Overall, XM offers Forex cashback to introducing brokers up to $25 per lot on Forex when their clients register a Micro, Standard, Share, or XM Ultra-Low Account. Furthermore, second-tier referrals can earn a 10% commission, according to XM.

| 🔎 XM Account | 🥇 Micro Account | 🥈 Standard Account | 🥉 Ultra-Low Account |

| 📈 Forex | $5.5 per lot | $5.5 per lot | Up to $7.50 per lot |

| 📉 Indices | Up to $2.65 per lot | Up to $2.65 per lot | Up to $2.65 per lot |

| 🪙 Cryptocurrency | Up to $15 | Up to $15 | Up to $15 per lot |

| 💎 Precious Metals | Gold + Silver $5.50 per lot | Gold + Silver $5.50 per lot | Gold - $3.00 per lot Silver - $7.50 per lot |

| 💡 Energies | Up to $6.50 per lot | Up to $6.50 per lot | Up to $6.50 per lot |

| 📊 Shares | Up to $3.33 per lot | Up to $3.33 per lot | Up to $3.33 per lot |

| 🍎 Soft Commodities | Up to $7.50 per lot | Up to $7.50 per lot | Up to $7.50 per lot |

| 💴 Payment Frequency | Payments are made to the XM MyWallet twice weekly There is monthly cashback available There are real-time reports | Payments are made to the XM MyWallet twice weekly There is monthly cashback available There are real-time reports | Payments are made to the XM MyWallet twice weekly There is monthly cashback available There are real-time reports |

XM Cashback Rebates – 30 Key Point Quick Overview

- ✅ XM Rebates Summary

- ✅ How to Open a Forex Cashback Account with XM (via SAShares)

- ✅ Number of Traders participating in XM Cashback Rebates

- ✅ XM Rebate Comparison vs. Notable Other Brokers

- ✅ Geolocation of Traders

- ✅ Detailed Summary of XM

- ✅ Advantages that XM has over Competitors

- ✅ Who will Benefit from Trading with XM?

- ✅ XM Regulation and Safety of Funds

- ✅ XM Awards and Recognition

- ✅ XM Account Types and Features

- ✅ How to open an Account with XM

- ✅ XM Trading Platforms

- ✅ Which Markets Can You Trade with XM?

- ✅ XM Trading and Non-Trading Fees

- ✅ XM Deposits and Withdrawals

- ✅ XM Education and Research

- ✅ XM Bonuses and Current Promotions

- ✅ How to open an Affiliate Account with XM

- ✅ XM Customer Support

- ✅ XM Corporate Social Responsibility

- ✅ XM Alternatives

- ✅ XM VPS Review

- ✅ XM Web Traffic Report

- ✅ XM vs. Other Notable Brokers

- ✅ XM Pros and Cons

- ✅ XM Customer Reviews

- ✅ Recommendation for Improving XM Cashback Rebates

- ✅ Our Verdict on XM

- ✅ XM Frequently Asked Questions

XM Rebates Summary

- ✅ XM has an Overall Rating of 4.7 / 5

- ✅ XM has a Real Customer Rating of 4.4 / 5

XM Conditions

- ✅ Positions must be held on Micro, Standard, and Ultra-Low Accounts for at least 5 minutes.

- ✅ Swap-Free Accounts on Micro and Standard Accounts are restricted to a minimum position time of 5 minutes.

- ✅ No discounts are granted to European or Australian customers.

XM Additional Notes on Cashback Rebates

- ✅ Payments to affiliates and consumers are made biweekly at no extra cost.

- ✅ XM gives up to a 100 percent reimbursement, equivalent to $58.5 per lot.

- ✅ XM provides several attractive incentive offers to traders.

- ✅ Rebates are instantly sent to the trader’s MyWallet account.

- ✅ There are no hidden costs, terms, or spread mark-ups.

XM’s Islamic Accounts qualify for rebates.

How to Open a Forex Cashback Account with XM (via SAShares)

You can follow these steps to register for a Forex Cashback Account with XM via SAShares.

For New Accounts

If you do not have an existing account with XM, you can easily obtain a cashback rebate in three simple steps.

Step 1: Visit the XM web page

Visit the XM website and click “Open New Account.”

Step 2: Submit a Trading ID.

Submit your Trading ID to us: [SAShares]

For Example:

To: [SAShares]

Subject: New XM Rebate Application

“Dear SAShares Team,

Please view my XM Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

Step 3: Wait for Approval

Wait for approval, which will be sent within [number of hours]. Once approval is given, you will automatically receive your cashback rebates from the XM system.

For Existing Accounts

If you have an existing XM account, you can get a cashback rebate by following these simple steps.

Step 1: Contact XM via Email

Send an email to XM: [email address for broker]. Request that the broker transfer the trading account under the following SAShares Affiliate ID: [SAShares]

For Example:

To: [SAShares]

Subject: Account Transfer Request

“Dear XM Partner/Affiliate Team,

I would hereby like to request that my account be transferred to IB/Partner/Affiliate code [SAShares Code]. Furthermore, I would hereby like to request to be assigned under the mentioned IB regardless of whether my account falls under an umbrella or parent IB.”

Step 2: Create an Additional Trading Account

Once you receive confirmation of the transfer from XM, you can create an additional trading account.

Step 3: Contact SAShares

Lastly, you can send your Trading or Client ID to [SAShares].

For Example:

To: [SAShares]

Subject: New XM Rebate Application

“Dear SAShares Team,

Please view my XM Client ID: 12345 (Your Account, Client, or Trading ID] and inform me whether my rebate application has been accepted.”

Number of Traders participating in XM Cashback Rebates

XM has a massive customer base of over 5 million. However, it is unclear how many of these registered traders currently participate in XM’s cashback rebates.

