Overall, Pepperstone offers a forex cashback on the Active Trader Program on the Standard and Razor accounts from 10% of the spread on indices and commodities or up to $3 per lot on Forex.

| 🔎 Pepperstone Account | 🥇 Standard Account | 🥈 Razor Account |

| 🅰️ Forex | Forex Majors – 0.24 pips Forex Minors – 0.30 pips | 12.857% of commissions paid |

| 🅱️ Payment Frequency | Monthly Cashback Offered Daily rebates paid directly to the trading account | Monthly Cashback Offered Daily rebates paid directly to the trading account |

Pepperstone Cashback Rebate – 35 Key Point Quick Overview

- ✅ Pepperstone Cashback Rebate Conditions

- ✅ Pepperstone Additional Notes on Cashback Rebates

- ✅ How to Open a Forex Cashback Account with Pepperstone (via SAShares)

- ✅ Number of Traders participating in Pepperstone Cashback Rebates

- ✅ Geolocation of Traders

- ✅ Detailed Summary of Pepperstone

- ✅ Pepperstone – Advantages Over Competitors

- ✅ Who will Benefit from Trading with Pepperstone?

- ✅ Pepperstone Regulation and Safety of Funds

- ✅ Pepperstone Awards and Recognition

- ✅ Pepperstone Account Types and Features

- ✅ How to open an Account with Pepperstone

- ✅ Pepperstone Trading Platforms

- ✅ Pepperstone Investment Programs

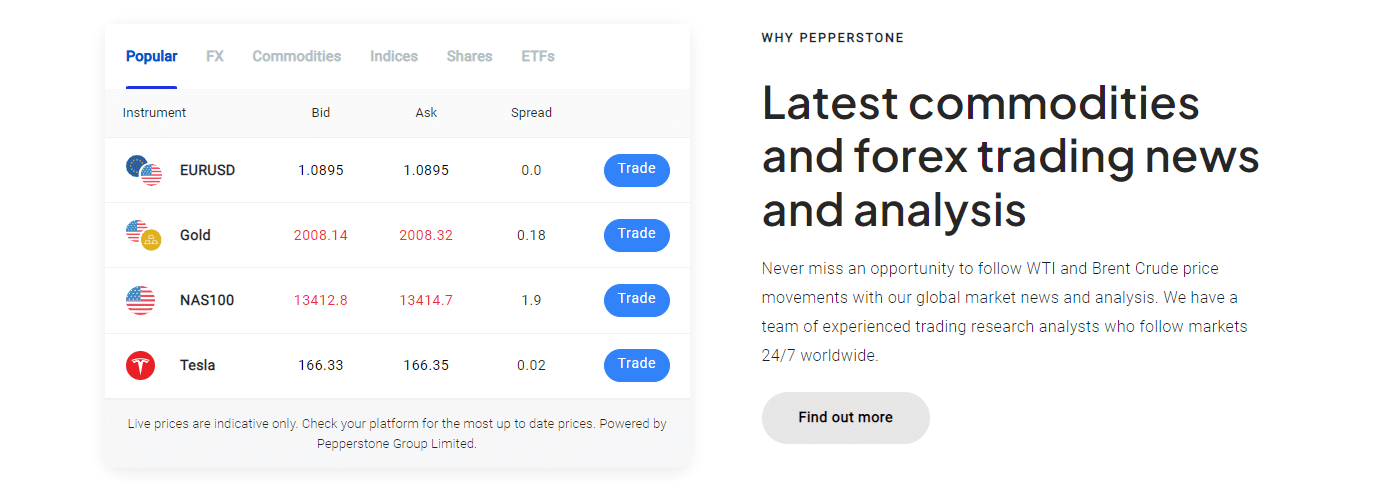

- ✅ Which Markets Can You Trade with Pepperstone?

- ✅ Financial Instruments and Leverage offered by Pepperstone

- ✅ Pepperstone Trading and Non-Trading Fees

- ✅ Pepperstone Deposits and Withdrawals

- ✅ How to Deposit Funds with Pepperstone

- ✅ Pepperstone Fund Withdrawal Process

- ✅ Pepperstone Education and Research

- ✅ Pepperstone Bonuses and Current Promotions

- ✅ How to open an Affiliate Account with Pepperstone

- ✅ Pepperstone Affiliate Program Features

- ✅ Pepperstone Customer Support

- ✅ Pepperstone Corporate Social Responsibility

- ✅ Pepperstone Alternatives

- ✅ Pepperstone VPS Review

- ✅ Pepperstone Web Traffic Report

- ✅ Pepperstone vs. Other Notable Brokers

- ✅ Trading with Pepperstone Pros and Cons

- ✅ Pepperstone User Reviews

- ✅ Recommendation for Improving Pepperstone Cashback Rebates

- ✅ Our Verdict on Pepperstone

- ✅ Pepperstone Frequently Asked Questions

Pepperstone Cashback Rebate Conditions

- ☑️ Tier 1 of the Active Trader Program is exclusive to Pepperstone Pro customers.

- ☑️ Pepperstone offers rewards only on forex pairings.

- ☑️ If traders want to keep their position as Active Traders, they must maintain the required trading volume for three months.

- ☑️ When transactions are concluded, rebates are paid in US dollars.

- ☑️ Accounts that are registered with CySEC and BaFin do not qualify for rebates.

- ☑️ Retail accounts in the EU and the UK are ineligible for rebates.

- ☑️ Islamic Accounts and Spread Betting Accounts are not eligible for rebates.

Japan, Belgium, France, and the Chinese mainland are ineligible for rebates.

Pepperstone Additional Notes on Cashback Rebates

- ✅ The Active Trader Program has three tier levels, with the lowest rebate paid to traders who execute 100 lots of forex trades every month. After that, the reimbursement is 10% or between $70 and $140, whichever is greater.

Tier 2 of the Active Trader Program provides rebates of 15% or between $200 and $500 to traders who trade between 200 and 500 standard lots.

How to Open a Forex Cashback Account with Pepperstone (via SAShares)

You can follow these steps to register for a Forex Cashback Account with Pepperstone via SAShares.

For New Accounts

If you do not have an existing account with Pepperstone, you can easily obtain a cashback rebate in three simple steps.

✅ Step 1: Visit the Pepperstone Website

Visit the Pepperstone website and click “Open New Account.”

✅ Step 2: Submit Trading ID

Submit your Trading ID to us: [SAShares]

For Example:

To: [SAShares]

Subject: New Pepperstone Rebate Application

“Dear SAShares Team,

Please view my Pepperstone Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

✅ Step 3: Wait for Approval

Wait for approval, which will be sent within [number of hours]. Once approval is given, you will automatically receive your cashback rebates from the Pepperstone system.

For Existing Accounts

If you have an existing Pepperstone account, you can get a cashback rebate by following these simple steps.

✅ Step 1: Contact Pepperstone via Email

Send an email to Pepperstone: [email address for broker]. Request that the broker transfer the trading account under the following SAShares Affiliate ID: [SAShares]

For Example:

To: [SAShares]

Subject: Account Transfer Request

“Dear Pepperstone Partner/Affiliate Team,

I would hereby like to request that my account be transferred to IB/Partner/Affiliate code [SAShares Code]. Furthermore, I would hereby like to request to be assigned under the mentioned IB regardless of whether my account falls under an umbrella or parent IB.”

✅ Step 2: Create an additional Account

Once you receive confirmation of the transfer from Pepperstone, you can create an additional trading account.

✅ Step 3: Contact SAShares

Lastly, you can send your Trading or Client ID to [SAShares].

For Example:

To: [SAShares]

Subject: New Pepperstone Rebate Application

“Dear SAShares Team,

Please view my Pepperstone Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

Number of Traders participating in Pepperstone Cashback Rebates

Pepperstone has more than 300,000 registered accounts, and it is uncertain how many of these traders are using Pepperstone’s rebates program.

Understanding Forex Trading Rebates: How They Work with Pepperstone

The Active Trader program at Pepperstone is intended for high-volume traders and provides a variety of perks, including cash rebates on Forex, Index, and Commodities trading fees. These rebates are credited to your trading account the next business day after closing a trade.

The rebate you earn is determined by the number of standard lots you trade each month; the more you deal, the greater your commission savings. The program is divided into three levels:

- ✅ Tier 1: $1 per FX lot rebate and 10% spread reduction for trading volumes of less than 200 FX lots, 400 Commodities lots, and 2,000 Index lots.

- ✅ Tier 2: $2 off every FX lot and a 20% spread reduction for trading volumes of 200 to 1,500 FX lots, 400 to 3,000 Commodities lots, and 2,000 to 15,000 Index lots.

