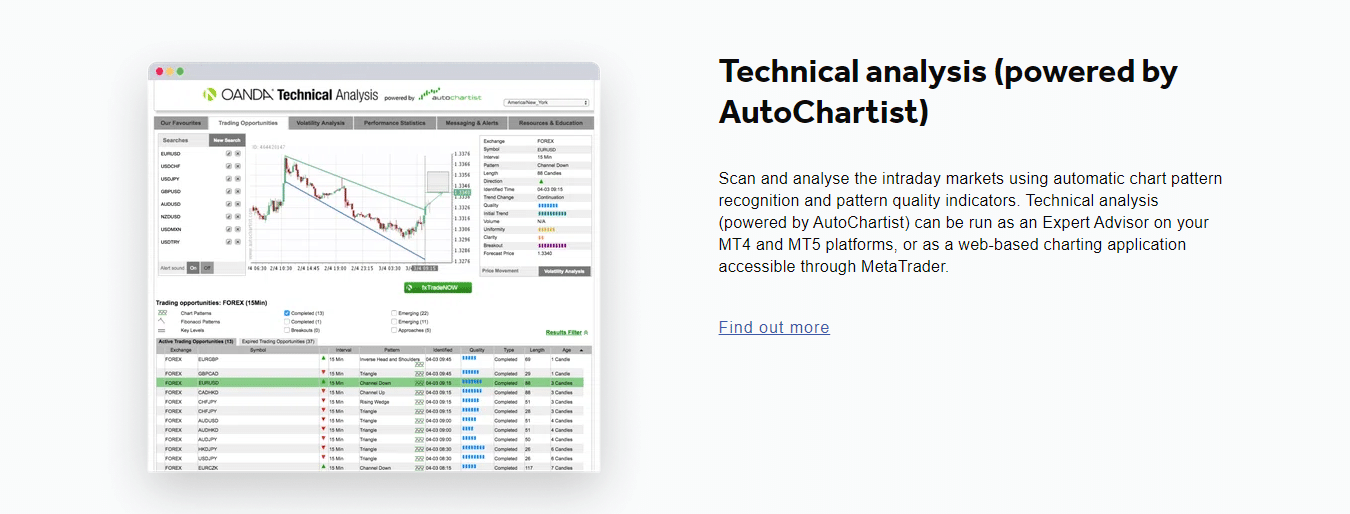

- ✅ The technical analysis offered by AutoChartist

- ✅ VPS

- ✅ Economic Calendar

and much more.

OANDA Bonuses and Current Promotions

OANDA offers the following bonuses and promotions.

Welcome Bonus

- ✅ A $1,000 welcome bonus on your first deposit when you open a retail trading account with OANDA. Existing customers who have an account but have not yet deposited cash are eligible for this incentive.

Referral Bonus

- ✅ A $1,000 referral bonus for both the recommending trader and their referrer. Referrals must open an OANDA Global Markets Account via the BVI business and deposit at least $200 to qualify.

Furthermore, within 30 days of registration, the referral must trade a notional volume of 200,000 units of the base currency (two standard lots). The recommending trader and referral might earn more on this incentive if the referral deposits more money and trades at a larger volume.

Legal and Tax Implications: Understanding Forex Trading Rebates with OANDA

Forex trading commissions are considered income and may be taxed based on your location. Currency traders in the spot forex market in the United States, for example, can opt to be taxed under the same tax regulations as conventional commodities (1256 contracts) or under special rules under Section 988 (Treatment of Certain Foreign Currency Transactions).

OANDA is regulated by many agencies throughout the world, including the Commodity Futures Trading Commission (CFTC) in the United States, and adheres to all relevant financial regulations.

However, it is important to understand the terms and conditions of OANDA’s rebate program, including any future program modifications and how they may influence your trading.

Risks and Limitations of Forex Trading Rebates at OANDA

While forex trading rebates have the potential to lower trading expenses and boost profitability, there are risks and restrictions to consider:

- ✅ Market Risk: Forex trading carries a high level of risk. Losses might outweigh deposits in a turbulent market. Rebates may assist in covering trading expenses, but they will not protect you from losses caused by negative market moves.