Understanding Forex Trading Rebates: How They Work with XM

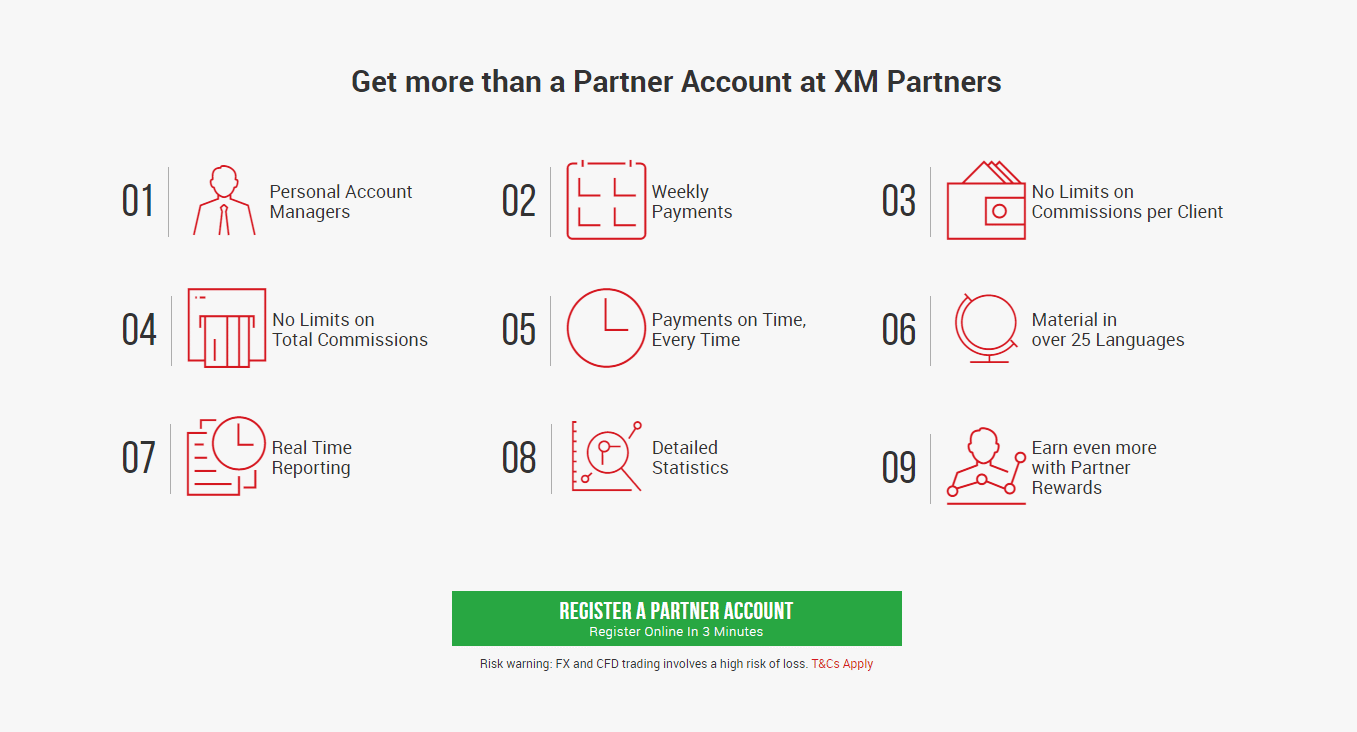

The XM Partners program is a partnership initiative launched by XM, a well-known Forex broker. Here are some of their rebate program’s most important features and benefits:

- ✅ XM provides a competitive rebate of up to $25 per traded lot. This can drastically reduce trading costs for active traders.

- ✅ No Initial Setup Fees: There are no initial setup fees for traders to begin receiving rebates, making it simple to begin.

- ✅ Transmission Between Introducing Broker and Client Account: XM allows for the transmission of funds between Introducing Broker (IB) and client accounts.

- ✅ XM ensures that rebate payments are made on time each time. This dependability is a significant advantage for traders who rely on these rebates.

- ✅ Personal Account Managers: XM offers personal account managers who can communicate in more than 30 languages, ensuring individualized and effective support.

- ✅ No Limits on Commissions: XM imposes no limits on the commissions that can be earned, providing their associates with unlimited earning potential.

- ✅ XM provides support in 25 languages, making it accessible to a global audience.

- ✅ On 2nd-tier Tier Referrals, XM also offers a 10% commission, providing their partners with an additional revenue stream.

Can I earn rebates as an XM client?

No, you cannot earn rebates directly from XM. However, you can earn with a partner or affiliate when you sign up.

Does XM have a sub-affiliate program?

Yes, XM offers a sub-affiliate program with rebates of up to 10% on commissions paid on trades.

XM Rebate Comparison vs. Notable Other Brokers

To view XM’s comprehensive Cashback Rebates Program, we compared it with other notable brokers using the VIP, ECN, or Professional Accounts.

| 🔎 Broker | 🥇 XM | 🥈 ThinkMarkets | 🥉 Axi |

| 📈 Forex | Up to $7.50 per lot | Up to $4.25 | 0.30 pips or up to $1.5 per lot |

| 💡 Energies | Up to $6.50 per lot | Up to $1.943 per contract | $0.02 per lot |

| 🪙 Cryptocurrency | Up to $15 per lot | Up to $5.34 per lot | Up to $2.50 per lot |

| 💎 Precious Metals | Up to $5.50 per lot | Up to $27.32 per lot | $1.50 per lot |

| 📉 Indices | Up to $2.65 per lot | Up to $1.943 per contract | Up to $0.5 per lot |

| 📊 Shares | Up to $3.33 per lot | N/A | Up to $0.01 |

| 🍎 Soft Commodities | Up to $7.50 per lot | N/A | N/A |

XM – Advantages over Competitors / The Benefits of Forex Trading Rebates with XM

Through its Forex trading rebate program, XM offers significant advantages over its competitors and several advantages over its competitors. Here are some of XM’s advantages over its competitors:

- ✅ Generous Rewards: XM believes in generously rewarding its associates. You can earn up to $10 per lot for each customer you refer.

- ✅ No Requotes or Rejections: XM’s execution policy is unparalleled. There are no requotes or rejections, assuring seamless and efficient trading for traders.

- ✅ Negative Balance Protection: XM offers negative balance protection to prevent traders from losing more than their account balance in volatile market conditions.

- ✅ Broad Selection of Trading Platforms: XM provides a broad selection of trading platforms, including MT4/MT5, to meet the requirements of different types of traders.

- ✅ Reduced Transaction Costs: XM’s rebates represent a portion of the transaction cost refunded to the client on every trade. This reduces the spread and increases the win ratio.

- ✅ XM rebates can be remitted directly to the trading account or credited to the rebate balance. These can be withdrawn through various methods, including wire transfer, Skrill, PayPal, and Neteller.

Forex rebates are an effective method of profit enhancement. You can receive compensation for every trade you execute, whether you win or lose.

When was XM established?

XM was founded in 2009 by Constantinos Cleanthous.

Who regulates XM?

XM is regulated by the FSCA in South Africa (Key Way Financial Pty Ltd), IFSC in Belize (XM Global Limited), ASIC in Australia (Trading Point of Financial Instruments Pty Ltd), CySEC in Cyprus (Trading Point of Financial Instruments Ltd), and DFSA in Dubai (Trading Point MENA Limited).

Geolocation of Traders

Most of XM’s market share is concentrated in these areas:

- ✅ Thailand – 23.37%

- ✅ Philippines – 9.84%

- ✅ Colombia – 9%

- ✅ India – 6.22%

- ✅ Egypt – 6.09%

XM’s Current Expansion Focus

- ✅ XM has one of the world’s largest customer bases, focusing on Africa, Asia, Europe, and Australia.

Countries not accepted by XM

XM restricts the following countries from service:

- ❎ The Islamic Republic of Iran

- ❎ The United States

- ❎ Canada

- ❎ Israel

Popularity among traders who choose XM

- ✅ XM is a large and reputable forex and CFD broker that ranks in the Top 10 in the industry.

