Overall, BDSwiss offers Forex cashback to Introducing Brokers of up to $4.20 per lot on Forex regardless of whether their clients register a Cent, Classic, VIP, RAW, or Premium Account. Furthermore, IBs could earn higher rebates on client trades, depending on their trading volume, according to BDSwiss.

| 🔎 BDSwiss Account | 🥇 VIP | 🥈 RAW | 🥉 Cent | 🏅 Classic | 🥇 Premium |

| 📉 Forex | $2.94 per lot | $0.75 per lot | $4.20 per lot | $4.20 per lot | $2.94 per lot |

| 📈 Indices | $0.42 per lot | $0.108 per lot | $0.6 per lot | $0.6 per lot | $0.42 per lot |

| 🪙 Cryptocurrency | $0.00294 - $2.94 per lot | $0.0075 - $0.75 per lot | $0.042 - $4.20 per lot | $0.042 - $4.20 per lot | $0.00294 - $2.94 per lot |

| 💎 Precious Metals | XAU, XPT - $2.94 per lot XAG - $0.84 per lot | XAU, XPT - $0.75 per lot XAG - $0.216 per lot | XAU - $4.20 per lot | XAU, XPT - $4.20 per lot XAG - $1.20 per lot | XAU, XPT - $4.20 per lot XAG - $0.84 per lot |

| 💡 Energies | $0.42 per lot | $0.108 per lot | $0.6 per lot | $0.60 per lot | $0.42 per lot |

| 📊 Shares | $0.0042 per lot | $0.0012 per lot | $0.006 per lot | $0.006 per lot | $0.0042 per lot |

| 💵 Payment Frequency | Monthly | Monthly | Monthly | Monthly | Monthly |

BDSwiss Cashback Rebates – 28 Key Point Quick Overview

- ✅ BDSwiss Rebates Summary

- ✅ How to Open a Forex Cashback Account with BDSwiss (via SAShares)

- ✅ Number of Traders participating in BDSwiss Cashback Rebates

- ✅ Detailed Summary of BDSwiss

- ✅ Geolocation of Traders

- ✅ BDSwiss – Advantages Over Competitors

- ✅ Who will Benefit from Trading with BDSwiss?

- ✅ BDSwiss Regulation and Safety of Funds

- ✅ BDSwiss Awards and Recognition

- ✅ BDSwiss Account Types and Features

- ✅ How to open an Account with BDSwiss

- ✅ BDSwiss Trading Platforms

- ✅ Which Markets Can You Trade with BDSwiss?

- ✅ BDSwiss Trading and Non-Trading Fees

- ✅ BDSwiss Deposits and Withdrawals

- ✅ BDSwiss Education and Research

- ✅ How to open an Affiliate Account with BDSwiss

- ✅ BDSwiss Customer Support

- ✅ BDSwiss Corporate Social Responsibility

- ✅ BDSwiss Alternatives

- ✅ BDSwiss VPS Review

- ✅ BDSwiss Web Traffic Report

- ✅ BDSwiss vs. Other Notable Brokers

- ✅ BDSwiss Pros and Cons

- ✅ BDSwiss – Customer Reviews

- ✅ Recommendation for Improving BDSwiss Cashback Rebates

- ✅ Our Verdict on BDSwiss

- ✅ BDSwiss Frequently Asked Questions

BDSwiss Rebates Summary

- ✅ BDSwiss has an overall rating of 4.5 / 5

- ✅ BDSwiss has a Real Customer Rating of 4.7 / 5

BDSwiss Cashback Forex Conditions

- ✅ Traders cannot receive rebates on positions that are hedged.

BDSwiss Additional notes on Cashback Rebates

- ✅ BDSwiss discounts Energies, Metals, Stocks, Indices, and Cryptocurrencies.

- ✅ Traders can anticipate rebates based on their account type, account level, and financial item traded.

How to Open a Forex Cashback Account with BDSwiss (via SAShares)

You can follow these steps to register for a Forex Cashback Account with BDSwiss via SAShares.

For New Accounts

If you do not have an existing account with BDSwiss, you can easily obtain a cashback rebate in three simple steps.

✅ Step 1: Visit the BDSwiss webpage

Visit the BDSwiss website and click “Open New Account.”

✅ Step 2: Submit a Trading ID

Submit your Trading ID to us: [SAShares]

For Example:

To: [SAShares]

Subject: New BDSwiss Rebate Application

“Dear SAShares Team,

Please view my BDSwiss Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

✅ Step 3: Wait for Approval

Wait for approval, which will be sent within [number of hours]. Once approval is given, you will automatically receive your cashback rebates from the BDSwiss system.

For Existing Accounts

If you have an existing BDSwiss account, you can get a cashback rebate by following these simple steps.

Step 1: Contact BDSwiss via Email

Send an email to BDSwiss: [email protected]. Request that the broker transfer the trading account under the following SAShares Affiliate ID: [SAShares]

For Example:

To: [SAShares]

Subject: Account Transfer Request

“Dear BDSwiss Partner/Affiliate Team,

I would hereby like to request that my account be transferred to IB/Partner/Affiliate code [SAShares Code]. Furthermore, I would hereby like to request to be assigned under the mentioned IB regardless of whether my account falls under an umbrella or parent IB.”

Step 2: Open an Additional Trading Account

Once you receive confirmation of the transfer from BDSwiss, you can create an additional trading account.

Step 3: Contact SAShares

Lastly, you can send your Trading or Client ID to [SAShares].

For Example:

To: [SAShares]

Subject: New BDSwiss Rebate Application

“Dear SAShares Team,

Please view my BDSwiss Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

Understanding Forex Trading Rebates: How They Work with BDSwiss

Forex trading rebates, often known as cashback, are a sort of promotion that many forex brokers, including BDSwiss, provide.

The primary goal of rebates is to give traders a way to save money on their trades. Rebates are normally computed based on trading volume, meaning the more transactions you execute, the more money you can receive.

BDSwiss is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). BDSwiss offers five retail trading accounts: Cent, Classic, Premium, VIP, and RAW.

Below are some details on how the BDSwiss trading rebates work:

- ✅ Broker Collaboration: Rebate providers like to work with various brokers. These rebate providers send clients to brokers in exchange for a percentage of the spread or commission.

- ✅ Client Registration: When a trader signs up with a broker using a referral link provided by a rebate provider, the broker is aware that that rebate source suggested this client.

- ✅ Trading & Compensation: The trader then resumes normal trading. The broker gets money on each trade through spreads or commissions. The rebate provider receives a percentage of this money.

The rebate provider then returns a portion of their revenues to the trader, which is the rebate. This can be a set sum per lot traded, a percentage of the spread or commission, or some other formula. Rebates might be paid out daily, weekly, monthly, or on any other schedule agreed upon by the broker, rebate supplier, and trader.

Does BDSwiss offer a Loyalty Program?

Yes, BDSwiss has a loyalty program via which traders can receive trading rebates based on their account type and trading volume. They provide various rebate percentages for various trading assets (such as Forex, Indices, Commodities, and so on).

What are the minimum rebates I can earn from BDSwiss?

BDSwiss offers rebates from $0.006 per lot on shares.

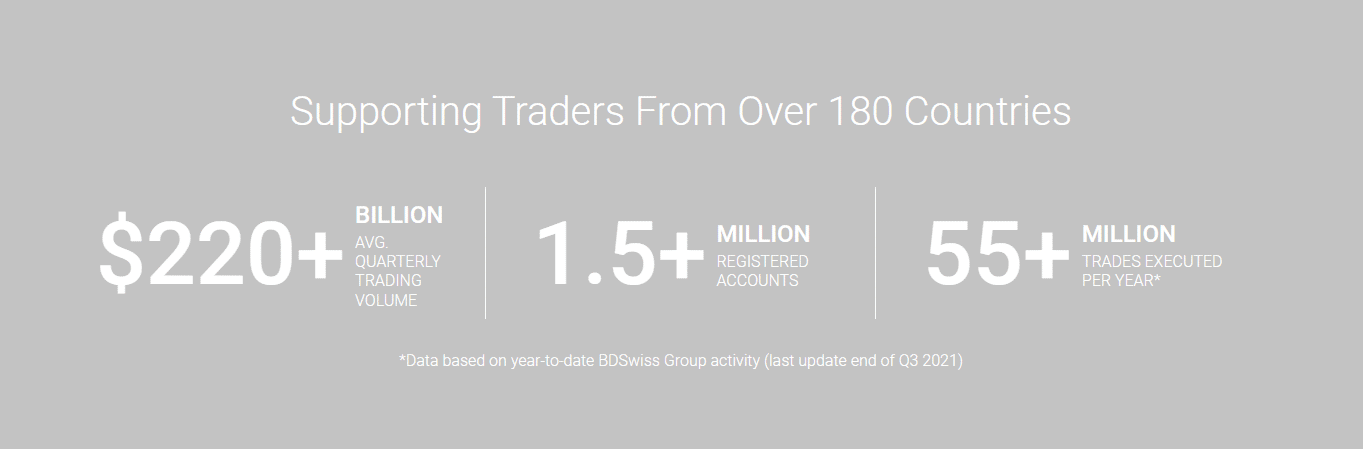

Number of Traders participating in BDSwiss Cashback Rebates

BDSwiss has more than 1.5 million registered traders, and there is no way of knowing how many of these participate in BDSwiss forex rebates.