- ✅ Tier 3: $3 per FX lot rebate and 30% spread reduction for trading volumes of more than 1,501 FX lots, 3,001 Commodities lots, and 15,001 Index lots.

Other features of the Active Trader membership include priority customer service, gratis VPS hosting for Pepperstone Pro clients, and special insights from Pepperstone’s market analysts.

Can I qualify for Pepperstone rebates if I only trade 5 lots a month?

Yes, you can. You will qualify under Tier 1, where you earn rebates on trading volumes of <200 lots per month.

Can I earn rebates from Pepperstone on exotic forex pairs?

Yes, you can earn rebates across all forex pairs offered by Pepperstone.

Pepperstone – Advantages over Competitors / The Benefits of Forex Trading Rebates with Pepperstone

Pepperstone has the following advantages over its competitors:

- ✅ Pepperstone has cheap trading costs, allowing traders to maximize earnings with tighter spreads.

- ✅ With a Trust Score of 92 out of 99, Pepperstone is well-known for its dependability and security, creating trust among traders.

- ✅ Pepperstone’s trading platform consistently outperforms its rivals, garnering high marks. Furthermore, by upgrading to Smart Trader Tools for MT4/MT5, traders may experience a more competitive atmosphere.

- ✅ Pepperstone’s Active Trader program entices high-volume traders with Forex Trading Rebates, which provide cash back on Forex, Index, and Commodities trading fees. These rebates are transferred daily into the trader’s account, providing a huge financial benefit.

Aside from rebates, the Active Trader program includes other benefits such as priority customer service, gratis VPS hosting for Pepperstone Pro clients, and special market insights from the company’s market experts.

Geolocation of Traders

Most of Pepperstone’s market share is concentrated in these areas:

- ✅ United Kingdom – 9.54%

- ✅ Hong Kong – 8.94%

- ✅ Australia – 6.46%

- ✅ Philippines – 4.98%

- ✅ Mongolia – 4.97%

Pepperstone’s Current Expansion Focus

Pepperstone’s services stretch across Australia, Europe, Asia, and Africa.

Countries not accepted by Pepperstone

Pepperstone does not offer services to these countries:

- ✅ Canada

- ✅ Iran

- ✅ Japan

- ✅ United States

- ✅ Iraq

- ✅ Zimbabwe

- ✅ Yemen, and others.

Popularity among traders who choose Pepperstone

Pepperstone is one of the largest brokers in the world, falling within the Top 100 brokers.

Detailed Summary of Pepperstone

| 🔎 Headquartered | Melbourne, Australia, with offices globally |

| 🌎 Global Offices | Australia, UK, Germany, Bahamas, Dubai, Kenya, Cyprus |

| 📌 Year Founded | 2010 |

| 📍 Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 📈 Regional Restrictions | United States, Canada, Iran, Japan, Iraq, Zimbabwe, Yemen, and others |

| 📉 Islamic Account | ✅ Yes |

| 📊 Demo Account | ✅ Yes |

| ↪️ Non-expiring Demo | No, only if you have a funded live account |

| ▶️ Demo Duration | 30 days if a live account is not registered |

| 🔟 Retail Investor Accounts | 2 |

| ✳️ PAMM Accounts | Only MAM for Fund Managers |

| 💧 Liquidity Providers | Barclays, HSBC |

| 💖 Affiliate Program | ✅ Yes |

| 📈 Order Execution | Market |

| 📉 Execution Venues | Sucden Financial Limited, IS Prime Limited, LMAX Limited, GAIN Capital, Jefferies Financial Services, Inc. (Morgan Stanley, Morgan Chase) |

| 📊 OCO Orders | ✅ Yes |

| 🫰🏻 One-Click Trading | ✅ Yes |

| 🅰️ Scalping Allowed | ✅ Yes |

| 🅱️ Hedging Allowed | ✅ Yes |

| 📰 News Trading Allowed | ✅ Yes |

| 📌 Expert Advisors (EAs) Allowed | ✅ Yes |

| 📍 Trading API | ✅ Yes |

| ▶️ Starting spread | Variable, from 0.0 pips EUR/USD |

| ⏩ Minimum Commission per Trade | From AU$7 |

| 💹 Decimal Pricing | 5th decimal pricing after the comma |

| 📈 Margin Call | 90% |

| ⛔ Stop-Out | 20% |

| ⬇️ Minimum Trade Size | 0.01 lots |

| ⬆️ Maximum Trade Size | 100 lots |

| 🪙 Crypto trading offered | ✅ Yes |

| 👤 Dedicated Account Manager | None |

| 📊 Leverage Restrictions | None |

| 💴 Minimum Deposit | AU$200 |

| 💵 Deposit Currencies | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD |

| 💶 Account Base Currencies (All) | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD |

| 👥 Active Pepperstone customers | 300,000+ |

| ⏰ Minimum Withdrawal Time | 1 business day |

| 🕰️ Maximum Estimated Withdrawal Time | Up to 7 business days |

| 💳 Instant Deposits and Instant Withdrawals | None |

| 🔁 Segregated Accounts | ✅ Yes |

| 💻 Trading Platform Time | UTC +03:00 |

| 🖥️ Observe DST Change | ✅ Yes |

| 📌 DST Change Time zone | Eastern Standard Time (EST) |

| 📍 Languages supported on the website | English, Spanish, Russian, Chinese, Vietnamese, Arabic, Indonesian, Italian, French, Laotian, German, Polish |

| 🚩 Customer Support Languages | Multilingual |

| ➕ Copy Trading Support | ✅ Yes |

| ⏰ Customer Service Hours | 24/5 |

| 🎁 Bonuses and Promotions | None |

| 🖍️ Education for beginners | ✅ Yes |

| ▶️ Proprietary trading software | None |

| ⏩ Is Pepperstone a safe broker for traders | ✅ Yes |

| 🔟 Rating for Pepperstone | 9/10 |

| 💯 Trust score for Pepperstone | 92% |

Tips for Choosing Pepperstone for Forex Trading Rebates / Key Factors to Consider When Evaluating Pepperstone’s Forex Trading Rebate Program

The rebate program is divided into tiers depending on trading volume. The more you trade, the greater your commission reduction. If you trade often, this might drastically minimize your trading expenses.

- ✅ Daily Rebates: Unlike other programs, Pepperstone distributes rebates daily, straight into your trading account, as opposed to monthly or quarterly. This may boost your trading capital and enhance your cash flow.

- ✅ Trading Assets: Pepperstone provides rebates on Forex, Index, and Commodity trading commissions. This might be a huge benefit if you trade a range of assets.

- ✅ Other features of the Active Trader membership include priority customer service, gratis VPS hosting for Pepperstone Pro clients, and special market insights from Pepperstone’s market analysts. These advantages may be worth more than the rebates themselves.

- ✅ Trust and security: Pepperstone is a well-known broker with a great security reputation. This might provide you with the assurance that your cash is secure.

- ✅ Joining is simple: Contact Pepperstone or chat with your account manager to join the Active Trader program. You must achieve the volume criteria over three months to remain a member.

Pepperstone provides a better trading platform with Smart Trader Tools for MT4/MT5, allowing for a more competitive trading environment.

Is Pepperstone trusted and reliable?

Yes, Pepperstone is extremely reliable and has a trust score of 92%.

Where is Pepperstone regulated?

Pepperstone is regulated in the Bahamas (SCB), Australia (ASIC), United Kingdom (FCA), Germany (BaFin), Kenya (CMA), Dubai (DFSA), and Cyprus (CySEC).

Number of Traders participating in Pepperstone Cashback Rebates / Real-Life Examples:

Pepperstone has more than 300,000 registered accounts, and while we do not know how many participate in the rebates program, we can provide a few examples of traders benefitting from Pepperstone’s active trader program.

Claudia Johnson

In a month, Claudia trades 150 standard lots of Forex. Claudia is in Tier 1 of Pepperstone’s rebate program and would earn a $1 rebate per lot. As a result, Claudia would get a $150 rebate (150 lots * $1) for that month.

Heather Mann

In a month, Heather trades 1,000 standard lots of Forex. Heather could earn a $2 rebate for each lot as a Tier 2 trader. As a result, Heather would get a $2,000 rebate (1,000 lots * $2) for that month.

Maxwell Moon

In a month, Maxwell trades 2,000 standard lots of Forex. Therefore, Maxwell could earn a $3 rebate for each lot as a Tier 3 trader. As a result, Maxwell will get a $6,000 rebate (2,000 lots * $3) for that month.