Detailed Summary of XM

| 🔎 Headquartered | Belize |

| 🌎 Global Offices | Belize, South Africa, Australia, Cyprus, Dubai |

| 📌 Year Founded | 2009 |

| 📍 Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

| ⛔ Regional Restrictions | The United States, Canada, Israel, the Islamic Republic of Iran |

| ☪️ Islamic Account | ✅ Yes |

| 🆓 Demo Account | ✅ Yes |

| ⏰ Non-expiring Demo | ✅ Yes |

| 🕰️ Demo Duration | Unlimited, but inactive accounts expire after 90 days |

| 🔟 Retail Investor Accounts | 4 |

| 📈 PAMM Accounts | No |

| 📉 Liquidity Providers | Unknown |

| 📊 Affiliate Program | ✅ Yes |

| ▶️ Order Execution | Market, Instant |

| ⏩ OCO Orders | No |

| 🫰🏻 One-Click Trading | ✅ Yes |

| 🅰️ Scalping Allowed | ✅ Yes |

| 🅱️ Hedging Allowed | ✅ Yes |

| 📰 News Trading Allowed | ✅ Yes |

| 💹 Expert Advisors (EAs) Allowed | ✅ Yes |

| 📌 Trading API | None |

| 📍 Starting spread | From 0.0 pips |

| 💴 Minimum Commission per Trade | From $1 per share |

| ✴️ Decimal Pricing | 5th decimal pricing after the comma |

| *️⃣ Margin Call | 50% to 100% (EU) |

| ⛔ Stop-Out | 20% to 50% (EU) |

| ⬇️ Minimum Trade Size | 0.01 lots |

| ⬆️ Maximum Trade Size | 100 lots |

| 🪙 Crypto trading offered | ✅ Yes |

| 👤 Dedicated Account Manager | None |

| 📈 Maximum Leverage | 1:888 |

| 📉 Leverage Restrictions | None |

| 💴 Minimum Deposit (USD) | $5 |

| 💵 Deposit Currencies | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| 💶 Account Base Currencies (All) | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| 👥 Active XM customers | 5 million+ |

| ⏰ Minimum Withdrawal Time | 1 working day |

| 🕰️ Maximum Estimated Withdrawal Time | 5 working days |

| 💳 Instant Deposits and Instant Withdrawals | ✅ Yes |

| 🔁 Segregated Accounts | ✅ Yes |

| 💻 Trading Platform Time | UTC +03:00 |

| 🖥️ Observe DST Change | Yes |

| ➡️ DST Change Time zone | Eastern European Time (EET) |

| 🔊 Customer Support Languages | Multilingual |

| 📈 Copy Trading Support | ✅ Yes |

| 📉 Customer Service Hours | 24/7 |

| 🎁 Bonuses and Promotions | ✅ Yes |

| 🖍️ Education for beginners | ✅ Yes |

| 💻 Proprietary trading software | None |

| 💝 Is XM a safe broker for traders | ✅ Yes |

| 🔟 Rating for XM | 9/10 |

| 💯 Trust score for XM | 90% |

Advantages that XM has over Competitors

XM has the following advantages over its competitors:

- ☑️ XM guarantees that 99.35% of all orders are completed instantly, and there are no requotes.

- ☑️ There is no markup on narrow market spreads.

- ☑️ XM is well-regulated and offers client fund protection.

- ☑️ XM is a MetaTrader-only broker with an innovative iOS and Android app.

- ☑️ Traders can register Micro Accounts that allow for smaller trading positions.

- ☑️ Traders can expect comprehensive market analysis and several trading tools.

- ☑️ Negative balance protection is offered to retail accounts.

and much, MUCH more!

Who will Benefit from Trading with XM?

All XM users have access to the numerous account types provided by XM. However, as there is a modest learning curve associated with MT4 and MT5, it is strongly suggested that traders have prior trading expertise or sign up for an XM non-expiring demo account before trading with XM.

Does XM offer support to affiliates?

Yes, XM offers dedicated affiliate managers.

When does XM credit rebates?

Rebates are credited monthly to affiliates.

Number of Traders participating in XM Cashback Rebates / Real-Life Examples:

XM has a massive customer base of over 5 million. XM offers a lucrative rebates program for affiliates and sub-affiliates, and here are some examples.

Enzo Mejia

Enzo is a high-volume trader transacting 1,000 lots per month. With XM’s rebate program offering $25 per lot, he could receive monthly rebates up to $25,000 (1,000 lots * $25 per lot). This substantial rebate can significantly reduce his trading expenses and boost his net profit.

Additionally, Enzo can earn an extra 10% commission on second-tier referrals if he refers other traders to XM, further enhancing his earnings.

Georgia Bridges

Georgia is a part-time trader executing 10 lots per month. Through XM’s $25 per lot rebate program, she could receive a monthly rebate of up to $250 (10 lots * $25 per lot). This rebate can effectively lower her trading expenses and increase her net profit.

Brendon Stark

Brendon actively trades 100 lots of currency per month. With XM’s rebate program offering $25 per lot, he can potentially receive up to $2,500 (100 lots * $25 per lot) in monthly rebates.

This considerable rebate can significantly impact his overall profitability, especially if he trades with narrow margins.

Does XM offer a rebate calculator?

No, XM does not offer a calculator for rebates. Therefore, traders must use third-party calculators.

Where can I find XM’s rebate payment schedule?

XM’s rebate payment schedule will be available to affiliates who receive rebates. Therefore, traders who sign up via XM partners must consult their manager or contact their rebate service about payment schedules.

XM Regulation and Safety of Funds

XM Global Regulations

| 🔎 Registered Entity | 🌎 Country of Registration | 📌 Registration Number | 📍 Regulatory Entity | 📈 Tier | 📉 License Number/Ref |

| 1️⃣ XM Global Limited | Belize | N/A | IFSC | 3 | 000261/158 |

| 2️⃣ Key Way Financial (Pty) Ltd | South Africa | 2018/527968/07 | FSCA | 2 | 49976 |

| 3️⃣ Trading Point of Financial Instruments Pty Ltd | Australia | ABN 32 164 367 | ASIC | 1 | AFSL 443670 |

| 4️⃣ Trading Point of Financial Instruments Ltd | Cyprus | N/A | CySEC | 2 | 120/10 |

| 5️⃣ Trading Point MENA Limited | Dubai | N/A | DFSA | 2 | F003484 |

How XM Protects Traders and Client Funds

| 🔎 Security Measure | 📍 Information |

| 🔒 Segregated Accounts | ✅ Yes |

| 🔏 Compensation Fund Member | ✅ Yes |

| 🔐 Compensation Amount | €20,000 or 90% of the covered investors' claim, whichever is lower. |

| 🔓 SSL Certificate | ✅ Yes |

| 🔒 2FA (Where Applicable) | ✅ Yes |

| 🔏 Privacy Policy in Place | ✅ Yes |

| 🔐 Risk Warning Provided | ✅ Yes |

| 🔓 Negative Balance Protection | ✅ Yes |

| 🔒 Guaranteed Stop-Loss Orders | ✅ Yes |

Does XM use “Know Your Customer” to verify traders?

Yes, all new traders who register an account must prove their residential address and identity before starting trading.

Is XM a safe broker?

Yes, XM is well-regulated and has a trust score of 90%.

Successful Traders Benefiting from XM’s Rebates – XM’s Forex Trading Rebates Empowering Retail Traders for Success

For many retail traders, XM’s Forex Trading Rebates program has been a game-changer, allowing them to reduce their trading costs and increase their profitability. Here’s how XM’s rebates can enable success for retail traders:

- ✅ Trading Cost Reduction is the most immediate advantage of XM’s rebates. When a trader opens a position, they must pay a spread or commission. The rebates offered by XM return a portion of these costs to the trader, effectively reducing trading costs. This can impact a trader’s bottom line, particularly for high-volume traders.