Detailed Summary of BDSwiss

| 🔎 Headquartered | Seychelles |

| 🌎 Global Offices | Cyprus, Mauritius |

| 📌 Year Founded | 2012 |

| 📍 Regulation | CySEC, FSC, BaFIN, FSA |

| ⛔ Regional Restrictions | The United States, Belgium, and other OFAC-sanctioned regions |

| ☪️ Islamic Account | ☑️Yes |

| 🆓 Demo Account | ☑️Yes |

| ➡️ Non-expiring Demo | ❎No |

| ⏰ Demo Duration | 30 days |

| 5️⃣ Retail Investor Accounts | 5 |

| ↘️ PAMM Accounts | ☑️Yes |

| 💧 Liquidity Providers | Unknown |

| 💖 Affiliate Program | ☑️Yes |

| 📊 Order Execution | Instant, Market |

| ↪️ OCO Orders | ❎No |

| 🫰🏻 One-Click Trading | ☑️Yes |

| ▶️ Scalping Allowed | ☑️Yes |

| ⏩ Hedging Allowed | ☑️Yes |

| 📰 News Trading Allowed | ☑️Yes |

| 🖋️ Expert Advisors (EAs) Allowed | ☑️Yes |

| ℹ️ Trading API | ☑️Yes |

| 📌 Is cashback Forex Calculator offered | ❎No |

| 📍 Cashback Forex Lot Size Calculator | ❎No |

| 🚩 Cashback Forex Compounding Calculator | ❎No |

| 📉 Starting spread | From 0.3 pips |

| 📈 Minimum Commission per Trade | From 0.15% |

| 💱 Decimal Pricing | 5th decimal pricing after the comma |

| 🔎 Margin Call | 50% |

| 🛑 Stop-Out | 20% |

| 🅰️ Minimum Trade Size | 0.01 lots |

| 🅱️ Maximum Trade Size | 50 lots |

| 🪙 Crypto trading offered | ☑️Yes |

| 🔁 Maximum Leverage | 1:1000 |

| ➡️ Leverage Restrictions | ❎No |

| 💴 Minimum Deposit (USD) | $10 |

| 💵 Deposit Currencies | USD, GBP, EUR |

| 💶 Account Base Currencies (All) | USD, GBP, EUR |

| 🥰 Active BDSwiss customers | 1.5 million+ |

| 🕰️ Minimum Withdrawal Time | 10 minutes |

| ⏰ Maximum Estimated Withdrawal Time | 7 to 10 working days |

| ➡️ Instant Deposits and Instant Withdrawals | ❎No |

| ↘️ Segregated Accounts | ☑️Yes |

| ↪️ Trading Platform Time | UTC +1 |

| 📌 DST Change Time zone | Coordinated Universal Time (UTC) |

| 📍 Customer Support Languages | Multilingual |

| 💻 Copy Trading Support | Yes, only for Partners |

| 💚 Customer Service Hours | 24/5 |

| 🎁 Bonuses and Promotions | ❎No |

| 🖍️ Education for beginners | ☑️Yes |

| ✴️ Proprietary trading software | ☑️Yes |

| ▶️ Is BDSwiss a safe broker for traders | ☑️Yes |

| 🔟 Rating for BDSwiss | 9/10 |

| *️⃣ Trust score for BDSwiss | 83% |

Geolocation of Traders

Most of BDSwiss’ market share is concentrated in these areas:

- Germany – 16.9%

- Italy – 10.3%

- Mexico – 7.2%

- Malaysia – 5.8%

- Brazil – 5.1%

BDSwiss Current Expansion Focus

- ✅ BDSwiss is currently expanding across Europe and the Mascarene Islands.

Countries not accepted by BDSwiss

BDSwiss does not provide its services to the following:

- ✅ The United States

- ✅ Belgium

- ✅ Other OFAC-sanctioned regions

Popularity among traders who choose BDSwiss

BDSwiss is a well-regulated broker that falls within the Top 150 forex and CFD brokers and forex rebates providers worldwide.

BDSwiss – Advantages Over Competitors

BDSwiss has the following advantages over its competitors:

- ✅ BDSwiss offers over 250 financial instruments to its traders.

- ✅ There are over 1.5 million traders registered with BDSwiss, proving that it is a good forex, CFD broker, and rebates provider.

- ✅ BDSwiss has a low deposit requirement of $10 on the Cent Account.

- ✅ There is a massive amount of analytical data provided to traders.

- ✅ BDSwiss offers leverage up to 1:1000.

- ✅ BDSwiss offers instant withdrawals.

There are powerful trading platforms offered, and BDSwiss ensures client safety.

Who will Benefit from Trading with BDSwiss?

BDSwiss offers a comprehensive platform that prioritizes excellent execution and competitive pricing, making it a valuable resource for investors of all levels. Both experienced traders and those just starting will find the platform useful, with access to popular tools such as MetaTrader 4 and MetaTrader 5, as well as straight-through processing execution and up-to-date market news.

In addition, BDSwiss provides demo accounts, low initial deposit requirements, a Trading Academy with extensive educational courses, and daily webinars to keep traders informed about changing market conditions.

Is BDSwiss ideal for beginners?

Yes, BDSwiss is suitable for beginners. Furthermore, BDSwiss offers educational videos, seminars, live sessions, and more.

Which trading platform can I use with BDSwiss?

You can use MetaTrader 4, MetaTrader 5, and the BDSwiss proprietary trading platform.

Tips for Choosing BDSwiss for Forex Trading Rebates / Key Factors to Consider When Evaluating BDSwiss’ Forex Trading Rebate Program

- ✅ When choosing BDSwiss for Forex Trading Rebates, here are some key factors to consider:

- ✅ Customer Reviews: Review verified customer reviews to understand their experiences with the platform. This can provide insights into the reliability and effectiveness of the rebate program.

- ✅ Expert Ratings: Check expert ratings on various aspects of BDSwiss, including its rebate program. These ratings can provide a more objective evaluation of the platform.

- ✅ Spreads & Fees: Consider the spreads and fees associated with trading on BDSwiss. Lower spreads and fees can increase the effectiveness of the rebates.

- ✅ Leverage: Evaluate the leverage offered by BDSwiss. Higher leverage can increase your potential profits but also comes with higher risk.

Assess the trading platforms offered by BDSwiss. A user-friendly and robust trading platform can enhance your trading experience. Look at the research tools and resources provided by BDSwiss. These can help you make informed trading decisions. Understand the risks associated with trading CFDs and ensure you can afford to risk losing your money.

Is BDSwiss a trusted broker for rebates?

Yes, BDSwiss is a legitimate and trusted broker regulated worldwide.

Can I open a demo account with BDSwiss to view its rebate offer?

You can open a free demo account with BDSwiss. However, you cannot earn rebates on this account.

Number of Traders participating in BDSwiss Cashback Rebates / Real-Life Examples:

BDSwiss has more than 1.5 million registered traders, and there is no way of knowing how many of these participate in BDSwiss forex rebates.

Baxter Juniper

A professional day trader, Baxter Juniper has been using the BDSwiss platform for several years. John primarily trades Forex, specifically the EUR/USD pair. Knowing the advantage of BDSwiss’ rebate program, he opts into the program to reduce his trading costs.

Baxter trades 50 lots on the EUR/USD pair in the first month on a VIP Account. BDSwiss’ rebate rate for this pair is $2.94 per lot for his account type.

At the end of the month, he receives a rebate of $147 ($2.94 x 50 lots) directly to his BDSwiss account. This rebate helps offset his trading costs and effectively reduces the spreads he has paid.

Anika Harrell

Anika Harrell is a newcomer to the forex market and has decided to use BDSwiss due to their educational resources and rebate program. Anika is still learning, so she trades small volumes. She traded 10 lots on the GBP/USD pair in her first month using the BDSwiss Cent Account.

The BDSwiss’ rebate rate for GBP/USD for Anika’s account type is $4.20 per lot. At the end of the month, Anika gets a rebate of $42 ($4.20 x 10 lots) credited to her BDSwiss account.

This rebate acts as a small but valuable boost, helping her to manage her initial trading costs and learn more about the market with reduced risk.