How does Pepperstone’s rebates program compare to that of competitors?

The active trader program from Pepperstone is extremely lucrative, and the terms are transparent.

Is there a maximum amount I could earn with Pepperstone’s rebates?

No, there is no cap on commissions or spread reduction that you can earn with Pepperstone.

Pepperstone – Advantages Over Competitors

Pepperstone has the following advantages over its competitors:

- ✅ Several reputable entities regulate Pepperstone.

- ✅ Pepperstone offers some of the best trading conditions in the market, with zero-pip spreads on major instruments.

- ✅ There are over 1,200 instruments that can be traded on MT4, MT5, cTrader, TradingView, Myfxbook, and DupliTrade.

- ✅ Pepperstone protects traders from negative balances.

- ✅ Traders can use Expert Advisors (EAs), allowing traders to use automatic strategies across markets.

Finally, traders can use scalping and hedging.

Who will Benefit from Trading with Pepperstone?

Pepperstone claims to be ideal for traders of all skill levels, and its account options reflect this. The Standard Account is ideal for novice traders who need a straightforward trading experience since fees are already included in the spread.

The Razor account, on the other hand, is ideal for experienced traders and scalpers. In addition, many teaching resources are available on the website, suggesting that Pepperstone is comfortable with beginners utilizing its services.

Successful Traders Benefiting from Pepperstone’s Rebates – Pepperstone’s Forex Trading Rebates Empowering Retail Traders for Success

The Forex Trading Rebates program at Pepperstone is intended to empower regular traders and improve their trading performance.

The program offers cash rebates on Forex, Index, and Commodity trading commissions, which are deposited into the trader’s account daily. This has the potential to cut trading expenses drastically, raise trading capital, and boost profitability.

Here are several methods that successful traders may take advantage of Pepperstone’s rebates:

- ✅ Increased Profitability: By lowering trading expenses through rebates, traders may be able to boost their net earnings. This is especially advantageous for high-volume traders who may earn substantial rebates.

- ✅ Improved Cash Flow: Because rebates are provided regularly, traders might profit from increased cash flow. This is especially useful for day traders and scalpers who enter and close positions regularly.

- ✅ Daily rebates may effectively enhance a trader’s trading capital, enabling them to establish bigger or more positions.

- ✅ Lowering trading expenses may also help with risk management by lowering transaction break-even points.

Aside from financial perks, Pepperstone’s Active Trader program provides additional benefits such as priority customer service, gratis VPS hosting for Pepperstone Pro clients, and special insights from Pepperstone’s market analysts. These may bring added value and help a trader succeed.

Pepperstone Regulation and Safety of Funds

Pepperstone Global Regulations

| 🔎 Registered Entity | 🌎 Country of Registration | 📌 Registration Number | 📍 Regulatory Entity | 📉 Tier | 📈 License Number/Ref |

| 1️⃣ Pepperstone Markets Limited | Bahamas | 177174 B | SCB | 3 | SIA-F217 |

| 2️⃣ Pepperstone Group Limited | Australia | ACN 147 055 703 | ASIC | 1 | 414530 |

| 3️⃣ Pepperstone Limited (UK) | United Kingdom | 08965105 | FCA | 1 | 684312 |

| 4️⃣ Pepperstone EU, Ltd. | Cyprus | HE 398429 | CySEC | 2 | 388/20 |

| 5️⃣ Pepperstone Markets Kenya Limited | Kenya | PVT-PJU7Q8K | CMA | 2 | CMA 128 |

| 6️⃣ Pepperstone Financial Services (DIFC) Limited | Dubai | DIFC 3460 | DFSA | 2 | F004356 |

| 7️⃣ Pepperstone GmbH | Germany | HRB 91279 | BaFin | 1 | 151148 |

How Pepperstone Protects Traders and Client Funds

| 💴 Security Measure | 🔎 Information |

| 💵 Segregated Accounts | ✅ Yes |

| 💶 Compensation Fund Member | ✅ Yes |

| 💷 Compensation Amount | £85,000 |

| 💴 SSL Certificate | ✅ Yes |

| 💵 2FA (Where Applicable) | None |

| 💶 Privacy Policy in Place | ✅ Yes |

| 💷 Risk Warning Provided | ✅ Yes |

| 💴 Negative Balance Protection | Yes, only for UK/EU clients |

| 💵 Guaranteed Stop-Loss Orders | None |

Through which regulatory entity must I register with Pepperstone?

When you sign up for an account, Pepperstone will direct you to the correct website and regulatory entity based on your location.

Who provides liquidity to Pepperstone?

Pepperstone’s liquidity providers are Barclays, HSBC, and several others. Furthermore, Pepperstone’s execution venues include GAIN Capital, Morgan Stanley, LMAX Limited, etc.

How to Maximize Your Savings/Profits with Forex Trading Rebates at Pepperstone

Maximizing your savings or earnings with Pepperstone Forex trading rebates requires a mix of clever trading and taking full use of the Active Trader program’s features. Here are some pointers:

- ✅ Increase Your Trading Volume: The more you trade, the greater your commission rebate. If you trade often, this might drastically cut your trading expenses while increasing your net earnings.

- ✅ Diversify Your Trades: Pepperstone provides commission rebates on Forex, Index, and Commodities trading. You might earn more rebates by spreading your bets across these various asset types.

- ✅ Expand Trading Capital with Daily Rebates: You may use this cash to expand your trading capital because rebates are provided daily. This allows you to open bigger or more positions, boosting your earnings.

- ✅ Take Advantage of Additional Perks: Other perks of the Active Trader program include priority customer service, gratis VPS hosting for Pepperstone Pro clients, and special market insights from Pepperstone’s market analysts. These may bring value to your trade and help your success.

- ✅ Maintain Your Membership: To remain an Active Trader member, you must satisfy the volume criteria for three months. You may continue to benefit from the program by keeping your membership active.

While the prospect of receiving rebates is appealing, it is vital to realize that trading entails risk. Always manage your risks carefully and never trade more than you can afford to lose to earn more rebates.

Pepperstone Awards and Recognition

According to Pepperstone’s website, the company has been recognized for the following honors in recent years as a broker:

- ✅ Global Forex Broker of the Year (2022), awarded by FxScouts.

- ✅ Best Forex Broker Overall (2022), awarded by Compareforexbrokers.com.

- ✅ Best MetaTrader 4 (MT4) Forex Broker in 2022.

Finally, Pepperstone was awarded the Best No-Commission Trading Account in 2022.

Pepperstone Account Types and Features

Pepperstone offers two types of retail accounts to clients, namely:

- ✅ Standard Account

- ✅ Razor Account

The Standard Account is suitable for beginner or non-professional traders, as it has no commission charges and offers institutional-grade STP spreads. This account is ideal for those who want to start trading with a more traditional account type. On the other hand, the razor Account is designed for professional traders willing to pay commission in exchange for consistently low spreads.

Commission for this account starts at 3.5 USD per side, while spreads start at 0.0 pips. The razor Account also offers adjustable leverage and fast trade execution through sophisticated algorithms.

Regardless of the account type, all Pepperstone accounts offer the same high-quality performance, support, and comprehensive platform features.

| 🔎 Live Account | 💶 Minimum Dep. | 📉 Average Spread | 💵 Commissions | 💴 Average Trading Cost |

| 🅰️ Standard | 200 AUD | 0.6 pips | None | 7.7 USD |

| 🅱️ Razor | 200 AUD | 0.0 pips | 7 AUD per lot | cTrader: 8.17 USD MT4: 8.17 USD MT5: 9.2 USD |

Pepperstone Standard Account

Standard Account is the most fundamental account type provided by Pepperstone, online forex, and CFD broker. It is appropriate for novice or non-professional traders who want to begin trading with little funds.

The Standard Account normally has no commission fees. It provides institutional-grade STP (Straight Via Processing) spreads, which implies that transactions are performed directly with liquidity sources and not through a dealing desk.

Furthermore, this could lead to quicker and more accurate transaction execution and reduced spreads.

| 🔎 Account Feature | 🥇 Value |

| 💴 Minimum Deposit | AU$200 |

| 📈 Minimum Trading Size | 0.01 lots |

| 📉 Maximum Trading Size | 100 lots in a single trade |

| 💵 Base Account Currency | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD |

| 📊 Trading Strategies Supported | All including scalping, hedging, and Expert Advisors (EAs) |

| 📰 News Trading Offered | ✅ Yes |

| 📌 Trade Execution | No-Dealing Desk (NDD) |

| 💶 Average EUR/USD Spread | From 0.6 pips |

| 💷 Commissions | None |

| 📍 Rollover Swaps | Yes, according to the market rates |

| ⛔ Negative Balance Protection Offered | ✅ Yes, only for retail clients |

| ↪️ Margin Close-Out (%) | 50% |

| ▶️ Trading Instruments offered | 1,200+ |

| 📌 Trading Platforms offered | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

Pepperstone Razor Account

The Razor Account is more sophisticated, provided by the online forex and CFD broker Pepperstone. It is meant for experienced traders who want to trade with no fees and low spreads.