- ✅ XM’s rebates can increase a trader’s profitability by reducing trading expenses. Even if traders break even on their transactions, they can still profit from rebates.

- ✅ Risk Mitigation XM’s reimbursements can also function as a risk mitigation mechanism. In volatile markets, the rebates a trader obtains can assist in offsetting any losses incurred.

The rebates a trader receives can be used to augment their trading capital. This can enable traders to establish larger positions or more transactions, increasing their prospective profits. XM also offers a 10% referral commission on second-tier referrals. Therefore, traders can earn additional income by referring other traders to XM.

XM Awards and Recognition

According to XM’s website, the company has been recognized for the following honors in recent years as a broker:

- ✅ Best Crypto CFDs (2022), awarded by the Financial Expo in Egypt.

- ✅ Best FX Service Provider (2022), awarded by the City of London Wealth Management Awards.

- ✅ Best Customer Support (2022), awarded by CFI.co.

Finally, XM was awarded the Best Forex Trading Support (2022), by the Global Forex Awards in the Retail category.

How to Maximize Your Savings/Profits with Forex Trading Rebates at XM

To maximize your savings or profits with XM’s Forex Trading Rebates, you must combine strategic trading with fully utilizing the rebate program. Here are some tips:

- ✅ Refer Other Traders to XM and receive a 10% referral commission. Thus, you can generate additional income by referring other traders to XM. This can be a significant source of supplemental income if you have a large network of traders.

- ✅ To maximize your savings or profits with XM’s Forex Trading Rebates, you must combine strategic trading with fully utilizing the rebate program. Here are some tips:

- ✅ Utilize Rebates to Improve Your Trading Capital: You can use rebates to improve your trading capital. This may enable you to establish larger positions or more transactions, increasing your profits.

- ✅ Withdraw Your Rebates Regularly: Be careful to extract your rebates regularly. This ensures that your rebates always generate additional trading capital or profits.

- ✅ Some currency pairings may provide greater rebates than others. Consider trading these combinations if feasible to maximize your rebate earnings.

- ✅ Increase Your Volume of Trades: The more you trade, the more rebates you can earn. This can reduce your trading costs and increase your net profit if you are a high-volume trader. It is essential to remember, however, that trading involves risk, and you should never trade more than you can afford to lose.

Keep track of the rebates you are accumulating. This can help you determine how much you save on trading costs and how much additional profit you generate. XM may occasionally offer promotions or adjust its rebate program. Keeping abreast of these alterations will allow you to maximize your rebate earnings.

XM Account Types and Features

XM provides a variety of trading accounts for all sorts of investors, ranging from Micro accounts to Zero accounts with varying executions and prices. The entry-level account is the XM Micro account, provided by XM Global Limited and organizations licensed in Cyprus and Australia.

| 🔎 Live Account | 💴 Minimum Dep. | 🔁 Average Spread | 🪙 Commissions | 💶 Average Trading Cost |

| 🥇 Micro | $5 | 1 pip | None | 10 USD |

| 🥈 Standard | $5 | 1 pip | None | 10 USD |

| 🥉 XM Ultra-Low | $5 | 0.6 pips | None | 6 USD |

| 🏅 Shares | $10,000 | Per exchange | From $1 | N/A |

XM Micro Account

The XM Micro account is ideal for inexperienced traders who want to evaluate their trading techniques on the currency markets with a minimal initial deposit since 1 lot on the Micro account is just 1,000 currency units (compared to the 100,000 currency units of a standard lot).

| 📌 Account Feature | 📍 Value |

| 💴 Base Currency Options | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| 📈 Position Size | 1,000 base currency units = 1 Lot |

| 📉 Negative Balance Protection Applied | ✅ Yes, to all retail accounts |

| 📊 The average spread on all major forex pairs | 1 pip EUR/USD |

| 📌 Commission charges | None |

| 📍 Maximum open or pending orders per trader | 300 lots |

| 4️⃣ Minimum trade volume MetaTrader 4 | 0.1 lot |

| 5️⃣ Minimum trade volume MetaTrader 5 | 0.1 lot |

| 🅰️ Hedging allowed | ✅ Yes |

| 🅱️ Lot Restrictions per trade | 100 lots |

| ☪️ Is an Islamic Account offered | ✅ Yes |

| 💵 Minimum Deposit Requirement | $5 |

XM Standard Account

The XM Standard account is offered by all Group entities and is intended for investors who want to trade simply using the bid and ask prices without additional fees.

| 📌 Account Feature | 📍 Value |

| 💴 Base Currency Options | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| 📈 Position Size | 100,000 base currency units = 1 Lot |

| 📉 Negative Balance Protection Applied | ✅ Yes, to all retail accounts |

| 📊 The average spread on all major forex pairs | 1 pip EUR/USD |

| 📌 Commission charges | None |

| 📍 Maximum open or pending orders per trader | 300 lots |

| 🅰️ Minimum trade volume | 0.1 lot |

| 🅱️ Hedging allowed | ✅ Yes |

| 💹 Lot Restrictions per trade | 50 lots |

| ☪️ Is an Islamic Account offered | ✅ Yes |

| 💵 Minimum Deposit Requirement | $5 |

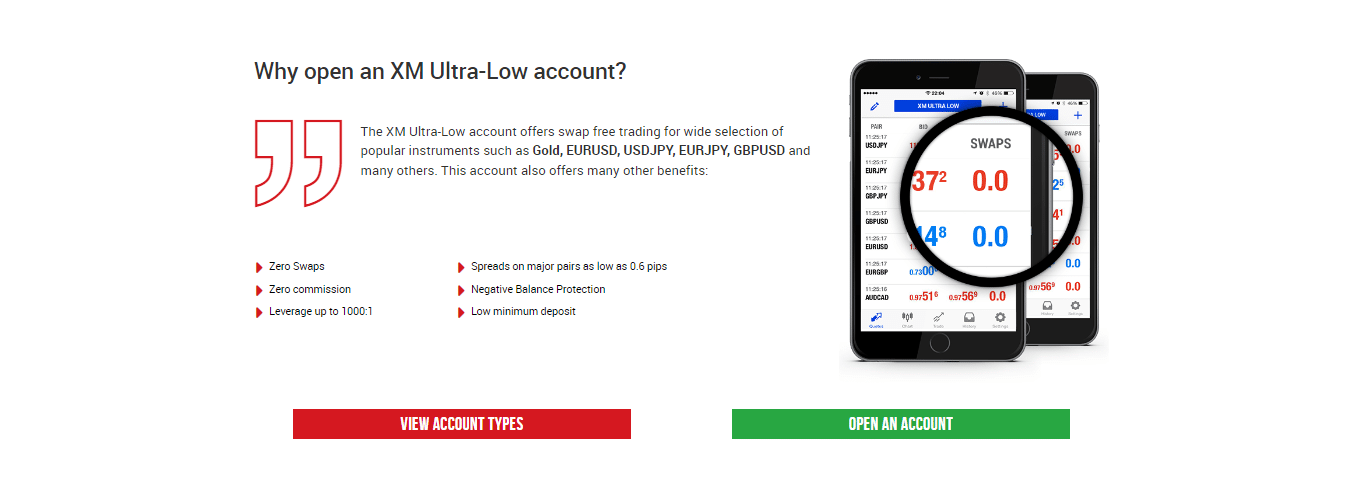

XM Ultra-Low Account

The XM Ultra Low account is more aggressively priced, particularly for trading currency pairs, with spreads as low as 0.6 pip and no commissions. Unfortunately, the Ultra-Low account is unavailable with the body regulated by the Cyprus CySEC.