Derek Weeks

Derek is a swing trader who focuses on long-term trends. He trades various assets but focuses on Indices. When he learned about BDSwiss’ rebate program, he signed up immediately to save some trade costs.

In a particular month, Derek traded 20 lots on the DAX index using the BDSwiss Premium Account. BDSwiss’ rebate rate for Indices for Paul’s account type is $0.42 per lot. At the end of the month, he receives a rebate of $8.4 ($0.42 x 20 lots) added to his BDSwiss account.

While not massive, this rebate helps Derek reduce his trading costs over time, improving his overall profitability.

Successful Traders Benefiting from BDSwiss’ Rebates – BDSwiss’ Forex Trading Rebates Empowering Retail Traders for Success

- ✅ Lower Transaction Costs: Forex trading rebates provide a portion of the transaction cost back to the trader on each trade. This effectively reduces the spread or transaction cost paid by the trader, allowing them to retain more of their profits. By lowering transaction costs, BDSwiss enables retail traders to optimize their trading strategies and improve their profitability.

- ✅ Increased Profitability: The cashback received through forex trading rebates directly contributes to the trader’s profitability. Retail traders can enhance their trading performance by earning rebates on every trade. The additional funds can be reinvested or used to expand their trading activities, potentially leading to higher returns.

- ✅ Risk Management: Forex trading rebates can be a risk management tool for retail traders. By reducing transaction costs, rebates help to improve the trader’s risk-to-reward ratio. This means that even if a trade results in a loss, the rebate received can partially offset the loss and reduce the overall impact on the trader’s account balance.

- ✅ Motivation and Discipline: The prospect of earning forex trading rebates can motivate retail traders to stay disciplined and focused on their trading activities. Knowing that they can receive a portion of their trading costs back encourages traders to adhere to their strategies, follow risk management principles, and maintain consistency in their trading approach.

By offering forex trading rebates, BDSwiss provides retail traders with a competitive edge in the market. Reducing transaction costs and increasing profitability sets traders up for success in a highly competitive trading environment. It can attract experienced traders and incentivize them to choose BDSwiss as their preferred trading platform.

BDSwiss Regulation and Safety of Funds

BDSwiss Global Regulations

| 🔎 Registered Entity | 🌎 Country of Registration | ➡️ Regulatory Entity | 📉 Tier | ↪️ License Number/Ref |

| 1️⃣ BDS Markets | Mauritius | FSC | 3 | 199/13 |

| 2️⃣ BDS Ltd | Seychelles | FSA | 3 | C116016172 |

| 3️⃣ BDSwiss GmbH | Germany | BaFin | 1 | 10134687 |

| 4️⃣ BDS Holding PLC | Cyprus | CySEC | 2 | SD047 |

How BDSwiss Protects Traders and Client Funds

| 🔎 Security Measure | ℹ️ Information |

| 🔒 Segregated Accounts | ✅ Yes |

| 🔏 Compensation Fund Member | None |

| 🔐 Compensation Amount | None |

| 🔓 SSL Certificate | ✅ Yes |

| 🔒 2FA (Where Applicable) | ✅ Yes |

| 🔏 Privacy Policy in Place | ✅ Yes |

| 🔐 Risk Warning Provided | ✅ Yes |

| 🔓 Negative Balance Protection | ✅ Yes |

| 🔒 Guaranteed Stop-Loss Orders | ✅ Yes |

When was BDSwiss founded?

BDSwiss was established in 2012.

Where is BDSwiss regulated?

BDSwiss is regulated in Cyprus by CySEC (199/13), Mauritius by the FSC (C116016172), BaFIN in Germany (10134687), and FSA in Seychelles (SD047).

BDSwiss Awards and Recognition

According to BDSwiss’ website, the company has been recognized for the following honors in recent years as a broker:

- ✅ The fifth annual Forex Expo Awards honored the most successful forex firms and brands of 2022. In addition, the “Fastest Deposits & Withdrawals” award was granted to BDSwiss in appreciation of their ability to create a streamlined and seamless customer experience.

- ✅ In 2022, BDSwiss won the Best Broker for Investor Education Award during the Fazzaco Business Awards.

BDSwiss was named as the broker with the Best Spreads and Trading Conditions in 2022 during the International Investor Awards.

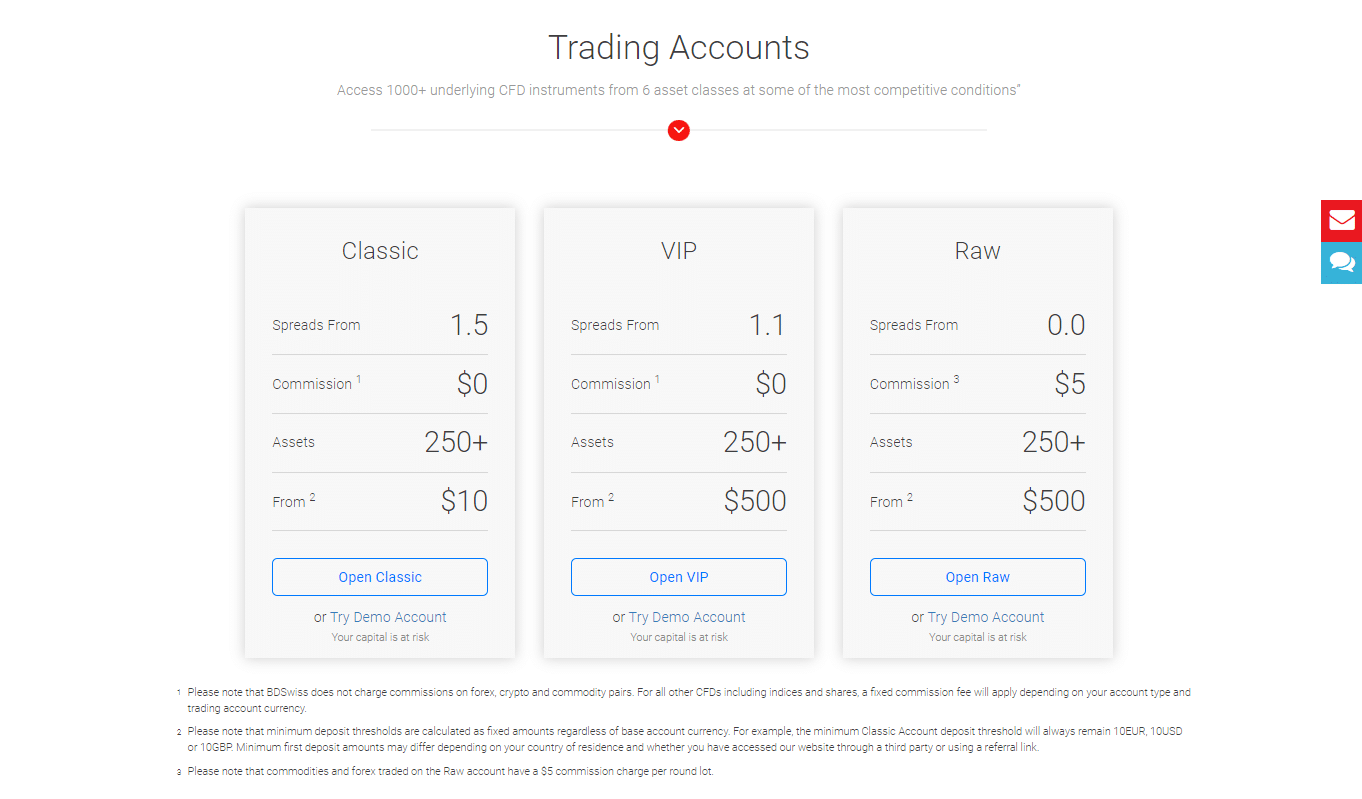

BDSwiss Account Types and Features

BDSwiss’ four retail investor accounts provide over 250 financial products. These user accounts are available:

- ✅ Cent Account

- ✅ Classic Account

- ✅ Premium Account

- ✅ VIP Account

- ✅ RAW Account

| 🔎 Live Account | 💵 Minimum Dep. | 📉 Average Spread | 💷 Commissions | 💴 Average Trading Cost |

| 🥇 Cent | $10 | 1.5 Pips | None | 15 USD |

| 🥈 Classic | $100 | 1.5 pips | 0.15% Indices | 15 USD |

| 🥉 VIP | $3,000 | 1.1 pips | 0.15% Shares | 11 USD |

| 🏅 RAW | $5,000 | 0.3 pips | From 0.15% | 8 USD |

| 🥇 Premium | $100 | 1.1 pips | None | 11 USD |

BDSwiss Cent Account

The BDSwiss Cent account is designed for novice traders, with a modest initial deposit of 10 USD and wider-than-average spreads beginning at 1.5 pips on the EUR/USD.