Spreads on the Razor Account are often substantially smaller than those on the Standard Account, and there are no commission fees. This implies that traders who use the Razor Account may be able to save money on trading charges, particularly if they trade often or in big numbers.

In addition to low spreads and no fees, the Razor Account provides other advantages experienced traders may find intriguing. For instance, it can provide variable leverage, allowing traders to modify the amount of borrowing they use while trading.

Traders who want to trade with greater positions relative to their account balance may find this handy. The Razor Account can also provide speedy trade execution with advanced algorithms, which may be advantageous for traders who must execute trades swiftly and precisely.

Details on the Razor Account are as follows:

| 🔎 Account Feature | 🥇 Value |

| 💴 Minimum Deposit | AU$200 |

| 📈 Minimum Trading Size | 0.01 lots |

| 📉 Maximum Trading Size | 100 lots in a single trade |

| 💵 Base Account Currency | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD |

| 📊 Trading Strategies Supported | All including scalping, hedging, and Expert Advisors (EAs) |

| 📰 News Trading Offered | ✅ Yes |

| 📌 Trade Execution | No-Dealing Desk (NDD) |

| 📍 Average EUR/USD Spread | Between 0.0 pips and 0.3 pips |

| 💷 Commissions | From AU$7 round turn on 100,000 traded |

| 💹 Rollover Swaps | Yes, according to the market rates |

| ⛔ Negative Balance Protection Offered | ✅ Yes, only for retail clients |

| ↪️ Margin Close-Out (%) | 50% |

| ▶️ Trading Instruments offered | 1,200+ |

| 💻 Trading Platforms offered | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

Pepperstone Demo Account

Pepperstone provides potential traders with an unlimited demo account to practice trading in real time. In addition, the MT4, MT5, and cTrader trading platforms provide a comprehensive spectrum of customizable trading tools and features to improve trading success.

Pepperstone MT4/5 demo accounts expire automatically after 30 days unless the trader has a real, paid account and requests the broker to extend the expiration date. If demo accounts are signed into at least once every 30 days, they will not expire.

The broker allows investors to assess its account types, Standard and Razor, and all its trading platforms (MT4, MT5, and cTrader).

Pepperstone’s trial account allows traders to evaluate the broker’s services and product offering on various financial instruments – forex, indices, stocks, commodities, and its range of cryptocurrency CFDs, including Bitcoin – without risking real funds.

A Pepperstone demo account is 100% risk-free. The money (up to $50,000) on the demo account is virtual – including the gains and losses – but it gives traders access to a risk-free environment where they can practice and test trading methods.

Pepperstone Islamic Account

The Islamic Account from Pepperstone is ideal for Muslim traders who participate in foreign currency operations while following Sharia law rules.

Since collecting or paying any interest is seen as exploitative and inefficient, the legislation prohibits charging any interest, including overnight fees.

If they match the conditions, Muslim traders can create an Islamic Account with Pepperstone if they are from the following locations:

- ✅ Albania

- ✅ Azerbaijan

- ✅ Bangladesh

- ✅ Burkina Faso

- ✅ Bahrain

- ✅ Brunei

- ✅ Nigeria

- ✅ Brunei Darussalam

- ✅ Algeria

- ✅ Egypt

- ✅ Guinea

- ✅ Indonesia

- ✅ Jordan

- ✅ Kyrgyzstan

- ✅ Kuwait

- ✅Morocco

- ✅ Mauritania and several other Islamic regions.

Pepperstone Professional Account

Traders with a proven track record of success on the market get additional advantages, rewards, and privileges as a token of gratitude for their accomplishments.

Among the benefits of having a professional account with Pepperstone are the following:

- ✅ The ability to employ a maximum leverage of 1:500.

- ✅ Dedicated Account Manager Access.

- ✅ 20% margin close-out on both MetaTrader 4 and 5.

- ✅ A 50% margin close-out while using cTrader.

To qualify for a Pepperstone Pro Account, traders must show compliance with at least two of the following three criteria:

- ✅ Professional traders must show their level of understanding by taking the condensed online Sophisticated Investor Test.

- ✅ To be eligible for a license to trade leveraged goods, you must have a trading history of at least AU$ 50,000 or at least twenty times each quarter during the previous four quarters.

- ✅ Traders must have maintained a basic net worth of at least AU$ 2.5 million or an annual gross income of at least $250,000 for the prior two years.

When traders qualify for a Pepperstone professional account, the following precautions will no longer be permitted:

- ✅ Leverage restrictions

- ✅ Mandatory margin close-outs

- ✅ Negative balance protection

- ✅ Retail disclosure information

Pepperstone PAMM/MAM Accounts

Pepperstone’s MAM/PAMM account enables fund managers to trade while maintaining subaccounts for their customers. The trades executed on these accounts and the account manager’s profits and losses are allocated equally among the customers.

If you are interested in trading, you may further diversify your portfolio by hiring several fund managers. The primary distinction between a Pepperstone MAM account and a PAMM account is the management and allocations.

With MAM, several accounts may be spread over many brokers, and there is more flexibility in allocating transactions to these accounts. A PAMM account distributes a percentage to traders according to the amount of capital they have invested with the money management.

A Pepperstone MAM/PAMM account allows you to manage hundreds of sub-accounts from a single place. Furthermore, since this system functions efficiently, there should be no delay between your allocation and its reflection in the subaccount.

You will also have access to various allocation techniques, such as by lot, percentage, and proportion. Various trading strategies, including using EAs and scalping, are also available, and each account’s administration and costs can be adjusted.

For example, on a Pepperstone sub-account, the minimum transaction size is 1 micro lot (0.01 lots), and you will have access to both MT4 and MT5 servers.

How to open an Account with Pepperstone

To register a live trading account with Pepperstone, you can follow these steps:

- ✅ Visit the Pepperstone website and click the box labeled “Open an Account.”

- ✅ Select the kind of account that you want to open. Standard Accounts, Razor Accounts, Islamic Accounts, Self-Managed Accounts, PAMM Accounts, and CFD Accounts are among the account types offered by Pepperstone. Choose the account type that matches your trading requirements and preferences the best.

- ✅ Complete the online application with your personal and financial details. This will contain your name, telephone number, and email address. You must also offer details on your trading experience and financial goals.

- ✅ Submit the application form and any paperwork requested. In addition, Pepperstone may request further identification and address verification documents. This can be a copy of your passport, driver’s license, or other government-issued ID and an address verification document.

- ✅ Activate your account. After accepting your application and creating your account, you must deposit funds before you can begin trading. Pepperstone provides a variety of financing alternatives, including bank transfers, credit/debit card deposits, and online payment services such as PayPal and Skrill.

- ✅ Download the Pepperstone trading platform and install it.

Start trading! After completing these steps, you are prepared to trade with Pepperstone. Through the trading interface, you may execute transactions, check your account balance and performance, and manage your trades and orders.

Can anyone open an Islamic Account with Pepperstone?

No, Pepperstone only offers an Islamic to certain regions, including Nigeria, Morocco, Albania, etc.

What is the minimum deposit for Pepperstone?

The minimum deposit for Pepperstone is AU$ 200.

Pepperstone Trading Platforms

Pepperstone offers traders a choice between these trading platforms:

- ✅ MetaTrader 4

- ✅ MetaTrader 5

- ✅ cTrader

- ✅ TradingView

- ✅ Myfxbook

- ✅ DupliTrade

MetaTrader 4

While many free technical indicators and trading tools are accessible online, MT4 offers several paid indicators on the marketplace. Furthermore, everything is simple, from chart analysis to making and maintaining trades.

You can easily move between the desktop version of MT4 and the mobile app to manage your account at your convenience. However, despite the merits of this excellent platform, it has fewer chart periods, order types, and indicators than its replacement, MT5.

MetaTrader 5

The MT5 trading platform is an improved version of the MT4 platform that retains most of MT4’s capabilities while adding more capability. MT5 has the following features:

- ✅ Comparable functions to MT4 with more indicators, periods, and charts

- ✅ Personalized charting and indications

- ✅ Supplementary order types

- ✅ Dept of the Market (DOM)

- ✅ Built-in economic calendar

cTrader

The easy platform design of cTrader’s professional online trading platform resembles an institutional trading environment.