| 📌 Account Feature | 📍 Value |

| 💴 Base Currency Options | EUR, USD, GBP, AUD, ZAR, SGD |

| 📈 Negative Balance Protection Applied | ✅ Yes, to all retail accounts |

| 📉 The average spread on all major forex pairs | 0.6 pips EUR/USD |

| 📊 Commission charges | None |

| 🅰️ Maximum open or pending orders per trader | 300 lots |

| 🅱️ Hedging allowed | ✅ Yes |

| ☪️ Is an Islamic Account offered | ✅ Yes |

| 💵 Minimum Deposit Requirement | $5 |

XM Shares Account

The XM Shares account is the stock trading account for the broker. Investors may own a piece of global corporations and banks and get dividends according to the number of their investments in their trading accounts.

XM offers the Shares account with no leverage, and trading may be conducted using the MT5 interface. Furthermore, the Shares account is exclusive to entities regulated by the Belize FSC.

| 📌 Account Feature | 📍 Value |

| 💴 Base Currency Options | USD |

| 📈 Position Size | 1 Share |

| 📉 Maximum Leverage Ratio | None |

| 📊 Negative Balance Protection Applied | ✅ Yes, to all retail accounts |

| ⏩ The average spread on all major forex pairs | According to the exchange |

| 💶 Commission charges | From $1 per share |

| 📌 Maximum open or pending orders per trader | 50 lots |

| 📍 Minimum trade volume | 1 lot |

| 🅰️ Hedging allowed | No |

| 🅱️ Lot Restrictions per trade | It will depend on each share |

| ☪️ Is an Islamic Account offered | ✅ Yes |

| 💵 Minimum Deposit Requirement | $10,000 |

XM Demo Account

Traders can evaluate XM and its products and services in real-world circumstances with a risk-free demo account, as the trial account is guaranteed to be like a real account.

New traders can easily hone their abilities using an XM demo account to trade virtual currency without jeopardizing their funds.

Furthermore, by opening a free, permanent demo account, traders can try the XM trading interface and the broker’s pricing on various forex, indices, stocks, and commodities in a risk-free environment.

Traders must note that while the XM demo account is unlimited, the account will expire if the account is dormant for 3 months.

XM Islamic Account

XM allows its clients to use either the MetaTrader 4 or MetaTrader 5 trading platforms.

Trading Point of Financial Instruments Ltd. (Cyprus) account holders can also select from three different trading accounts: the Micro Account, the Standard Account, and the Ultra-Low Account.

Moreover, XM offers an Islamic Account option for each account type. As a bonus for Muslim traders, XM does not impose additional fees on Islamic accounts. This is not a customary practice since most brokers charge an administrative fee for Islamic accounts rather than swaps.

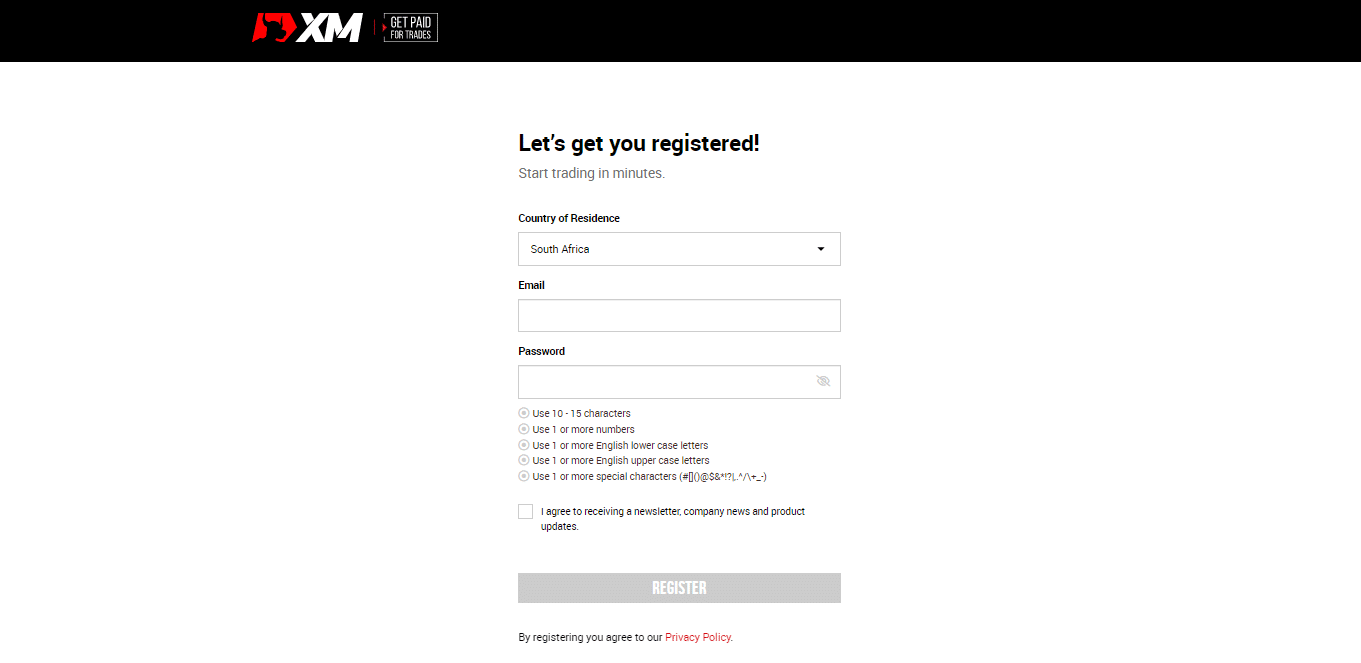

How to open an Account with XM

To register a live trading account with XM, you can follow these steps:

- ☑️ You may create an XM account by going to their website and clicking the “Open an Account” link.

- ☑️ Find the account type you are interested in opening and fill out the application form. You will be asked to provide your name, email address, chosen base currency, and leverage.

- ☑️ Please provide the necessary documents to verify your account. Depending on the laws in your area, they can include a photocopy of your government-issued identification card, an invoice showing your current address, and other paperwork.

- ☑️ Add money to your account by selecting a payment type and then depositing. XM allows several payment types, including major credit cards, debit cards, bank transfers, and electronic wallets.

- ☑️ You can start trading with XM after your account has been financed and validated. The platform provides a few trading tools and information, including charts, technical indicators, and an economic calendar, to help you study the markets and make educated trading choices.