While the minimum deposit required is fair, most brokers provide entry-level accounts with spreads of 1 pip or less (EUR/USD) on average.

| 🔎 Account Feature | ℹ️ Value |

| 📉 Average Spread on EUR/USD | 1.5 pips |

| 📈 Maximum Leverage | 1:500 |

| 📊 Tradable Instruments | Up to 70 |

| ➡️ Commissions per round lot | None |

| ↘️ Margin Call | 50% |

| ↪️ Stop-out level | 20% |

| 📌 Instant Withdrawals offered | Yes, only on credit cards up to 2,000 €/$/£ |

| 📍 0% fees on Deposits and CC Withdrawals | ✅ Yes |

| 🚩 Platforms available | All |

| ▶️ Are trading alerts offered | Limited Access Granted |

| ⏩ AutoChartist Performance Stats offered | None |

| ✴️ Priority Service | ✅ Yes |

| 📉 AutoChartist Standard Tools | ✅ Yes |

| 📈 Personal Account Manager | ✅ Yes |

| 📊 Access to Trading Central | None |

| ➡️ Trading Academy and Live Webinars | ✅ Yes |

| ↘️ Trade Companion offered | None |

| ☪️ Islamic Account option | ✅ Yes |

| 🟥 VIP Webinars | $10 |

BDSwiss Classic Account

This is an account that is ideal for casual traders who are moving up from a Cent Account. This account requires a larger deposit and provides additional features as traders scale up the account ranks. Furthermore, traders can expect forex rebates of up to $4.20 per lot on forex.

| 🔎 Account Feature | ℹ️ Value |

| 📉 Average Spread on EUR/USD | 1.5 pips |

| 📈 Maximum Leverage | 1:500 |

| 📊 Tradable Instruments | Over 250 |

| ➡️ Margin Call | 50% |

| ↘️ Stop-out level | 20% |

| ↪️ Instant Withdrawals offered | Yes, only on credit cards up to 2,000 €/$/£ |

| 📌 0% fees on Deposits and CC Withdrawals | ✅ Yes |

| 🖥️ Platforms available | All |

| 💻 Are trading alerts offered | Limited Access Granted |

| 📍 AutoChartist Performance Stats offered | None |

| 🔍 Priority Service | ✅ Yes |

| 🅰️ AutoChartist Standard Tools | ✅ Yes |

| 🅱️ Personal Account Manager | ✅ Yes |

| ✴️ Access to Trading Central | None |

| ▶️ Trading Academy and Live Webinars | ✅ Yes |

| ⏩ Trade Companion offered | None |

| ☪️ Islamic Account option | ✅ Yes |

| 📊 VIP Webinars | $100 |

BDSwiss Premium Account

BDSwiss introduced the Premium Account in November 2021. Similar to the Classic Account, this account requires a minimum deposit of 100 USD.

Spreads on the EUR/USD begin at 1.1 pips, which is wider than other comparable brokers, although leverage is as high as 1000:1 on popular Forex pairings. Like the Cent Account, traders are restricted to 70 of the 250 financial products offered by BDSwiss. Furthermore, the Premium Account provides traders forex rebates of up to $2.94 on forex majors.

| 🔎 Account Feature | ℹ️ Value |

| 📉 Average Spread on EUR/USD | 1.1 pips |

| 📈 Maximum Leverage | 1:1000 |

| 📊 Tradable Instruments | Over 70 |

| ➡️ Commissions per round lot | None |

| ↘️ Margin Call | 50% |

| ↪️ Stop-out level | 20% |

| 📌 Instant Withdrawals offered | Yes, only Credit Cards up to 2,000 €/$/£ |

| 📍 0% fees on Deposits and CC Withdrawals | ✅ Yes |

| 🚩 Platforms available | BDSwiss Web, BDSwiss Mobile, MetaTrader 4 |

| 💹 Are trading alerts offered | Limited Access Granted |

| ▶️ Priority Service | None |

| ⏩ AutoChartist Standard Tools | ✅ Yes |

| ❤️ Personal Account Manager | ✅ Yes |

| ℹ️ Access to Trading Central | ✅ Yes |

| ✴️ Trading Academy and Live Webinars | None |

| 🅰️ Trade Companion offered | ✅ Yes |

| 🅱️ Islamic Account option | None |

| 🖇️ VIP Webinars | ✅ Yes |

| ☎️ 24/5 Customer Service and Support | $100 |

BDSwiss VIP Account

The minimum deposit for a VIP Account is $3,000 and spreads on the EUR/USD start at an average of 1.1 pips. In addition to narrower spreads, the VIP Account provides access to various trading and instructional tools, including AutoChartist, a personal account manager, and VIP trend analysis tools.

Traders participating in BDSwiss’ forex rebate program can expect up to $2.94 on forex, XAU, and Crypto pairs such as BTC/USD, BTC/EUR, and BTC/GBP.

| 🔎 Account Feature | ℹ️ Value |

| 📉 Average Spread on EUR/USD | 1.1 pips |

| 📈 Maximum Leverage | 1:500 |

| 📊 Tradable Instruments | Over 250 |

| ➡️ Commissions per round lot | 0.15% on Shares |

| ↘️ Margin Call | 50% |

| ↪️ Stop-out level | 20% |

| 📌 Instant Withdrawals offered | Yes, only Credit Cards up to 2,000 €/$/£ |

| 📍 0% fees on Deposits and CC Withdrawals | ✅ Yes |

| 🚩 Platforms available | All |

| ▶️ Are trading alerts offered | VIP Access |

| ⏩ AutoChartist Performance Stats offered | ✅ Yes |

| #️⃣ Priority Service | ✅ Yes |

| *️⃣ AutoChartist Standard Tools | ✅ Yes |

| 🅰️ Personal Account Manager | ✅ Yes |

| 🅱️ Access to Trading Central | ✅ Yes |

| 🖍️ Trading Academy and Live Webinars | ✅ Yes |

| 📉 Trade Companion offered | ✅ Yes |

| ☪️ Islamic Account option | ✅ Yes |

| 💻 VIP Webinars | ✅ Yes |

| ☎️ 24/5 Customer Service and Support | ✅ Yes |

| 💴 Minimum deposit requirement | $3,000 |

BDSwiss Raw Account

A greater minimum deposit of $5,000 is required to access the Raw Account, which is aimed at experienced traders and offers raw spreads. As a result, spreads on major currency pairings may drop to zero pips, with the EUR/USD pair seeing a spread of 0.3 on average.

Furthermore, the commission fee on Forex pairings is a fair $5 for each round turn per lot. However, an Islamic (swap-free) option is not currently available for this account type.

Traders on this account can expect Forex rebates of up to $0.75 per lot on Forex, metals, and crypto, $0.1 per lot on Energies, $0.0012 per lot on shares, and up to $0.108 per lot on indices.

| 🔎 Account Feature | ℹ️ Value |

| 📉 Average Spread on EUR/USD | 0.3 pips |

| 📈 Maximum Leverage | 1:500 |

| 📊 Tradable Instruments | Over 250 |

| ➡️ Margin Call | 50% |

| ↘️ Stop-out level | 20% |

| ↪️ Instant Withdrawals offered | ✅ Yes |

| 📌 0% fees on Deposits and CC Withdrawals | ✅ Yes |

| 📍 Platforms available | BDSwiss Mobile, BDSwiss Web, MetaTrader 4 |

| 🚩 Are trading alerts offered | VIP Access |

| ▶️ AutoChartist Performance Stats offered | ✅ Yes |

| ⏩ Priority Service | ✅ Yes |

| #️⃣ AutoChartist Standard Tools | ✅ Yes |

| *️⃣ Personal Account Manager | ✅ Yes |

| 📉 Access to Trading Central | ✅ Yes |

| 📈 Trading Academy and Live Webinars | ✅ Yes |

| 📊 Trade Companion offered | ✅ Yes |

| ☪️ Islamic Account option | None |

| 💻 VIP Webinars | ✅ Yes |

| ☎️ 24/5 Customer Service and Support | ✅ Yes |

| 💶 Minimum deposit requirement | $5,000 |

BDSwiss Demo Account

Beginners can easily get some practice trading Forex or CFDs without taking on any real financial risk by opening a “Demo Account” with BDSwiss and using one of the 100,000€/$/£ virtual funds available there.

BDSwiss Islamic Account

Muslim traders can convert their Classic, Premium, or VIP accounts to Islamic Accounts, which frees them from overnight costs. Furthermore, the features traders can expect from their Islamic Accounts will depend on the live account they convert.

How to open an Account with BDSwiss

To register a live trading account with BDSwiss, you can follow these steps:

- ✅ Traders must visit the official BDSwiss website and register for a trading account from the homepage.