Due to its straightforward and user-friendly interface, cTrader is also appropriate for beginners. However, if this is essential, it also contains more complicated automated functions.

TradingView

With cTrader-powered integration, you can access TradingView’s extensive charting tools and engage with millions of other traders. TradingView is an industry-leading charting software with several features and functionalities that will help you advance your trading.

Myfxbook

Myfxbook is a service offered by Pepperstone that enables traders to assess their trading performance and compare it to that of other traders. It is a third-party tool that automatically records and shows a trader’s account performance by connecting to Pepperstone’s trading servers.

Using Pepperstone’s Myfxbook, traders may access comprehensive information about their transactions, such as the number of trades, the average profit/loss per trade, the biggest drawdown, and the total profit/loss for a certain timeframe.

In addition, they may see charts and graphs that depict their account’s performance over time and compare it to that of other traders or market benchmarks.

DupliTrade

Pepperstone allowed investors to diversify their accounts through DupliTrade, a prominent marketplace for trading strategies that automate trading.

DupliTrade utilizes signals from proprietary traders, using their experience, so that you may expand your trading skills and get a fundamental grasp of pro approaches.

Does Pepperstone offer free VPS?

Yes, Pepperstone offers free VPS to high-volume traders who can access this service and meet the required monthly trading volumes.

Does Pepperstone have social trading?

Yes, Pepperstone offers social trading through DupliTrade.

Pepperstone Investment Programs

The following are examples of investment schemes that Pepperstone may provide:

- ✅ A PAMM (Percentage Allocation Management Module) account is a form of managed account that enables traders to invest in a portfolio of financial assets managed by a professional trader. With a PAMM account, a professional trader makes all investment choices on the client’s behalf, and the investor receives a portion of the gains or losses depending on their investment.

- ✅ Copy trading is a feature that enables traders to copy the trades of other successful traders. By linking their account to a copy trading platform, traders may duplicate in real-time the transactions of a selected trader or traders. This might be a good method for traders to diversify their portfolios or to gain knowledge from the expertise of more seasoned traders.

A managed account is a form of investment account managed on behalf of the investor by a professional asset manager. With a managed account, the asset manager makes all investment choices and executes all transactions on behalf of the investor, who receives a portion of the account’s profits or losses.

Which Markets Can You Trade with Pepperstone?

Traders can expect the following range of markets from Pepperstone:

- ✅ Forex

- ✅ Cryptocurrencies

- ✅ Shares

- ✅ ETFs

- ✅ Indices

- ✅ Commodities

- ✅ Currency Indices

Financial Instruments and Leverage offered by Pepperstone

| 🅰️ Instrument | ➡️ Number of Assets Offered | ➡️ Leverage Offered |

| 🅱️ Forex | 70 | 1:200 (retail) 1:500 (Pro) |

| 💎 Precious Metals | 11 | 1:200 |

| 📌 ETFs | 100 | 1:20 |

| 📍 Indices | 28 | 1:200 |

| 📈 Stocks | 1,000 | 1:10 |

| 🪙 Cryptocurrency | 19 | 1:10 |

| 🍎 Commodities | 17 | 1:200 |

Can I trade VIX 75 with Pepperstone?

Yes, Pepperstone offers access to the Volatility 75 under “VIX” with spreads from 1.6 pips.

What typical spreads can I expect on BTC/USD with Pepperstone?

The minimum spreads you can expect on the Razor Account start from 16.50 pips, with minimum spreads from 15 pips.

Pepperstone Trading and Non-Trading Fees

Pepperstone Spreads

Spreads charged by Pepperstone vary on various variables, including account type, traded financial instrument, and market circumstances. Pepperstone provides cheap spreads on various financial products, including currency pairs, indices, commodities, and stocks.

For instance, the spreads on Pepperstone’s Standard Account are often greater than those on the Razor Account. Nonetheless, the Standard Account has no commission fees, but the Razor Account costs a commission on every transaction.

This implies that traders utilizing the Standard Account may incur reduced total trading costs, depending on their trading volume and the spread and commission rates for the individual instruments they trade.

Pepperstone’s spreads can fluctuate based on market circumstances and may be wider during periods of high volatility or low liquidity. These are the typical spreads that traders can expect from Pepperstone are as follows:

- ✅ Standard Account – from 0.6 pips EUR/USD

- ✅ Razor Account – between 0.0 pips and 0.3 pips EUR/USD

- ✅ Islamic Account Option – from between 1 pip and 1.2 pips EUR/USD

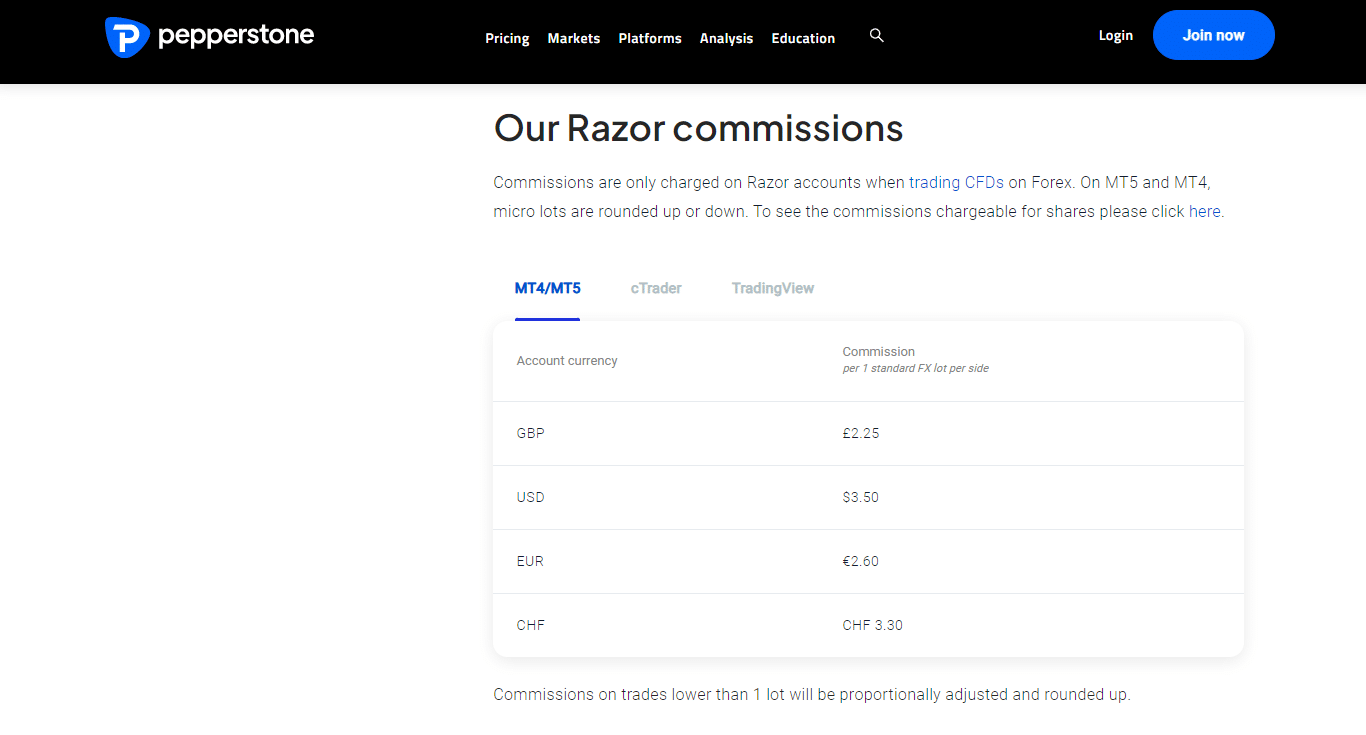

Pepperstone Commissions

The Standard Account from Pepperstone does not charge commissions. Thus, traders using this account will not incur any extra expenses on top of the spreads.

However, Pepperstone’s razor Account charges a fee for each transaction, beginning at $3.5 per side for Forex pairs and $5 for other products.