Traders must note that the criteria and methods for creating a trading account with XM vary according to the country in which you are situated.

Does XM have a Cent Account?

No, XM does not have a Cent Account. However, XM offers a Micro account where 1,000 base currency units equal one lot.

What are XM’s account-based currencies?

You can register an account with XM in USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, and ZAR.

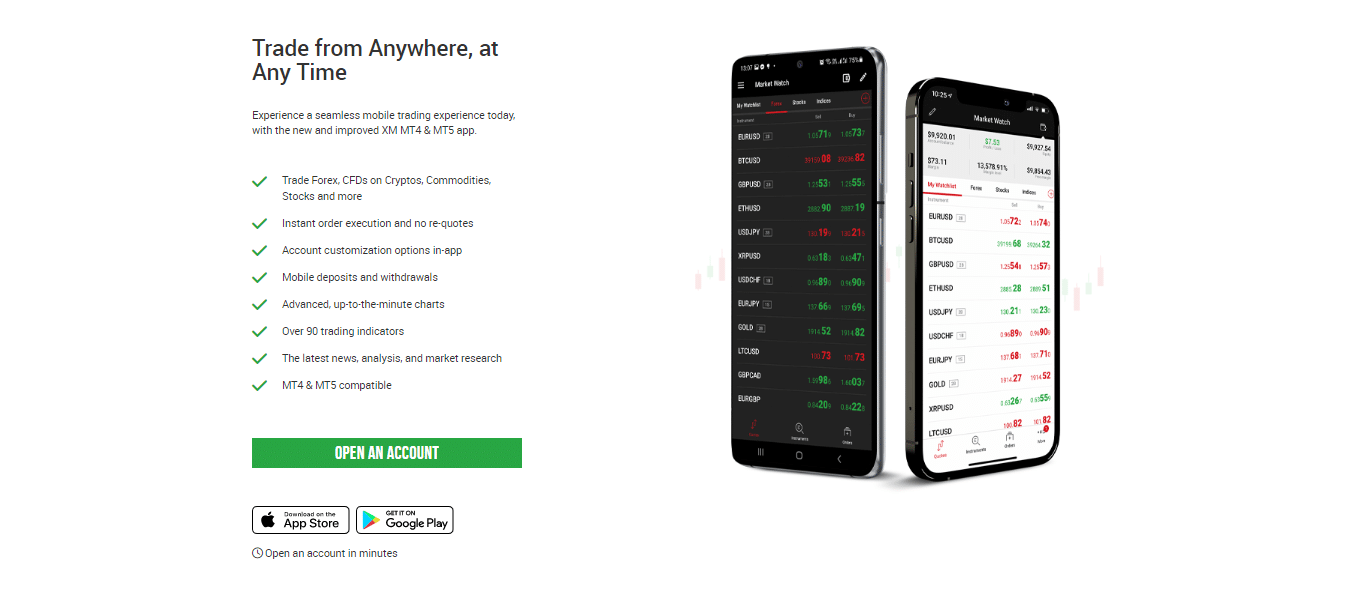

XM Trading Platforms

XM offers traders a choice between these trading platforms:

- ✅ MetaTrader 4

- ✅ MetaTrader 5

- ✅ XM Mobile App

Regardless of the trading style or asset class, all XM customers will find a suitable home on the XM MT4 or MT5 platforms. Traders can use many innovative tools and features, as well as higher levels of support and autonomy, on these sophisticated but approachable platforms.

The XM mobile trading application is compatible with iPads, iPhones, and other iOS and Android-powered devices. Furthermore, this proprietary app has some of these unique features:

- ✅ All types of traders can use this high-tech, custom-made instrument.

- ✅ More than a thousand instruments are accessible for trading through the application’s user interface.

- ✅ Orders are fulfilled immediately and without requoting.

- ✅ Utilize the application’s options to fine-tune your trading profile.

- ✅ The capacity to see current, up-to-date charts.

- ✅ Over 90 distinct technical indicators are accessible.

- ✅ Access without restriction to the latest publications, research, and market analysis.

By integrating the XM app with MetaTrader 5, you might have access to additional features and advantages on the platform.

Can I trade Forex on the XM App?

Yes, the XM App offers several features, including trading Forex and other instruments.

Does MetaTrader offer advanced charting with XM?

Yes, XM’s MetaTrader suite offers advanced charting and other advanced features.

Which Markets Can You Trade with XM?

Traders can expect the following range of markets from XM:

- ☑️ Forex

- ☑️ Cryptocurrencies

- ☑️ Stock CFDs

- ☑️ Commodities

- ☑️ Equity Indices

- ☑️ Precious Metals

- ☑️ Energies

- ☑️ Individual Shares

Financial Instruments and Leverage offered by XM

| 🔎 Instrument | 📌 Number of Assets Offered | 📍 Max Leverage Offered |

| 📈 Forex | 57 | 1:888 |

| 💎 Precious Metals | 2 | 1:400 |

| 📉 Stock CFDs | 1,291 | 1:10 |

| 📊 Indices | 14 | 1:200 |

| 📌 Individual Shares | 100+ | 1:10 |

| 🪙 Cryptocurrency | 31 | 1:250 |

| 💡 Energies | 5 | 1:67 |

| 🍎 Commodities | 10 | 1:50 |

Can I trade real shares with XM or only CFDs?

Yes, XM offers individual share trading on top exchanges in addition to Stock CFDs.

Can I trade US Oil with XM?

Yes, XM offers US Oil under “WTI Oil” as cash and futures CFDs, with spreads from 0.03 pips.

XM Trading and Non-Trading Fees

Spreads

The spreads charged by XM vary depending on the account type and the traded asset. For instance, spreads for micro accounts may begin at 1 pip for prominent currency pairings such as EUR/USD, while spreads for regular accounts may begin at 0.6 pip for the same currency pairs.

Spreads for the ultra-low account could begin at 0 pips for key currency pairings; nevertheless, a fee may be levied for each transaction.

Notably, the spreads given by XM are changeable and subject to change, dependent on market circumstances. For example, during extreme volatility or little liquidity, spreads can also widen. In addition, XM provides various other trading products, including indices, commodities, and equities, which can have variable spreads based on the asset being traded.

Traders must comprehend the spreads and other fees connected with each asset since they might impact their total trading expenses and profitability.

Commissions

The commission fees may vary based on the kind of account and the exchanged item. For instance, micro and standard accounts may not impose fees on forex and CFD transactions.

However, Ultra-Low accounts can impose a fee on each transaction, which can vary according to the underlying asset. The Ultra-Low account is intended for traders who want to take advantage of XM’s narrow spreads without incurring commission fees.

Overnight Fees, Rollovers, or Swaps

To determine the cost of holding an overnight position with XM, traders in traders must consider numerous factors, such as the type of financial instrument being traded, the direction of the position (long or short), the amount of money involved, and so on.