- ✅ Traders must provide their name, country of residence, date of birth, phone number, and email address. Afterward, an SMS message is used to validate the phone number.

Traders must also produce identity, and address verification documents, and pass a short suitability examination.

How do I choose the right BDSwiss account for me?

You must understand your unique needs and objectives and choose an account according to your level of expertise.

How long does the BDSwiss demo account last?

The BDSwiss Demo Account is available for 30 days.

BDSwiss Trading Platforms

BDSwiss offers traders a choice between these trading platforms:

- ✅ MetaTrader 4

- ✅ MetaTrader 5

- ✅ BDSwiss Mobile

- ✅ BDSwiss Web

MetaTrader 4 and 5

MetaTrader 4 and MetaTrader 5 are offered in several versions, including a web-based platform that does not need installation. MT4 is used by millions of traders across the globe because of its superior charting capabilities, tools, and, most significantly, a vast selection of add-ons that make trading more pleasurable.

MT5, a more recent version, has also gained popularity because of its expanded features and thorough analysis options, which both beginners and professionals favor.

In addition, there are a variety of approaches that are advantageous for both novice and seasoned traders, whether manual trading or trading with forex rebates EAs.

BDSwiss Mobile

BDSwiss’ mobile app, which has won several awards, is easier to use than the default MT4 app. It is designed to be compatible with the desktop MT4 program and has a user-friendly trading interface. The app’s mobile interface provides access to certain trading, research, and account administration basics. For example, traders can enter, exit, and modify positions, add, and remove stops on existing trades, and cancel active orders.

Furthermore, live charts allow for in-the-moment analysis, and automatic alerts let traders keep track of market movement and capitalize on favorable possibilities.

BDSwiss Web Trader

The BDSwiss WebTrader is a browser-based platform that provides traders with access to the same extensive market watch and real-time pricing information as the downloaded versions of MT4. In addition, it is compatible with both Macs and PCs and does not need any software downloads. The BDSwiss WebTrader is available in more than 24 languages to meet the requirements of international traders.

The BDSwiss WebTrader is a robust trading platform that provides a wide range of features, such as special indicators and a smart order window that instantly computes position size, leverage, and margin.

However, the platform does not support automated trading or other third-party applications, unlike MT4 and MT5.

Does BDSwiss offer Trading API?

Yes, BDSwiss has Trading API.

Does BDSwiss have a proprietary platform?

Yes, BDSwiss offers its proprietary platform as a web-based terminal and mobile app for iOS and Android.

Which Markets Can You Trade with BDSwiss?

Traders can expect the following range of markets from BDSwiss:

- ✅ Forex

- ✅ Commodities

- ✅ Shares

- ✅ Indices

- ✅ Cryptocurrencies

Financial Instruments and Leverage offered by BDSwiss

| 🔎 Instrument | ➡️ Number of Assets Offered | ↪️ Max Leverage Offered |

| 📈 Forex | 50 | 1:1000 |

| 📉 Commodities | 6 | 1:200 |

| 📊 Indices | 10 | 1:100 |

| 📌 Stocks | 141 | 1:5 |

| 🪙 Cryptocurrency | 27 | 1:5 |

Is it risky to trade using leverage up to 1:1000?

Yes, while it increases the potential for profit, leverage ratios this high could clear your account.

Does BDSwiss offer crypto CFDs or the actual coins?

BDSwiss only offers crypto CFDs.

BDSwiss Trading and Non-Trading Fees

Spreads

Depending on the account type you choose for your BDSwiss account, you will be charged varying spreads and fees. The following are the typical spreads for the BDSwiss account types:

- ☑️ Cent Account – 1.5 pips EUR/USD

- ☑️ Classic Account – 1.5 pips EUR/USD

- ☑️ Premium Account – 1.1 pips EUR/USD

- ☑️ VIP Account – 1.1 pips EUR/USD

- ☑️ RAW Account – 0.3 pips EUR/USD

Commissions

BDSwiss imposes fees for some accounts and financial products, particularly when traders might anticipate tighter and more competitive spreads. This list of fees varies by account type, and traders should consider it.

- ☑️ Classic Account – $2 on indices and 0.15% on shares

- ☑️ VIP Account – 0.15% on shares

- ☑️ RAW Account – $2 on indices, $5 on forex pairs, 0.15% on shares

Overnight Fees, Rollovers, or Swaps

There are overnight costs ranging from -0.5 pips for short swaps to -0.7 pips for long swaps on EUR/USD, independent of the kind of trading account utilized. Other overnight expenses for instruments include:

- ☑️ GBP/USD – a short swap of -0.7 pips and a long swap of -6.7 pips

- ☑️ USOIL – a short swap of -23.0 pips and a long swap of -39.0 pips

- ☑️ XAU/USD – a short swap of -3.5 pips and a long swap of -8.2 pips

- ☑️ XAG/USD – a short swap of -0.05 pips and a long swap of -0.25 pips

- ☑️Stocks – a short swap of -2.0 pips and a long swap of -4.0 pips

- ☑️ NAS100 – a short swap of -4.1706 pips and a long swap of -3.2694 pips

- ☑️ Cryptocurrencies – short swaps of -100% and long swaps of -100%

Deposit and Withdrawal Fees

- ☑️ BDSwiss does not impose any deposit-related fees. However, withdrawals of less than 100 EUR incur a tax of 10 EUR for each withdrawal that falls below the minimum level.

Inactivity Fees

- ☑️ Accounts with no trading activity for three consecutive months incur an inactivity charge of 10%.

Currency Conversion Fees

Currency conversion fees will apply when traders deposit or withdraw in currencies that differ from their account currency.

What are the minimum spreads I can expect with BDSwiss?

The spreads that you can expect from BDSwiss will depend on your trading account and the instrument being traded. However, on EUR/USD using a RAW account, you can expect spreads from 0.3 pips.

Does BDSwiss offer a Swap-Free option for Muslim Traders to eliminate overnight fees?

Yes, BDSwiss offers an Islamic Account that exempts Muslim traders from paying overnight fees.

Calculating Forex Trading Rebates with BDSwiss

To calculate Forex trading rebates with BDSwiss, you will need to consider the rebate rate and your trading volume. Here is a general formula to calculate the rebate amount:

- ✅ Rebate Amount = BDSwiss Rebate Rate x Trading Volume

- ✅ Determine the Rebate Rate: The rebate rate is the percentage of the trading volume that you will receive as a rebate. This rate may vary depending on your account type, trading volume, or promotional offers. Refer to BDSwiss’ official website and account terms or contact their customer support to obtain the specific rebate rate applicable to your account.

- ✅ Calculate the Trading Volume: Calculate your trading volume for a specific period. Trading volume is usually measured in lots or units depending on the broker’s specifications. It represents the total value of your trades during that period. For example, if you traded 10 lots in a month, your trading volume would be 10.

Multiply the rebate rate by the trading volume to calculate the amount. For instance, if the rebate rate is 0.5% and your trading volume is 10 lots, the rebate amount would be Rebate Amount = 0.5% x 10 = 0.05 lots or units. You would receive a rebate of 0.05 lots or units based on your trading volume and the applicable rebate rate.

Does BDSwiss use Instant or Market Execution on trades?

BDSwiss uses both Instant and Market execution according to your account type.

How fast does BDSwiss execute trades?

BDSwiss executes trades in 0.01 seconds and even less.

Claiming and Withdrawing Forex Rebates at BDSwiss

Follow these general steps to claim and withdraw Forex rebates from BDSwiss:

- ✅ Open an Account: If you do not already have a BDSwiss account, you must create one. Make sure you select an account type that is qualified for Forex rebates.

- ✅ Fulfill Rebate conditions: To qualify for Forex rebates, some brokers, like BDSwiss, may have specified conditions. Check if you fulfill any restrictions, such as a minimum trading volume or certain trading circumstances.

- ✅ Start Trading and Earn Rebates: Begin trading with BDSwiss to earn rebates based on your trading volume and the applicable rebate rate. Keep track of your trading activities and the rebates you earn.

- ✅ Check Rebate Balance: BDSwiss usually gives a rebate balance or summary within your trading account. This balance indicates the rebates you have earned during a specified time.

- ✅ Request Withdrawal: Log in to your BDSwiss account and navigate to the withdrawal section once you have accumulated rebates. To initiate the rebate withdrawal request, follow the steps supplied by BDSwiss.

- ✅ Select a Withdrawal Method: Choose your desired withdrawal method from the alternatives offered by BDSwiss. Bank transfers, e-wallets, and other payment methods may be available. Check to see if you have met any withdrawal requirements or verification procedures.

- ✅ Submit a Request for Withdrawal: Enter the amount of the rebate withdrawal and submit the withdrawal request using the BDSwiss portal. Any further information or paperwork needed for the withdrawal procedure should be provided.