- ✅ Leverage Risk: Leverage may magnify both earnings and losses. While the CFTC restricts the highest leverage offered to retail forex trading in the United States to 50:1, losses may be significant.

- ✅ Account Requirements: To qualify for refunds, you may need to satisfy certain criteria, such as a minimum deposit amount or trading volume. Not all traders will meet these standards.

- ✅ CFD risks: If you trade CFDs, you should be aware that they are complicated products with a significant danger of losing money quickly owing to leverage. A significant proportion of retail CFD accounts lose money.

Finally, Rebate Caps The amount of refund you may receive may be limited, and the rebate program can be changed or terminated by OANDA.

Strategies to Maximize Rebates with OANDA

Start by diversifying your Trades by spreading your risk across several currency pairings will help you boost your trading volume, which can lead to bigger rebates. High volatility times, such as during important economic news, might result in higher price changes and more trading possibilities. This may enhance your trading volume and, as a result, your rebates. Furthermore:

- ✅ Use a Trading Bot: If you are familiar with algorithmic trading, a trading bot may assist you in executing more transactions and increasing your trading volume. This might result in greater rebates. However, be cautious of the dangers of algorithmic trading.

- ✅ Utilize OANDA’s Tools and Resources: OANDA offers a variety of tools and resources to assist you in making educated trading choices. Making use of them may assist you in improving your trading approach and increasing your trading volume and rebates.

- ✅ Consider Swing Trading or Day Trading: These trading strategies entail making many transactions in short periods of time, which may enhance your trading volume and your rebates. They do, however, come with an elevated danger.

Stay Informed About Market Trends: Staying informed about market trends will help you uncover additional trading opportunities, thereby boosting your trading volume and rebates. Reviewing and changing your trading strategy on a regular basis will help you enhance your trading success, leading to bigger trading volumes and more rebates.

How to open an Affiliate Account with OANDA

To register an Affiliate Account with OANDA, traders can follow these steps:

- ✅ Go to the OANDA website and choose the “Partner with us” option from the main menu.

- ✅ Click the “Become an Affiliate” button on the partner page.

- ✅ Fill out the form with your contact and personal information.

- ✅ Accept the terms and conditions before submitting the form.

After you submit the form, OANDA will examine it and provide you with further information about the next stages. Keep in mind that OANDA’s affiliate program has stringent qualifying conditions and not all candidates will be accepted.

OANDA Affiliate Program Features

The OANDA partner program is the official affiliate program for the OANDA brand, which runs globally. It is considered one of the most effective and profitable affiliate programs industry. OANDA’s affiliate program enables partners to earn up to $600 for each qualifying trader they bring to the company’s platform from any accepted region that OANDA serves.

Each OANDA program partner is assigned a professional affiliate manager responsible for assisting with the platform and providing advice on how to strengthen their digital presence. Affiliates can track referrals on OANDA’s revolutionary affiliate site, which provides them with a comprehensive set of marketing resources to help maximize conversion.

These materials span from digital banner adverts to remarkably effective landing pages. Another advantage of the OANDA affiliate program is that partners can participate for free.

OANDA Customer Support

The OANDA service desk is open 5 days a week and may be reached via phone, email, or live chat. OANDA chat is a virtual assistant that begins the conversation.

The website’s help page has a Frequently Asked Problems (FAQs) section that may provide rapid solutions to certain frequent questions. In addition, the social media networks offered include Facebook, Twitter, LinkedIn, and YouTube.

Does OANDA offer a dispute resolution policy?

Yes, OANDA has a Complaints and Disputes Policy that can be viewed online.

How long does it take to get a hold of OANDA?

The response time for OANDA’s customer support depends on when you contact them and how you reach out. Emails can take up to 1 working day while telephonic support answers quickly.

OANDA Alternatives

- 🥇 IG provides a complete trading package with superior trading and research tools, industry-leading education, and a vast array of tradeable markets.