These variables can affect the overall trading costs and profitability of the position. Traders must understand and consider these factors when trading with XM. Below are some of the typical overnight fees that traders can expect with XM:

| ➡️ Instrument | 🔁 Long Swap (Buy) | ↪️ Short Swap (Sell) |

| 💴 AUD/CAD | -3.93 pips | -3.4 pips |

| 💵 AUD/CHF | -1.24 pips | -4.04 pips |

| 💶 CHF/JPY | -7.17 pips | -3.07 pips |

| 💷 AUD/USD | -2.34 pips | -1.54 pips |

| 💴 EUR/USD | -5.43 pips | -0.83 pips |

| 💵 GBP/CAD | -5.9 pips | -8.3 pips |

Deposit and Withdrawal Fees

XM does not charge deposit or withdrawal fees.

Inactivity Fees

After one year of inactivity, there is a one-time maintenance cost of $15, followed by a monthly fee of $5 if the account continues inactive.

Currency Conversion Fees

XM will charge currency conversion fees when deposits and withdrawals are made in currencies that differ from the account-based currency.

XM Deposits and Withdrawals

XM offers the following deposit and withdrawal methods:

- ✅ Credit Card

- ✅ Debit Card

- ✅ Bank Wire Transfer

- ✅ Local Bank Transfer

- ✅ Skrill

and many more.

How to Deposit Funds with XM

To deposit funds to an account with XM, traders can follow these steps:

- ✅ Click the “Deposit” button in the “Account” section of the trading site after logging into your XM account.

- ✅ Choose your desired payment method from the available choices. Among the payment options accepted by XM are credit/debit cards, bank transfers, and e-wallets.

- ✅ Enter the desired deposit amount and other relevant information, such as your card or bank account details.

- ✅ Examine the deposit information and then confirm the transaction.

Until the monies are deposited to your XM account, you must wait. The processing time for deposits might vary based on the selected payment type.

XM Fund Withdrawal Process

To withdraw funds from an account with XM, traders can follow these steps:

- ✅ Click the “Withdraw” button in the “Account” section of the trading site after logging into your XM account.

- ✅ Choose your desired payment method from the available choices. XM permits withdrawals with the same payment methods that may be used to make contributions.

- ✅ Enter the amount you want to withdraw, and any further information requested, such as your card number or bank account information.

- ✅ Examine the withdrawal information and then confirm the transaction.

Await the transmission of money to your selected payment method. The processing time for withdrawals may vary based on the selected payment method and any extra security checks that may be necessary.

How long does XM take to process withdrawals?

All withdrawals are processed within 24 hours by the XM back office.

Does XM offer PayPal?

No, XM does not offer PayPal but offers Credit/Debit Cards, Bank Wire Transfers, Neteller, Skrill, and several others.

Calculating Forex Trading Rebates with XM

XM’s Forex trading rebate calculations are straightforward. XM offers a rebate of up to $25 per lot. A “lot” typically refers to 100,000 units of the basic currency in forex transactions. Therefore, if you trade 1 unit, you could receive a rebate of up to $25.

Here is a simple formula to calculate your potential rebate:

- ✅ Number of Lots Traded x Rebate per Lot = Total Rebate

- ✅ For example, if you trade 10 lots in a month, your potential rebate would be:

- ✅ 10 Lots x $25/Lot = $250

Does XM offer commission-free trading?

Yes, XM offers commission-free trading on the Micro, Standard, and XM Ultra-Low Accounts.

Is XM a market maker broker?

Yes, XM is a Market Maker or Dealing-Desk (DD) broker. Market Makers create a market for their clients and provide continuous buy and sell quotes for financial instruments.

Claiming and Withdrawing Forex Rebates at XM

With XM, claiming and withdrawing your Forex rebates is also a simple process as follows:

- ✅ XM credits rebates directly to your trading account. In your account’s dashboard, you can view your rebates.

- ✅ You might need to obtain your rebates if they are not automatically deposited into your trading account. It is recommended to consult the specific instructions provided by XM for this procedure, as they can vary.

Once your rebates have been deposited into your account, you can withdraw them. You must submit a withdrawal request via the account dashboard to accomplish this. XM provides various withdrawal options, such as bank transfer, credit/debit card, and online payment systems like Skrill and Neteller.

XM Education and Research

Education

XM offers the following Educational Materials:

- ✅ XM Live

- ✅ Live Education

- ✅ Live Education Schedule

- ✅ Educational Videos

- ✅ Forex Webinars

- ✅ Platform Tutorials

- ✅ Forex Seminars

Research

XM offers traders the following Research and Trading Tools:

- ✅ Trading Tools

- ✅ MQL5

- ✅ Forex Calculators

- ✅ Markets Overview

- ✅ News Feed

- ✅ XM Research

- ✅ Trade-Ideas

- ✅ Technical Summaries

- ✅ Economic Calendar

- ✅ XM TV

- ✅ Podcasts

and much more.

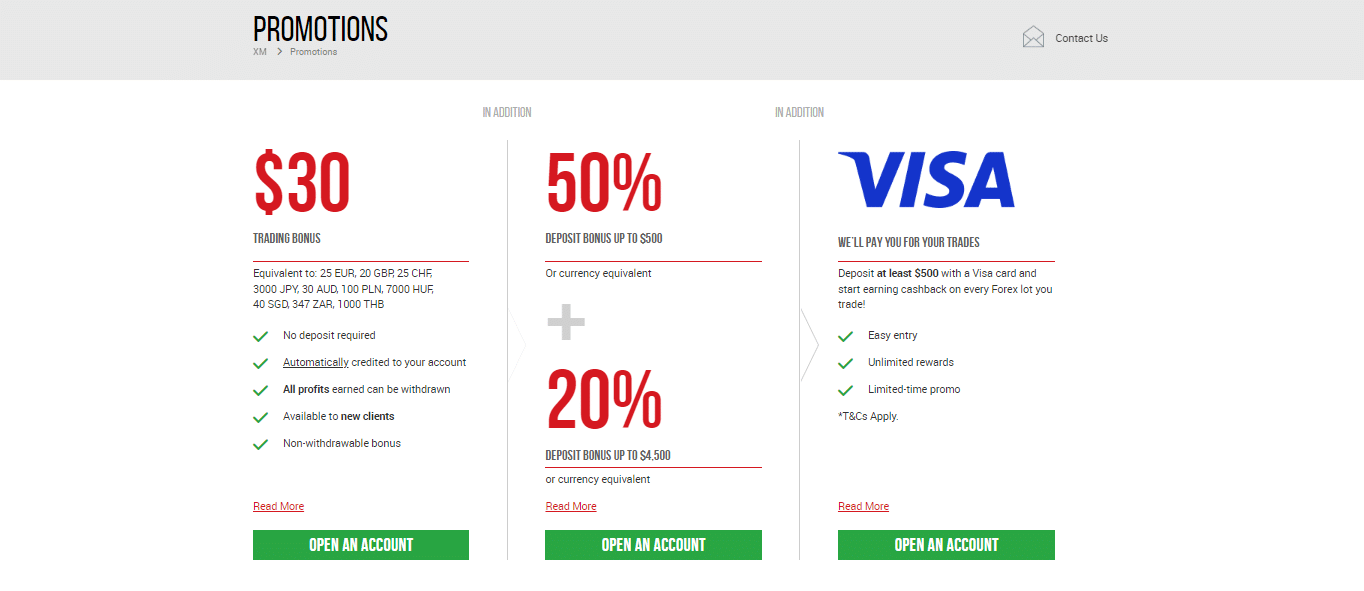

XM Bonuses and Current Promotions

XM offers several promotions and incentives to attract new traders to the platform and to reward current customers and traders.