BDSwiss will process your rebate withdrawal request within the timeframes mentioned. The processing period may vary based on the withdrawal method and internal BDSwiss procedures. After BDSwiss approves and processes your rebate withdrawal request, you will receive the rebate amount in your preferred withdrawal method. The funds will be credited to the account or payment method you specify.

BDSwiss Deposits and Withdrawals

BDSwiss offers the following deposit and withdrawal methods:

- ✅ Bank wire transfer

- ✅ Debit Card

- ✅ Credit Card

- ✅ Skrill

- ✅ Neteller

How to Deposit Funds with BDSwiss

To deposit funds to an account with BDSwiss, traders can follow these steps:

- ✅ Log into your BDSwiss account and pick the account to be financed by clicking “Payments” and then “Deposits” from the left-hand navigation menu.

- ✅ Specify the amount of the deposit.

- ✅ “Proceed to Payment” will display after a payment method has been chosen.

After confirming the deposit information on the subsequent page, you must complete any further procedures that the payment provider may need.

BDSwiss Fund Withdrawal Process

To withdraw funds from an account with BDSwiss, traders can follow these steps:

- ✅ By logging onto their secure client site, traders can access the appropriate menu and choose the withdrawal option.

- ✅ Before initiating a withdrawal from their trading account, traders must check that their account has been validated.

- ✅ Traders who want to withdraw funds from their accounts must utilize the same deposit method with which they funded their accounts.

- ✅ Traders must then identify the number of funds they want to withdraw and adhere to any further instructions provided.

The trader must make the withdrawal request after the completion of the transaction, at which point the appropriate department handles it.

Are deposits and withdrawals free with BDSwiss?

Yes, BDSwiss does not charge any deposit fees. However, withdrawals of less than 100 EUR incur a tax of 10 EUR for each withdrawal that falls below the minimum level.

How quickly will my funds return to my bank account after submitting a withdrawal request?

Withdrawals can take 10 minutes to 10 working days, depending on when you requested the withdrawal and which payment method you chose.

BDSwiss Education and Research

Education

BDSwiss offers the following Educational Materials:

- ✅ Forex Glossary

- ✅ Educational Videos

- ✅ Seminars

- ✅ Learning centers

- ✅ Live Education

- ✅ Forex Basic Lessons

- ✅ Forex eBooks

Research

BDSwiss offers traders the following Research and Trading Tools:

- ✅ Currency Heatmap

- ✅ Trading Calculators

- ✅ Trade Comparison

- ✅ Trend Analysis

- ✅ Trading Central

- ✅ AutoChartist

- ✅ Real-Time Trading Alerts

- ✅ Special Reports

- ✅ Analyst financial commentary

- ✅ Live Daily Webinars

- ✅ Economic Calendar

- ✅ VPS Service

and much more!

How to open an Affiliate Account with BDSwiss

To register an Affiliate Account with BDSwiss, traders can follow these steps:

- ✅ Navigate to the official BDSwiss website and choose “Partners” from the menu at the top of the webpage.

- ✅ A new page directs prospective affiliates to the Partner Page, where they can click on “Start Now.”

- ✅ Affiliates can register for their favorite program by clicking the “Register” button.

Affiliates can complete the registration form and submit it to the customer service department of BDSwiss for evaluation.

BDSwiss Affiliate Program Features

Anyone with a large web presence could be a BDSwiss network affiliate. Anyone with an active blog, social media account, instructional Forex center, or other digital channel qualifies. One of the affiliate program’s benefits is the potential to make money while promoting BDSwiss’ products and services to the affiliate’s target audience.

Affiliates can use a variety of BDSwiss marketing and tracking tools to help spread the word about the company. To gain from the affiliate’s impact, partners must learn about BDSwiss affiliate commission choices via the affiliate’s program.

BDSwiss provides the following benefits to its affiliates:

- ✅ High conversion rates (37%), quick referral onboarding, specialized contact centers, and diverse local and international payment options contribute to this success.

- ✅ Over 250 CFDs and assets from various asset classes are included in our multi-product solutions. In addition, platforms that have received many prizes are also available on multiple platforms.

- ✅ A 100% response rate with response times of 13 seconds or less. There are affiliate managers as well as personal account managers for VIP referrals.

- ✅ The finest tracking solutions must include ad serving, tracking, and management.

BDSwiss also provides independent mobile traffic monitoring, rapid and thorough reporting performance, and other capabilities.

How to Maximise Your Savings/Profits with Forex Trading Rebates at BDSwiss

- ✅ Select the Correct Account Type: Open a BDSwiss account qualified for forex trading rebates. Different account types may have different rebate structures, so choose the one with the best conditions.

- ✅ Trade Frequently: Forex trading rebates are usually calculated based on the number of deals you make. Aim to trade regularly and keep an active trading presence to optimize rebates. However, always prefer quality over quantity and stick to your trading approach.

- ✅ Consider Rebate Rates and Tiers: Certain brokers, such as BDSwiss, provide tiered rebate rates based on trading volume. The rebate rates may grow as your trading volume increases. Monitor BDSwiss’ rebate rates and tiers and change your trading volume to take advantage of higher rates.

- ✅ Trade in Liquid Markets: Concentrate on trading currency pairings and liquid markets.

- ✅ Use rebate calculators: Use rebate calculators offered by BDSwiss or third-party websites. Based on your trading volume, account type, and rebate rates, you can use these tools to estimate your rebates. Y

- ✅ Combining Forex Trading Rebates with Other Trading Methods: Forex trading rebates can be combined with other trading methods to increase your savings and profits. For example, scalping or day trading tactics can boost trade volume and grab more rebates.

- ✅ Monitor and examine Rebate Payments: Review your rebate payments regularly and examine their impact on your overall trading success. Identify trends, evaluate the success of your trading strategy, and make necessary adjustments to maximize your savings and earnings.

Keep up to date on any changes or additions to the BDSwiss forex trading rebate program. Be on the lookout for promotional deals or limited-time incentives that can provide additional opportunities to enhance your savings and income.

BDSwiss Customer Support

| 🔎 Customer Support | BDSwiss’ Customer Support |

| ⏰ Operating Hours | 24/5 |

| 📌 Support Languages | English, French, Italian, Spanish, German, Portuguese |

| 🥰 Live Chat | ✅ Yes |

| 📬 Email Address | ✅ Yes |

| ☎️ Telephonic Support | ✅ Yes |

| ↪️ Local Support in Botswana | None |

Traders can easily contact BDSwiss by using any of these channels available:

- ✅ Contact form: On the BDSwiss website, you can fill out a contact form and send it to the customer care staff.

- ✅ Email: You can contact BDSwiss via email using the addresses provided on the official website.

- ✅ BDSwiss can be contacted by phone using the phone numbers listed on the official website under the “Contact” option.

- ✅ Live chat: BDSwiss’ website has a live chat function that lets you contact a customer service person in real-time.

Finally, Social media. You can contact BDSwiss through their social media outlets, such as Twitter and Facebook.

Does BDSwiss have a live chat?

Yes, BDSwiss offers live chat on its official website.

Can I contact BDSwiss on social media?

Yes, you can contact BDSwiss on Twitter, Facebook, Instagram, LinkedIn, and several other channels.

BDSwiss Corporate Social Responsibility

BDSwiss is committed to being a socially responsible company. To achieve this, the company encourages its employees to embrace philanthropy and has established a corporate culture that supports global and local efforts to make a positive impact.

One example of BDSwiss’ dedication to social responsibility is their annual donation of €5,000 to the “Elpida” Foundation for Children with Cancer & Leukaemia. This contribution helps children undergoing cancer treatment and their families by providing financial and emotional support.

BDSwiss Alternatives

- Forex.com – FOREX.com is a fantastic trading platform with innovative pricing and a mobile application. For trading various currency pairs, traders may anticipate in-depth market analysis, automated trading systems, and high-tech mobile applications.

- XTB – XTB is renowned for providing the greatest customer service. In addition, XTB allows trading in other asset classes, such as currency pairings and key forex pairs. Furthermore, XTB is regulated in many major financial hubs and offers a more competitive product than competing platforms.

- City Index – City Index is one of the most well-regarded brokers that has built its reputation by providing superior forex trading services. As a result, the customers get helpful trading instruments, financial services, and attractive spreads on numerous underlying asset classes.

BDSwiss VPS Review

The VPS solution provided by BDSwiss utilizes an external server to guarantee that your platform is always operational, enabling your plans to be performed even while you are offline.

Co-located with MT4 servers, BDSwiss’ VPS servers provide even quicker trade execution, ultra-low latency, and continuous trading. Additionally, rebate EAs can be run continuously without requiring a login.