- 🥈 Interactive Brokers is a highly reputable multi-asset broker that provides comprehensive access to global marketplaces for trading. In addition, it offers low costs, high-quality research and education, and a contemporary trading platform suite of institutional standards.

- 🥉 CMC Markets is well-respected worldwide and provides an exceptional trading experience with its competitive pricing and variety of over 12,000 products.

OANDA VPS Review

The VPS partners of OANDA provide a more robust and dynamic trading experience. Partner VPS services from OANDA guarantee minimal latency and enhanced stability.

BeeksFX

- ✅ BeeksFX is one of the major forex VPS providers, having New York and London data centers. BeeksFX’s fully managed VPS provides some of the lowest latency in the retail forex business, assuring precise transaction entry and exit.

- ✅ BeeksFX’s dependable VPS provides improved OS performance and dependability while running your strategies 24/5, allowing you to monitor and respond to market conditions continuously.

Liquidity Connect

- ✅ Liquidity Connect is the premier technology supplier of outsourced Infrastructure as a Service (IaaS), enabling the Global Financial Markets’ business operations. Their main concern is minimal latency.

OANDA Web Traffic Report

| 🌎 Global Rank | 9,873 |

| 🚩 Country Rank | 10,164 |

| 🅰️ Category Rank | 78 |

| 🅱️ Total Visits | 5.8 million |

| ⚽ Bounce Rate | 43.43% |

| 📉 Pages per Visit | 4.94 |

| 📈 Average Duration of Visit | 00:02:23 |

| 📊 Total Visits in the last three months | October – 6.1M November – 6M December – 5.7M |

OANDA vs. Other Notable Brokers

| 🔎 Broker | 🥇 OANDA | 🥈 Markets.com |

| 💴 Withdrawal Fee | ☑️ Yes | ❎ No |

| 🆓 Demo Account | ☑️ Yes | ☑️ Yes |

| 💵 Min Deposit | $0 | $100 |

| 📈 Spread | Variable, from 0.1 pips | From 0.6 pips |

| 📉 Commissions | $40 | Spread only |

| ⛔ Margin Call/Stop-Out | 100%/ 50% | 50%/20% |

| 📊 Order Execution | Market | Instant, Market |

| 🎁 No-Deposit Bonus | ❎ No | ❎ No |

| 🪙 Cent Accounts | ❎ No | ❎ No |

| ⏰ Customer Service Hours | 24/5 | 24/5 |

| 🔟 Retail Investor Accounts | 3 | 2 |

| ☪️ Islamic Account | ☑️ Yes | ☑️ Yes |

| ⬇️ Minimum Trade Size | 0.01 lots | 0.01 lots |

| ⬆️ Maximum Trade Size | 1,000 lots | 100 lots |

| 🕰️ Min. Withdrawal Time | 1 business day | 24 hours |

| ⌛ Max. Withdrawal Time | 7 to 10 business days | 7 working days |

| 💳 Instant Withdrawals | ❎ No | ☑️ Yes |

OANDA Pros and Cons

| ✅ Pros | ❎ Cons |

| OANDA is one of the very few brokers who accommodate traders from the United States and Canada | Cashback rebates are only offered on forex, and the rebates are not as attractive as that of other brokers |

| OANDA features well-designed and powerful trading technology | Account protection is not granted to US clients |

| The broker is well-regulated by international entities, including NFA and FCA, among others | US and UK clients do not have access to Guaranteed Stop-Loss Orders |

OANDA Customer Reviews

🥇 Favorable Experience.

Over a month has passed since I started working with OANDA. I have had a favorable experience. Reliable candlesticks, cheap spreads, and excellent customer service are also worthy of note. I want to thank OANDA, Bradley, for his assistance and support throughout registration and setup. You may link your OANDA account to TradingView to effortlessly assess the market and place orders. – Josh McBride

🥈 Very Happy!