Furthermore, Pepperstone applies an administrative fee to the Islamic account when traders hold their positions past a certain time. These admin fees are as follows:

- ✅ Cryptocurrencies (Professional Account Only), commodities, equities – 1.5 USD

- ✅ Index Markets – 10 USD

- ✅ SpotCrude and SpotBrent – 20 USD

- ✅ Forex, precious metals on the retail account – 50 USD

- ✅ Only on the professional account – Crypto10, Crypto20, and Crypto30 – 50 USD

- ✅ BTC/USD (Professional Account Only) – 125 USD

- ✅ GER40, FRA40, JPN225, CN50, ETH/USD (Professional Account Only) – 12 USD

- ✅ US30 – 30 USD

Pepperstone Overnight Fees, Rollovers, or Swaps

Overnight financing is a fee for maintaining a position in equities, commodities, cryptocurrencies, metals, or index markets and a swap for foreign currency holdings held beyond the rollover period.

Traders should be informed that a triple swap is done every Friday to CFD Equities and Indices to account for weekend holdings.

Muslim traders who use Pepperstone’s Islamic Account should be informed that they will incur administrative fees every 10 days they maintain an open position.

Pepperstone Deposit and Withdrawal Fees

Most Pepperstone’s traders are not charged any deposit or withdrawal fees, regardless of location. However, traders using International Telegraphic Transfer (TT) would incur a $20 cost.

Pepperstone Inactivity Fees

Pepperstone does not charge any inactivity fees.

Pepperstone Currency Conversion Fees

Currency conversion fees might apply when traders deposit or withdraw in currencies different from the base currency of the trading account.

Can I contact Pepperstone on weekends?

No, Pepperstone does not currently offer support over weekends or public holidays. All queries are addressed during business hours.

How long does Pepperstone take to respond to live chat queries?

Live chat queries are typically answered within a few minutes, and customer support is helpful and friendly.

Calculating Forex Trading Rebates with Pepperstone

The Active Trader program at Pepperstone provides a tiered rebate structure depending on the monthly standard lots traded. The rebates are determined as follows:

- ✅ Tier 1: If you trade fewer than 200 FX lots, 400 Commodities lots, or 2,000 Index lots in a month, you will get a $1 rebate per FX lot and a 10% spread reduction.

- ✅ Tier 2: If you trade 200 to 1,500 FX lots, 400 to 3,000 Commodities lots, and 2,000 to 15,000 Index lots monthly, you will earn a $2 rebate per FX lot and a 20% spread reduction.

- ✅ Tier 3: If you trade more than 1,501 FX lots, 3,001 Commodities lots, or 15,001 Index lots in a month, you will earn a $3 rebate per FX lot and a 30% spread reduction.

Simply multiply the number of lots you trade by the rebate per lot for your tier to obtain your rebate. For example, if you are a Tier 2 trader who trades 1,000 FX lots each month, your rebate would be $1,000 * $2 = $2,000.

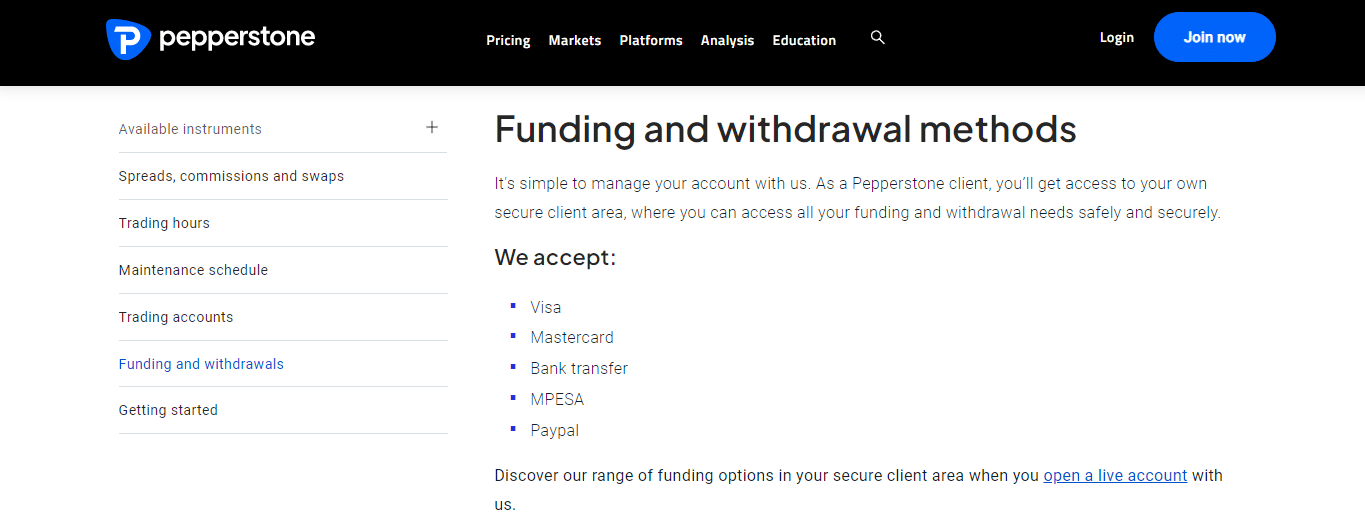

Pepperstone Deposits and Withdrawals

Pepperstone offers the following deposit and withdrawal methods:

- ☑️ Visa

- ☑️ Mastercard

- ☑️ Bank transfer

- ☑️ MPESA

- ☑️ Paypal

- ☑️ Bpay

- ☑️ Neteller

and many more.

How to Deposit Funds with Pepperstone

To deposit funds to an account with Pepperstone, traders can follow these steps:

- ☑️ Sign in to the client site for Pepperstone.

- ☑️ Select “Deposit Funds” from the menu or the dashboard.

- ☑️ Select the deposit method that you want to utilize. Pepperstone provides a variety of deposit options, including bank transfers, credit/debit card deposits, and e-wallet options, such as PayPal and Skrill.

- ☑️ Follow the steps to finish the deposit procedure. This could entail submitting your personal and financial information and any necessary papers.

Validate the deposit. After completing the deposit procedure, you must confirm the deposit to finalize the transaction.

Pepperstone Fund Withdrawal Process

To withdraw funds from an account with Pepperstone, traders can follow these steps:

- ☑️ Log in to the Pepperstone client portal.

- ☑️ Click on the “Withdraw Funds” button in the menu or on the dashboard.

- ☑️ Choose the withdrawal method that you would like to use. Pepperstone offers a range of withdrawal methods, including bank transfers, credit/debit card withdrawals, and online payment methods like PayPal and Skrill.

- ☑️ Follow the instructions provided to complete the withdrawal process. This could involve entering your personal and financial information and any required documentation.

Confirm the withdrawal. Once you have completed the withdrawal process, you must confirm the withdrawal to complete the transaction.

How long will it take to receive my rebates from Pepperstone after withdrawing?

It can take 1 to several days, depending on your method.

How much does Pepperstone charge for withdrawals?

Pepperstone does not typically charge withdrawals unless traders use International Telegraphic Transfer, which attracts a $20 fee.

Claiming and Withdrawing Forex Rebates at Pepperstone

One of the benefits of Pepperstone’s Active Trader program is that rebates are paid straight into your trading account regularly. This means you will not have to claim your rebates since they will be paid to your account the day after a position is terminated.

Withdrawing your rebates is normally done like withdrawing any other monies from your Pepperstone account.

To withdraw money to your preferred payment method, log into your account, browse the withdrawal area, and follow the directions. Remember that withdrawal timelines and associated costs may differ depending on the withdrawal method you use.

Pepperstone Education and Research

Education

Pepperstone offers the following Educational Materials:

- ✅ Learn to Trade CFDs

- ✅ Learn to Trade Forex

- ✅ Learn to Trade Crypto

- ✅ Learn to Trade Shares

- ✅ Trading Guides

- ✅ Webinars

Research

Pepperstone offers traders the following Research and Trading Tools:

- ✅ Market Analysis

- ✅ cTrader Automate

- ✅ AutoChartist

- ✅ API Trading

- ✅ Economic Calendar

- ✅ Meet the Pepperstone analysts

Smart Trader Tools for MetaTrader and much more.

Pepperstone Bonuses and Current Promotions

Pepperstone offers traders the following bonuses and promotions:

- ✅ The referral bonus for Professional clients

- ✅ The referral bonus for Retail traders

Can I use the referral bonus with my Pepperstone rebates program?

Yes, you can participate in the Pepperstone active trader program and earn a bonus when you successfully refer others to the platform.

How much can I earn from the Pepperstone referral bonus?

You can earn AU$100 when you successfully refer others to sign up for an account, deposit their first capital, and start trading.

How to open an Affiliate Account with Pepperstone

To register an Affiliate Account with Pepperstone, traders can follow these steps:

- ✅ Navigate to Pepperstone’s official website.