BDSwiss offers the following VPS plans to traders:

- ✅ The Basic plan offers 1 CPU core with 1GB Random Access Memory (RAM) and 40GB HDD storage. Furthermore, the bandwidth is 100GB, and the server is Windows 2012 R2. The basic plan will cost the trader 30 EUR per month.

- ✅ The Advanced plan offers 2 CPU cores with 2GB RAM and 50GB HDD storage. Furthermore, the bandwidth is 100GB, and the server is Windows 2012 R2. The basic plan will cost the trader 50 EUR per month.

The Pro plan offers 4 CPU cores with 4GB RAM and 100GB HDD storage. Furthermore, the bandwidth is 100GB, and the server is Windows 2012 R2. The basic plan will cost the trader 70 EUR per month.

BDSwiss Web Traffic Report

| 📉 Total Visits | 44.9K |

| 📈 Bounce Rate | 25.30% |

| 📊 Pages per Visit | 12.45 |

| ➡️ Average Duration of Visit | 00:09:40 |

| ↪️ Total Visits in the last three months | October – 133.6K November – 113.8K December 44.9K |

BDSwiss vs. Other Notable Brokers

| 🔎 Broker | 🥇 BDSwiss | 🥈 JustMarkets | 🥉 AvaTrade |

| 💴 Withdrawal Fee | Yes, <100 EUR withdrawals | None | None |

| 🆓 Demo Account | ✅ Yes | ✅ Yes | ✅ Yes |

| 💵 Min Deposit | $10 | $1 | $100 |

| 📉 Spread | From 0.3 pips | From 0.0 pips | Fixed, from 0.9 pips |

| 📈 Commissions | $2 to $5 | $3 units per lot/side | None |

| 📊 Order Execution | Instant/Market | Market | Instant |

| ➡️ No-Deposit Bonus | None | ✅ Yes | None |

| ↪️ Cent Accounts | In Progress | ✅ Yes | None |

| ⏰ Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 🔟 Retail Investor Accounts | 5 | 7 | 1 |

| ☪️ Islamic Account | ✅ Yes | ✅ Yes | ✅ Yes |

| ⬇️ Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 pips |

| ⬆️ Maximum Trade Size | 50 lots | 100 lots | Unlimited |

| 🕰️ Min. Withdrawal Time | 10 Minutes | Instant | 24 to 48 Hours |

| 📌 Max. Withdrawal Time | Between 7 to 10 days | 10 bank days | Up to 10 days |

| 📍 Instant Withdrawals | None | ✅ Yes | None |

BDSwiss Pros and Cons

| ✅ Pros | ❎ Cons |

| BDSwiss charges tight commissions and competitive commissions | Withdrawals can be expensive |

| The broker offers the best educational materials to beginners | BDSwiss does not offer a cashback forex lot size calculator |

| BDSwiss is one of the best forex rebate brokers with lucrative returns | Currency conversion fees apply |

| Customer support is useful and prompt in their responses | There are limited deposit and account base currency options |

Legal and Tax Implications: Understanding Forex Trading Rebates with BDSwiss

Legal Consequences

- ✅ Regulatory Compliance: Ensure that BDSwiss and the rebate program are per the laws of the jurisdiction in which you operate. Different nations and areas may have different rules and regulations for Forex trading, refunds, and financial services.

- ✅ Terms and Conditions: Read the terms and conditions of BDSwiss’ rebate program. Understand each party’s rights and obligations, including qualifying requirements, rebate computation procedures, and limitations or restrictions.

- ✅ Contractual Agreements: You may engage in a contractual agreement with BDSwiss while participating in a Forex trading rebate program. Before accepting the terms, read and comprehend the agreement.

Forex trading entails hazards that must be understood. Make certain that BDSwiss publishes clear risk disclosure statements to notify you of the potential dangers involved with Forex trading and rebates.

Implications for Taxation

- ✅ Tax Jurisdiction: Tax legislation governing Forex trading and rebates differ depending on the country and jurisdiction. Consult a tax specialist to learn how Forex trading refunds are handled in your jurisdiction.

- ✅ Income Classification: The tax status of Forex trading refunds might vary depending on how they are categorized. It could be classified as extra income, trading gains, or another suitable tax category. Seek the advice of a tax specialist to ascertain the proper categorization.

- ✅ Tax Reporting and Compliance: Ensure you follow your jurisdiction’s tax reporting laws. Keep careful records of your trading activities and rebate earnings for correct tax reporting.

In some situations, you may be eligible to deduct some expenses related to your Forex trading operations, such as transaction costs or trading fees. Consult a tax professional to determine any potential deductions that may apply to you. In some jurisdictions, foreign exchange transactions are governed by special legislation and controls. Understand any limits or reporting requirements in your jurisdiction regarding Forex trading refunds.

Risks and Limitations of Forex Trading Rebates at BDSwiss

While Forex trading rebates can potentially deliver benefits, it is critical to be aware of their dangers and limits. Here are some things to consider regarding the risks and restrictions of Forex trading rebates at BDSwiss.

Market Risk

Forex trading has inherent market risks, such as price volatility, economic events, and geopolitical issues. Rebates cannot eliminate or lessen these risks on their own. Understanding the hazards of trading and developing a sound trading strategy is critical.

Trading Costs

While rebates can help minimize transaction costs, traders should consider spreads, commissions, and swap fees. Rebates may not entirely cover these costs, particularly if trade volume or rebate rates are low.

Trading Volume Requirements

Certain minimum trading volumes may be necessary to qualify for refunds. Meeting these criteria may necessitate increased trading activity and exposure to potential market hazards.

Before aiming for increased trading volumes, traders should thoroughly examine their trading capabilities and financial resources.

Eligibility limitations

Forex trading rebates at BDSwiss may be subject to eligibility limitations, such as account types, trading instruments, or minimum deposit requirements. Reviewing and comprehending these terms to be eligible for rebates is critical.

Rebate Rates and Tiers

Rebate rates can differ depending on trading volume and account type. Higher rebate rates may necessitate significant trading volumes, making it difficult for small-scale traders to reach the greatest rates.

Based on their trading preferences and capabilities, traders should examine the viability of obtaining higher rebate categories.

Program Changes and Exclusions

Rebate programs are subject to change or exclusion at BDSwiss’ discretion. To avoid unexpected changes in rebate eligibility or rates, staying up to speed on any changes or exclusions to the rebate program terms and conditions is critical.

Tax ramifications

Forex trading rebates may have tax ramifications. The tax laws and regulations governing rebate profits differ from jurisdiction to jurisdiction.

To understand the tax treatment of rebates in their region and ensure compliance with tax requirements, traders should consult a tax specialist.

Potential Conflicts of Interest

Financial arrangements between brokers and rebate suppliers may be involved in rebate schemes. Traders should be aware of any potential conflicts of interest that may exist because of these arrangements, and they should assess the independence and integrity of rebate providers.

Strategies to Maximise Rebates with BDSwiss

Consider the following techniques to optimize your refunds with BDSwiss.

Select the Appropriate Account Type

BDSwiss may provide many account types with distinct rebate systems. Compare the rebate rates and terms of each account type and select the one that provides the best terms for maximizing your rebates.

Trade Frequently and in Larger Volumes

Rebates are frequently calculated based on trading volume. Aim to trade frequently and in bigger volumes to optimize your rebates while keeping your risk tolerance and trading capabilities in mind. However, you should always prioritize quality transactions and follow your trading plan.

Monitor Promotions and Special Offers

Stay up to date on any BDSwiss promotions or special offers. They may, from time to time, offer higher refund rates or bonuses for specific trading actions or periods. Utilize these opportunities to maximize your rebates.

Use Rebate Calculators

Make use of rebate calculators offered by BDSwiss or third-party websites. Based on your trading volume, account type, and applicable rebate rates, you can use these tools to determine your rebates. Using rebate calculators, you may plan and adjust your trading strategy to maximize your refunds.

Recognize and Use Rebate Tiers

Some rebate programs may have tiered structures in which bigger trading volumes result in higher refund rates. Be mindful of these levels and strive to exceed greater volume thresholds to access higher refund rates. Keep track of your progress and change your trading activity as needed.

Stay Active and Engaged

Maintain an active status and regularly engage in trading activities to maximize rebates. Inactive periods may decrease refund rates or exclude certain rebate schemes. Keep up to date on any requirements or conditions for maintaining active status.

Manage Costs and Spreads

While rebates can help lower transaction costs, it is critical to manage other trading expenses successfully. Optimize your trading technique to reduce spreads, commissions, and transaction costs. This can assist in maximizing the impact of rebates on overall profitability.

Monitor and Review Rebate Payments

Review your rebate payments regularly and analyze the influence on your trading performance.

Maintain accurate records of your trading volume, rebate rates, and actual rebate payments received. This study might assist you in identifying areas for improvement and adjusting your trading strategy as needed.