I have been trading on demo accounts for the last six months. I will not name names, but I can say that upon discovering OANDA today, I will CERTAINLY open an existing account with them. The chart is extremely clear, the spreads are minuscule, and the tabs such as Technical Analysis and Market Pulse are great; I would suggest this brokerage to anybody who is just starting their trading career or even an experienced trader since it has so much to offer. – Ian Rich

🥉 Excellent.

I have had an excellent experience with Oanda, from the registration process to customer service. It is wonderful to have someone on the other end of the phone to address any questions you may have. – Maximus Holden

Recommendation for Improving OANDA Cashback Rebates

OANDA currently only offers cashback rebates on Forex up to $1 per standard lot, which, compared to competitors, is not attractive. This is especially so when considering high-frequency traders. Therefore, OANDA could include other asset classes and consider improved rebates.

- ✅ Enhanced openness: While OANDA is recognized for its openness, it could improve even more by giving a more complete description of how rebates are computed and any related costs that may alter the net rebate amount.

- ✅ Improved Customer Support: While OANDA’s customer support is typically great, there is always room for improvement. Offering 24/7 customer service and additional instructional tools about the rebate program might improve the user experience.

- ✅ Flexible Rebate Tiers: Currently, the rebate amount is connected to the trading volume. OANDA may explore creating more flexible refund levels to accommodate traders with various trading volumes.

- ✅ Promotional deals: OANDA could consider running promotional deals that give enhanced rebates for a short time. This could increase trade activity and attract new clients.

- ✅ Simplified Withdrawal procedure: To improve customer experience, OANDA can focus on streamlining the rebate withdrawal procedure. This could include lowering the number of procedures necessary to withdraw refunds or shortening the withdrawal time.

- ✅ Integration with Other Promotions: If feasible, enabling traders to combine forex trading rebates with other promotions or incentives could make the program more appealing.

- ✅ Frequent updates: OANDA should guarantee that its rebate program is updated on a regular basis to stay up with market movements and client requirements. This involves modifying rebate rates or offering new features depending on customer input and market circumstances.

Furthermore, OANDA can improve further as a rebate broker by offering traders access to rebate tools such as a cashback forex lot size calculator, cashback forex pip calculator, and a cashback forex calendar.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. This evaluation comprises positives, disadvantages, and an overall score based on our findings. We want to assist you in locating the ideal broker for your requirements. Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Our Verdict on OANDA

According to our research, OANDA’s cashback rebates program, branded as the Forex Trading Rebates program inside their Elite Trader program, allows traders to earn cash rebates ranging from $5 to $17 for every million traded.

This rebate system is directly proportional to trade volume, suggesting that bigger trading volumes have the potential for larger rebates. Furthermore, this program is especially beneficial to retail traders since it helps to reduce trading expenses while improving profit margins.

Our findings also showed that OANDA’s reputation for offering reasonable exchange rates, a diverse selection of currency pairings, and cutting-edge tools and technology adds to the attraction of its rebate program. Traders benefit from the company’s worldwide reach and financial soundness.

However, in our experience, the actual rebate amount varies depending on the account type and trading activity. Clients with an OANDA Advanced Trader account, for example, are eligible for refunds of up to USD 15 per million, depending on their deposits and monthly trading volumes.

While the rebate program has large potential benefits, we urge that traders remember about additional expenditures, such as financing fees and business bank fees, which could balance the rebate benefits.

OANDA Frequently Asked Questions

What are Forex Cashback Rebates?

A rebate is a kind of remuneration offered to a trader for each deal they make in forex trading. This rebate is normally a modest percentage of the transaction value and is provided to the trader by the broker to minimize the trader’s trading costs.

Traders may use forex rebates to offset trading expenses like spreads, commissions, and other fees, allowing them to improve their profits.

Is OANDA a Forex Rebate provider?

Yes, OANDA is a rebate broker that offers cashback on forex up to $1 per 100k USD traded.

Does OANDA provide a Cashback Forex Contest?

OANDA does not currently provide a cashback forex contest to traders.

How does the Forex Cashback Rebate process work?

Traders register an account with OANDA and start trading forex. Then, for every trade, they can earn a small percentage (up to $1).