- ✅ Prospective affiliates can visit the affiliate area and click “Find out more” from the homepage.

- ✅ A new page will appear, and potential affiliates can study the material offered by Pepperstone to see whether this collaboration aligns with their goals.

- ✅ Once completed, potential affiliates can begin the application process by clicking “Start Earning Today.”

- ✅ The application form must be filled out with all the needed information before it can be submitted for consideration.

- ✅ Once authorized, affiliates can access their entire affiliate bundle by navigating the affiliate section.

Affiliates can now start referring other traders to the Pepperstone website, and they can anticipate money within 30 days for each successful recommendation.

Pepperstone Affiliate Program Features

Pepperstone provides traders with a robust affiliate network that enables company expansion. In addition, Pepperstone provides an extensive assortment of information and solutions to assist affiliates in getting more consumers.

Pepperstone makes it simple for affiliates to earn up to $1,300 for each recommended client. In addition, Pepperstone provides affiliates with access to 24/7 real-time reporting, a tiered CPA structure, comprehensive support, and more.

Pepperstone’s affiliate program is suitable for individuals with a solid social media following and the ability to reach a broad audience, as well as those with a high volume of website traffic who may profit from a collaboration with a reputable and well-known broker.

Pepperstone Customer Support

Based on the sort of service you need. Some alternatives include:

- ✅ Pepperstone provides a live chat service that is accessible 24/7/365. (Monday to Friday). To initiate a chat session with a customer care professional, click the “Live Chat” icon on the Pepperstone website and provide your name and email address.

- ✅ You may also contact Pepperstone’s customer service by email by sending a message to the relevant department.

If you want to talk with a customer service agent over the phone, you may dial Pepperstone’s customer service number. The telephone number will vary based on your region; however, a list of international telephone numbers is available on the Pepperstone website.

Can I contact Pepperstone on weekends?

No, Pepperstone does not currently offer support over weekends or public holidays. All queries are addressed during business hours.

How long does Pepperstone take to respond to live chat queries?

Live chat queries are typically answered within a few minutes, and customer support is helpful and friendly.

Pepperstone Corporate Social Responsibility

Pepperstone is an online forex and CFD broker devoted to corporate social responsibility (CSR) and community assistance. Among the CSR activities in which Pepperstone has participated are:

- ✅ Pepperstone has collaborated with various organizations and charities to support its activities and positively influence the community. For instance, the corporation has donated to the Starlight Children’s Foundation, a charity that assists children and their families who are gravely sick.

- ✅ Pepperstone has also taken measures to reduce its environmental effect and advance sustainability. For example, the corporation has adopted various energy-efficient measures in its offices and has engaged in programs such as Earth Hour, which attempts to raise awareness of climate change and promote energy conservation.

Finally, Engagement of Employees. Pepperstone heavily focuses on employee engagement and supports various activities to foster cooperation, collaboration, and personal growth. Additionally, the firm provides its workers with various advantages, such as flexible work arrangements and possibilities for professional growth.

Pepperstone Alternatives

- 🥇 Saxo Bank: Saxo Bank is a Danish broker that offers a range of forex, CFD, and futures products. It is known for its advanced trading platform and research tools and is regulated by the Danish Financial Supervisory Authority (DFSA) and other regulatory agencies.

- 🥈 CMC Markets is an online broker that provides a variety of financial instruments, including forex, contracts for difference (CFDs), and spread betting products for trading. The organization has its headquarters in London, United Kingdom, and is governed by the Financial Conduct Authority (FCA).

- 🥉 FXCM is appropriate for a variety of traders, including novices and professionals. It features a variety of account options, including Standard Accounts and Active Trader Accounts, and a variety of risk management measures, including negative balance protection and guaranteed stops.

Pepperstone VPS Review

Virtual Private Server (VPS) hosting enables traders to operate their trading platform and automated algorithmic methods, such as expert advisers, on a virtual computer 24 hours a day, seven days a week.

This means you do not always need to have your computer on, which minimizes the risk of system downtime due to technological and networking issues. Pepperstone has partnered with two prominent VPS providers, FXVM and New York City Servers, to give customers a significant discount on all available VPS plans.

You may use the cheap VPS if you intend to operate trading robots around the clock and cannot have your computer operational.

Pepperstone Web Traffic Report

| 🌎 Global Rank | 39,259 |

| 📈 Country Rank | 15,045 |

| 📉 Category Rank | 107 |

| 📊 Total Visits | 943.2K |

| 📌 Bounce Rate | 42.36% |

| 📍 Pages per Visit | 2.41 |

| ⏩ Average Duration of Visit | 00:03:40 |

Total Visits in the last three months:

- ⬆️ September – 976K

- ⬇️ October – 937.1K

- ⬆️ November – 943.2K

Legal and Tax Implications: Understanding Forex Trading Rebates with Pepperstone

Forex trading rebates, like any other source of revenue, may be subject to legal and tax consequences. The details will depend on your jurisdiction and particular circumstances.

- ✅ Legal Implications: It is important to realize that rebates are part of your trading agreement with Pepperstone and are controlled by the Active Trader program’s terms and conditions. Always read these terms carefully and, if necessary, seek legal counsel.

Trading rebates may be deemed taxable income in several countries. This implies you would have to record them on your tax return and pay tax on them. The tax treatment varies based on your overall income, tax location, and whether you trade as a person or a company. It is strongly advised that you speak with a tax expert to understand the tax consequences of your case fully.

Risks and Limitations of Forex Trading Rebates at Pepperstone

While Forex trading rebates may give financial rewards, it is critical to understand the dangers and limitations:

- ✅ Trading Volume Requirement: You must achieve specific trading volume criteria to be eligible for rebates. This may encourage overtrading, which increases your risk.

- ✅ Market Risk: Forex trading carries a high level of risk. The possibility of earning rebates should not be allowed to overshadow the inherent hazards of trading. Always trade with a good strategy and risk management ideas in mind.

Pepperstone has the right to modify the conditions of the Active Trader program at any moment. This might influence your rebate eligibility or the rebates you can receive.

Strategies to Maximize Rebates with Pepperstone

Here are some other ideas for maximizing your Pepperstone rebates:

- ✅ Consistent Trading: Trading consistently might help you achieve the volume criteria for rebates. Create and stick to a trading strategy.

- ✅ Leverage automatic Trading: Consider adopting automatic trading tactics if you are comfortable with them. These can enhance your trade volume without needing any more time or effort on your behalf.

- ✅ Trade During Peak Hours: Peak hours in the forex market are when the trading volume is greatest. Trade during these periods may enhance your trade volume and, as a result, your rebates.

- ✅ Consider Using Rebates to Fund Further Transactions: Consider using your rebates to fund further transactions. This may significantly improve your trading money as well as your trading volume.

Although these methods could help you optimize your rebates, they should be utilized with a complete trading strategy considering your unique trading objectives, risk tolerance, and market circumstances. Always trade responsibly and, if required, seek expert counsel.

Pepperstone vs. Other Notable Brokers

| 🔎 Brokers | 🥇 Pepperstone | 🥈 FOREX.com | 🥉 HFM |

| 💵 Withdrawal Fee | None | None | None |

| 🆓 Demo Account | ✅ Yes | ✅ Yes | ✅ Yes |

| 💴 Min Deposit | 200 AUD | $100 | $5 |

| 📉 Leverage | 1:400 | 1:400 | 1:1000 |

| 📈 Spread | From 0.0 pips | From 0.2 EUR/USD | 0.0 pips |

| 📊 Commissions | From AU$7 | $10 per round turn | $3 to $4 |

| ➡️ Order Execution | Market | Market | Market |

| 💷 No-Deposit Bonus | None | None | None |

| 🪙 Cent Accounts | None | None | None |

| 💙 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| ↪️ Retail Investor Accounts | 2 | 3 | 4 |

| ☪️ Islamic Account | ✅ Yes | ✅ Yes | ✅ Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots (100k on DMA Account) | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | Depends on available funds | 60 lots |

| ⏰ Min. Withdrawal Time | 1 business day | Instant | 10 Minutes |

| ✔️ Max. Withdrawal Time | Up to 7 business days | Between 1 to 2 working days | 10 business days |

| 📍 Instant Withdrawals | None | ✅ Yes | None |

Trading with Pepperstone Pros and Cons

| ✅ Pros | ❎ Cons |

| Pepperstone advertises low minimum spreads on forex pairs | The demo account will expire after 30 days if traders do not register and fund a live account |

| Pepperstone is well-regulated by reputable entities | There is a high minimum deposit |

| Client funds are protected and kept in top-tier accounts with the best banks | Non-UK/EU traders do not have negative balance protection |

| UK traders receive negative balance protection | Guaranteed Stop Loss Orders are not available |

Pepperstone User Reviews

🥇 Happy Client.