BDSwiss – Customer Reviews

Excellent Broker.

Since 2018, I have been a long-term client of BDSwiss, and all I can say is that it is an excellent broker for all trading and investment requirements. Using the platform has been a delight, as all requests and questions are addressed proficiently. A simple thank you from a satisfied client. – Kaitlin Lester

Great Support.

The outcomes of my trading and interactions with customer service have been favorable. Therefore, I would suggest BDSwiss for trading purposes. – Cordelia Day

Excellent Customer Service.

I experienced some account concerns during the last several days, so I called an agent, who rectified the issues within the allotted period and allowed me to trade without any problems. I appreciate his excellent customer service and look forward to working with him. Excellent client service BDSwiss. – Roy Morrow

Recommendation for Improving BDSwiss Cashback Rebates

BDSwiss offers rebates on all five retail account types, ensuring that all traders qualify for the cashback program. In addition, traders will benefit from certain tools such as a cashback forex calendar, cashback forex contest, and other tools.

Our Verdict on BDSwiss

BDSwiss was much more successful than its competitors. As a result, it was able to extend its customer base to over one million. BDSwiss’ extensive client base stems from a user-friendly trading interface and brilliant customer service with minimal fees. As a result, BDSwiss is destined to increase in popularity with time within the trading industry. Furthermore, BDSwiss will undoubtedly see good development as a result.

The BDSwiss trading platform, which has won several awards, lives up to its reputation as a feature-rich online environment that provides good trading conditions for traders of all experience levels.

From its unique WebTrader and mobile application to the daily seminars provided by the firm’s analysts, BDSwiss provides customers with various value-added products and services geared to enhance their trading experience.

Four of BDSwiss’ five accounts have higher-than-average trading expenses, while the Raw Account’s costs are much lower in return for a hefty minimum deposit. In addition, BDSwiss offers transparent rebate schedules and guarantees prompt payments to traders.

BDSwiss Frequently Asked Questions

What are Forex Cashback Rebates?

BDSwiss offers rebates as an incentive. The rebate is a percentage of the trading volume across five trading accounts and markets, paid to the trader monthly. With BDSwiss, traders receive cash that can be withdrawn, or they can offset their trading costs.

Is BDSwiss a Forex Rebate provider?

Yes, BDSwiss offers rebates to traders on all five trading accounts.

Does BDSwiss provide a Cashback Forex Contest?

No, BDSwiss does not currently offer any contests, let alone a cashback contest.

How does the Forex Cashback Rebate process work?

Traders can register any of the five retail accounts offered by BDSwiss (Cent, Classic, Premium, RAW, or VIP) and start trading to qualify for forex rebates.

Where can I find BDSwiss’ Cashback Forex Calendar?

BDSwiss does not offer a forex cashback calendar but an economic calendar and several other tools.

I’m an existing trader, how can I transfer my account to earn rebates via BDSwiss?

You can register with BDSwiss to become eligible and notify your current broker that you would like to transfer your trading account. Your broker will then transfer your account, funds, and open positions to BDSwiss, allowing you to start trading.

Can I use a Forex Rebate EA with BDSwiss?

You can use any Expert Advisors with BDSwiss as the broker supports MetaTrader, including rebate EAs.

How many traders with BDSwiss use the Cashback Rebate feature?

It is unclear how many of BDSwiss’ over 1.5 million traders use the cashback program.

What are the maximum rebates I could earn with BDSwiss?

You can earn up to $4.20 on the Cent and Classic Accounts when you trade Forex or Precious Metals.

Will my BDSwiss fees and spreads increase when I use the Cashback Rebate feature?

BDSwiss does not increase your fees or spreads when you participate in BDSwiss’ cashback rebates.

Why should I work through the SA Shares Cashback?

You can expect some of the highest commissions if you work through SA Shares to earn Cashback Rebates from BDSwiss.

This is because SA Shares aims to negotiate the most competitive commission rates with brokers such as BDSwiss to ensure you get the most back from your trading activities.

How quickly will I receive my sign-up bonus?

“Please note that in the meantime, we have no bonus offers. However, please note that our team is working on new offers to present to our clients by the beginning of next year.”

How can I manage my trading risk when I sign up?

“Stop Loss, Take Profit, and Trailing Stop orders are limits that can be added to a trade and mitigate your Risk.”

Do you recommend leverage?

“Please note that Leverage means controlling a large amount of money using little of your own money and borrowing the rest. Forex traders use leverage to profit from small price changes in currency pairs with a higher investment amount (higher buying power) beyond what would be available from their cash balance alone.

However, leverage is considered a “double-edged sword” as it can amplify profits and losses. Therefore, this all depends on your risk appetite.”

Which Forex Rebate Trading Strategy should I try as a beginner?

“Please note that we do not provide trading advice. Therefore, it is totally up to you to choose the strategy. On the other hand, upon signing up with BDSwiss, you will be allocated an Account Manager to guide you through and assist you when needed.”

Do you provide compensation to eligible clients?

“Please note that we have Negative Balance protection. If a negative balance occurs in the Client’s Trading Account, the Company will make a relevant adjustment of the full negative amount, so the Client does not suffer the loss as per our Negative Balance Policy, meaning that the client can never owe money or be in debt with the company

You can also check our Terms and Conditions.”

What is your requote policy?

“We do not have a requotes policy – meaning, the order is opened at a price available when you open it. So, if it changes the next second, it doesn´t affect your opening price.”

How do you protect client data and information?

“I do not know the specifics; however, I do know that as a regulated company, we are required by our regulators to keep records of our client’s data and documentation for five years once the business relationship finishes.

However, please note that the company will handle all clients’ data according to the relevant laws and regulations for protecting personal data.”

What execution speeds can I expect, and what is your execution policy?

“We cannot recommend that.”

How do you handle customer complaints?

“We have a specific complaint department, and once again, in this case, I do not know the specifics. The complaint is resolved within 5 days. If you have a complaint you want to file, we will escalate it to that department, and the team will handle it with their procedures.”

What is the recommended initial deposit?

“We cannot recommend that the minimum deposit would be 10 USD/EUR/GBP, yet it is up to you completely!”

What are forex trading rebates?

BDSwiss offers rebates as an incentive. The rebate is a percentage of the trading volume across five trading accounts and markets, paid to the trader monthly. With BDSwiss, traders receive cash that can be withdrawn, or they can offset their trading costs.

How do forex trading rebates work with BDSwiss?

Traders can register any of the five retail accounts offered by BDSwiss (Cent, Classic, Premium, RAW, or VIP) and start trading to qualify for forex rebates.

Are BDSwiss rebates paid in cash or as a credit in my trading account?

BDSwiss rebates are typically credited directly to your trading account as a cash bonus or rebate credit that can be used for trading or withdrawn.

How are BDSwiss rebates calculated?

BDSwiss rebates are often calculated based on your trading volume, with a specified rebate rate per lot traded or a percentage of the spread or commission paid.

Are forex trading rebates taxable?

The tax treatment of forex trading rebates depends on your jurisdiction’s tax laws and regulations. In some countries, rebates may be considered taxable income, while in others, they may be treated as a reduction of trading costs.

Are there any limitations or restrictions on using forex trading rebates?

Forex trading rebates may have certain limitations or restrictions imposed by brokers. These include minimum trading volume requirements, specific account types, and eligibility conditions.

How do I qualify for BDSwiss rebates?

To qualify for BDSwiss rebates, you must sign up for an eligible account type and trade a certain volume specified by the rebate program.

Are there any requirements to be eligible for forex trading rebates with BDSwiss?

Specific requirements may apply to be eligible for forex trading rebates with BDSwiss. These include maintaining an active trading account, reaching minimum trading volume thresholds, or meeting other criteria.

Can I combine forex trading rebates with other promotions or bonuses offered by BDSwiss?

The ability to combine forex trading rebates with other promotions or bonuses offered by BDSwiss may depend on the specific terms and conditions of each promotion.

Some promotions or bonuses may be mutually exclusive with the rebate program, while others may allow for simultaneous participation.

How are forex trading rebates credited to my account with BDSwiss?

The crediting of forex trading rebates to your account with BDSwiss can vary. Rebates may be credited directly to your trading account balance or held in a separate rebate account.

How can I sign up for forex trading rebates with BDSwiss?

To sign up for forex trading rebates with BDSwiss, you typically need to open an account with them and meet any requirements for rebate eligibility.

How can I track and monitor my forex trading rebates with BDSwiss?

BDSwiss usually provides tools or features within its platform to track and monitor your Forex trading rebates. These may include rebate dashboards, account statements, or reports that show your rebate earnings and accumulated amounts.

How much can I earn through forex trading rebates with BDSwiss?

You can earn up to $4.20 on the Cent and Classic Accounts when you trade Forex or Precious Metals.