Where can I find OANDA’s Cashback Forex Calendar?

OANDA currently only provides an economic calendar. To find out about OANDA’s cashback forex calendar and when regular payments are made, traders can contact OANDA’s customer support.

I’m an existing trader, how can I transfer my account to earn rebates via OANDA?

You can transfer your account to OANDA by contacting customer support to inquire about transferring your account from your existing broker. Follow the instructions provided, and once the account is transferred to OANDA, you can earn rebates.

Can I use a Forex Rebate EA with OANDA?

You can use any type of Expert advisor with OANDA as the rebate provider does not restrict trading strategies.

How many traders with OANDA use the Cashback Rebate feature?

There is no indication of how many OANDA customers are signed up to receive rebates.

What are the maximum rebates I could earn with OANDA?

You can earn up to $1 on forex trades with OANDA.

Will my OANDA fees and spreads increase when I use the Cashback Rebate feature?

OANDA does not increase fees or spreads when you use the Cashback Rebate feature.

Why should I work through the SA Shares Cashback?

You can expect some of the highest commissions if you work through SA Shares to earn Cashback Rebates from OANDA. This is because SA Shares aims to negotiate the most competitive commission rates with brokers such as OANDA to ensure you get the most back from your trading activities.

How quickly will I receive my sign-up bonus?

“The deposit Bonus will be credited into the Qualifying Applicant’s account forty-five (45) days after the minimum deposit amount is met and the account’s accumulated trading volumes exceed the Minimum Trade Volume Requirement prior to the Promotion’s expiration date.”

Do you recommend leverage?

“All OANDA accounts come with leverage, and it will not be possible to trade without leverage.”

What is your requote policy?

“OANDA does not requote orders that are executed at the valid market price when the request is received at our server.

No automated rejections, market orders only fail to be executed if they fall outside the upper/lower bounds that you choose to place to protect against price fluctuations, or if you have insufficient funds to execute your trade.”

What execution speeds can I expect, and what is your execution policy?

“Execution speed and numbers are based on the median round trip latency from receipt to response for all Market Order and Trade Close requests executed between January 1 and May 1, 2019, on the OANDA execution platform.

Client Orders are executed at the best available price for the notional size requested that is valid on our price server at the time of execution. This may not be the same as the price you see on our trading platform, depending on the speed of your internet connection, for example.

To protect yourself from unexpected, rapid price movements, on the FxTrade trading platform you may specify bounds with market and entry Orders so that such Orders will only execute if the price lies within your specified bounds.”

How do you handle customer complaints?

” You can send us an email at [email protected] with more details of your complaint and our complaint team will assist in investigating the issue/experience you have had with us. We should respond to complaints made within one business day of receiving them.

This does not mean that all complaints made will be resolved within one business day, but that all complaints should be acknowledged within one business day. We aim to investigate and resolve all complaints within five calendar days of receiving them.”

What is the recommended initial deposit?

“There is no minimum deposit or minimum balance required to open or maintain an OANDA account. You will, however, need funds in your account in order to open positions. We are unable to recommend you on your initial deposit amount.”

How is the rebate amount determined in the OANDA Rebate Program?

The rebate amount in the OANDA Rebate Program is determined based on your trading volume, with higher trading volumes typically resulting in higher rebates.

Can I lose my rebates at OANDA?

OANDA reserves the right to terminate and withdraw the rebates on the expiry of a 30-day notice, so it’s possible to lose your rebates if you do not meet the program’s requirements.

What are the eligibility criteria for OANDA’s Rebate Program?

Eligibility for OANDA’s Rebate Program typically requires meeting certain trading volume requirements and may also require having a specific type of account, such as an Advanced Trader account.

How can I track my rebates at OANDA?

You can track your rebates at OANDA through your account dashboard or by contacting OANDA’s customer service.

How are rebates calculated in the OANDA Advanced Trader Account?

In the OANDA Advanced Trader Account, rebates are calculated based on your deposits and monthly trading volumes, with rebates up to USD 15 per million.