This broker platform has been profitable for six years. Compared to other brokers, Pepperstone is still the finest. – Eddie Bean

🥈 Excellent and Efficient.

The broker is excellent, efficient, and operates efficiently. Most significantly, the assistance you get is excellent and quick. – Damian Ranch

🥉 Excellent Experience.

Excellent experience. Trading with ease with TradingView. PayPal allows you to make a quick and simple deposit. Amazing! Fast response on help. – Jimmy Flynn

Recommendation for Improving Pepperstone Cashback Rebates

One of the primary areas where Pepperstone could improve is by offering rebates on instruments other than forex, such as shares, indices, crypto, and commodities.

- ✅ While Pepperstone’s rebate program is very straightforward, they can include more specific examples or a rebate calculator on their website to assist traders in understanding how much they can earn.

- ✅ Flexibility: The program is now largely tailored to high-volume traders. Pepperstone could add additional levels or a sliding scale to accommodate traders with smaller quantities.

- ✅ Education: Pepperstone can provide additional instructional tools, such as webinars or tutorials, to assist traders in learning how to optimize their rebates.

- ✅ Promotion: Pepperstone could offer periodic promotions or incentives relating to the rebate program to recruit new traders and incentivize current traders to raise their volume.

Pepperstone can collect input from traders on the rebate program regularly and utilize this feedback to make continuing improvements.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. This evaluation comprises positives, disadvantages, and an overall score based on our findings. We want to assist you in locating the ideal broker for your requirements. Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Our Verdict on Pepperstone

Pepperstone, in our view, provides a thorough and attractive rebate program for its traders. According to our findings, the Active Trader program offers a tiered rebate system depending on the monthly standard lots sold, which may boost a trader’s profits.

User evaluations show high satisfaction with Pepperstone’s services, with users applauding the platform’s efficiency, support, and dependability.

However, in our experience, although these rebates might be financially advantageous, they should not be allowed to obscure the inherent hazards of trading.

Pepperstone Frequently Asked Questions

What are Forex Cashback Rebates?

Rebates are the compensation you might get from your broker according to your trading volume.

Does Pepperstone offer Forex Cashback Rebates?

Yes, Pepperstone offers Forex cashback rebates, but only on Forex.

How does the Forex Cashback Rebate process work?

Most often, rebates are paid depending on the trading volume with the broker. This is also true for Pepperstone, albeit there are a few other methods.

The first will be to work as a referral partner or affiliate for the broker, enabling you to earn rebates. Either of these may also open the door to further rewards, such as using a private VPS, extensive market insights, and more.

I’m an existing trader, how can I transfer my account to earn rebates via Pepperstone?

You can open an account with Pepperstone and request that your current broker transfer your existing account and positions to your new Pepperstone account.

How many traders with Pepperstone use the Cashback Rebate feature?

Of Pepperstone’s over 300,000 traders, it is not certain how many are part of its rebates program.

What are the maximum rebates I could earn with Pepperstone?

You can earn up to 0.3 pips or 21.857% back on commissions.

Will my Pepperstone fees and spreads increase when I use the Cashback Rebate feature?

Your fees and spreads do not increase with Pepperstone’s cashback rebates.

Why should I work through the SA Shares Cashback?

You can expect some of the highest commissions if you work through SA Shares to earn Cashback Rebates from Pepperstone.

This is because SA Shares aims to negotiate the most competitive commission rates with brokers such as Pepperstone to ensure you get the most back from your trading activities.

How quickly will I receive my sign-up bonus?

“Pepperstone does not offer a sign-up bonus.”

How can I manage my trading risk when I sign up?

“We offer smart trade tools for MT4/5 and allow our clients to use EA.”

Do you recommend leverage?

“Pepperstone does not make any trade recommendations. However, kindly note that your leverage is fixed and cannot be changed as a Retail client.”

Which trading strategy should I try as a beginner?

“As mentioned above, we do not offer trade recommendations. Although you can check on our website page for education and choose the strategy, you would like to use, and I can explain to you a bit about the account we offer at Pepperstone so you can understand better.”

How do you protect client data and information?

“Please note that your data is protected at Pepperstone. If you want to learn more, you can check our Privacy Policy.”

What execution speeds can I expect, and what is your execution policy?

“The A and B book broker model is not something a broker of Pepperstone’s size utilizes. Instead, Pepperstone internally matches clients’ trades against one another, and excess exposure is hedged in the market with our liquidity providers. This model ensures fast execution speed, price stability, and reduced trading costs for our clients.”

How do you handle customer complaints?

“We always take our clients’ feedback and complaints seriously; if you need to raise a complaint, an Account manager can help you with that or via live chat/email, and our Compliance department will check your complaint as soon as possible.”

What is the recommended initial deposit?

“We do not enforce a minimum deposit so you can start with any amount. However, due to the margin requirements of trades, clients will deposit around 500.”

What are forex trading rebates?

Rebates are incentives traders can get from Pepperstone based on their trading volume.

How do forex trading rebates work with Pepperstone?

Pepperstone offers forex trading rebates as part of its Active Trader program. The program provides a tiered rebate structure depending on the monthly standard lots traded.

The more you trade, the greater your commission reduction. These rebates are credited to your trading account the next business day after closing a trade.

Can I earn rebates on all types of trades with Pepperstone?

Pepperstone provides a commission or spreads rebates on Forex, Index, and Commodity trading.

Are there any requirements to be eligible for forex trading rebates with Pepperstone?

Yes, you must be a Pepperstone’s Active Trader program member to be eligible for forex trading rebates. To qualify for rebates, you must fulfill the program’s volume criteria.

Does Pepperstone offer rebates to traders in all countries?

The Active Trader program is open to all Pepperstone customers. However, if you have any queries regarding your eligibility, please contact Pepperstone immediately.

Can I combine forex trading rebates with other promotions or bonuses Pepperstone offers?

Yes, you can. If you participate in the Active Trader program, you could qualify for other bonuses, such as the referral bonus.

What is the minimum trading volume to qualify for rebates with Pepperstone?

To qualify for Pepperstone rebates, you must trade at least 200 standard lots of Forex, 400 commodity lots, or 2,000 index lots every month.

How can I sign up for forex trading rebates with Pepperstone?

You must first join their Active Trader program to sign up for Pepperstone’s forex trading rebates. You can do this by contacting Pepperstone or chatting with your account manager.

Do I need to apply for rebates each month with Pepperstone?

No, once enrolled in the Active Trader program, you are not required to apply for monthly rebates. They are credited to your account automatically, depending on your trading volume.

Are forex trading rebates taxable?

Trading rebates may be considered taxable income in several countries. This implies you’d have to record them on your tax return and maybe pay tax on them. The tax treatment varies based on your overall income, tax location, and whether you trade as a person or a company.

Can I use my rebates to cover withdrawing funds from my Pepperstone account?

Yes, the rebates are applied to your trading account and can be utilized as a part of your trading capital, including offsetting withdrawal fees.

Are there any limitations or restrictions on using forex trading rebates?

Yes, there are. Forex trading rebates are deposited into your trading account and may be utilized to supplement your trading capital. However, to remain part of the Active Trader program and get rebates, you must achieve the three-month volume criteria.

Does Pepperstone offer a higher rebate rate for professional traders?

Pepperstone’s rebate rate is determined by trading volume, not whether you are a retail or professional trader. Professional traders who trade large quantities, on the other hand, could be eligible for bigger rebates.

How much can I earn through forex trading rebates with Pepperstone?

You can earn between $1 – $3 per lot on Forex and between 10% – 30% spread reduction on Index and Commodities.

However, the amount you may earn via Pepperstone forex trading rebates is determined by your trading volume and tier in the Active Trader program. The more you trade, the greater your commission rebate, resulting in larger potential rebates.

How are forex trading rebates credited to my account with Pepperstone?

Forex trading rebates are credited to your account the day after a position is closed. You do not need to claim your rebates; they will be deposited into your account immediately.

Can I lose my eligibility for rebates with Pepperstone?

Yes, you must achieve the volume criteria for three months to remain a part of the Active Trader program and continue getting rebates.

How can I track and monitor my forex trading rebates with Pepperstone?

You can track and monitor rebates through your Pepperstone trading account. In addition, if you have any concerns or want help, contact Pepperstone’s customer service.