The following assets are accessible to traders:

- ✅ Current customers may enter “Trade and Win” contests and events.

- ✅ Referral Program and Loyalty Bonus for XM Radio.

- ✅ XM Gala Event 2022, where traders can win over $30,000 in prizes.

- ✅ Deposits and withdrawals of up to $200 made using major credit cards, electronic payment providers, or bank wire transfers are fee-free for eligible consumers.

The trader’s account will be credited with $30 whether a deposit is made. In addition, the trader can get a 50% deposit bonus and a 20% deposit bonus for up to $4,000.

Does XM have a sign-up bonus?

Yes, XM has a sign-up bonus of 30 USD that does not require an initial deposit.

Can I withdraw my deposit bonus from XM?

No, you cannot withdraw the deposit bonus. This bonus can only be used as trading credit. However, profits made while using this bonus can typically be withdrawn.

How to open an Affiliate Account with XM

To register an Affiliate Account with XM, traders can follow these steps:

- ✅ Navigate to the XM website and choose the “Affiliates” option.

- ✅ Click “Join Now” and then complete the online application form. You must give personal and contact data and choose your chosen payment method and account currency.

- ✅ XM must first evaluate and approve your application. This procedure might take many days.

- ✅ After your application has been accepted, you will have access to the affiliate dashboard and promotional materials, such as banners and links, that you may use to promote the platform.

Start advertising XM to your audience and get money for each new customer you introduce to the platform. Depending on the kind of recommendation and the number of customers you refer, XM can provide varying compensation rates and payment periods.

XM Affiliate Program Features

XM offers a comprehensive Partner Program for affiliates with countless benefits and features. These include:

- ✅ Attractive commission rates of up to $25 per lot for referred clients.

- ✅ The ability to transfer funds between IB and client accounts at no additional cost and no restrictions on earning potential.

- ✅ The Partner Program also offers a high percentage of client retention, no weekly limits on commission earnings, fast pay-outs, and access to a Personal Account Manager.

- ✅ XM regularly runs contests and offers ongoing discounts and rewards to encourage new client acquisition and increased trading volume, as well as providing various promotional materials and real-time data and analytics.

The platform is also committed to maintaining client security and the protection of client funds. In addition, it offers a sub-partner program that allows affiliates to earn additional income and incentives through their affiliate marketing activities.

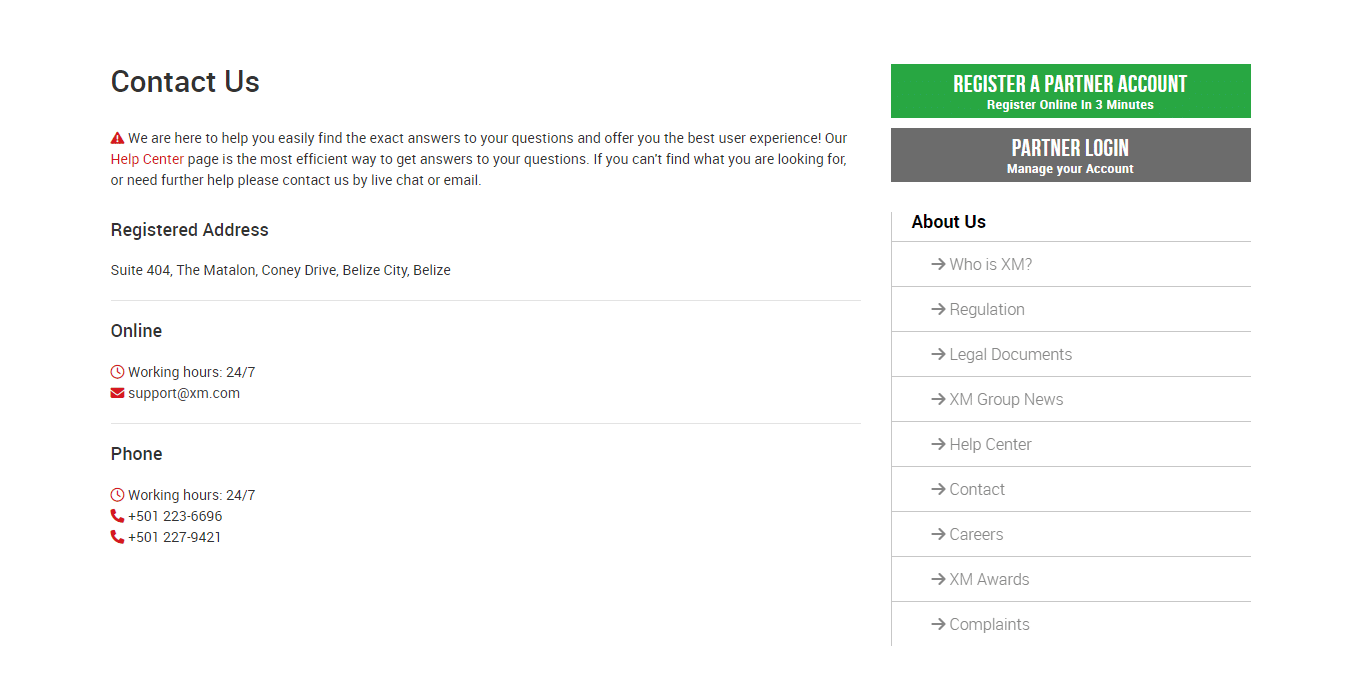

XM Customer Support

XM is a forex and CFD trading platform that provides its customers with many avenues for contacting customer service. The channels and operation hours could differ depending on the client’s location. Customers can reach XM customer assistance through the following channels:

- ✅ Live Chat is a handy and speedy method for contacting XM customer service since it lets you connect with a person in real-time.

- ✅ XM offers its customers a dedicated telephone support line. The exact quantity can differ according to the area in which you reside.

- ✅ You can email XM customer service using the website’s contact form or the email address given for your region.

- ✅ XM maintains a strong presence on social media sites, including Twitter and Facebook, via which you may communicate with the customer service staff.

Customer service for XM is available throughout the platform’s business hours, which can vary by region and market circumstances. Furthermore, before trying to call customer care, it is vital to verify the business hours for your region.

In addition to these channels, XM’s website has a comprehensive FAQ section that covers various subjects and may give answers to frequently asked questions and difficulties.

Can I contact XM over public holidays?

No, XM’s customer support only operates during business days.

How long does it take XM to respond to emails?

XM can take a few hours up to 1 business day to respond to emails, depending on when they were sent.

XM Corporate Social Responsibility

Recently, XM and MyCARE collaborated on a disaster relief effort in Malaysia to assist those affected by the December 2021 floods that devastated major portions of the nation. MyCARE is a charitable organization recognized by the United Nations Economic and Social Council for supporting low-income families. XM has also supported Plan Korea, a Korean children’s charity focused on improving the lives of children and promoting gender equality and opportunities.

Furthermore, XM has assisted youth in developing nations and collaborated with other humanitarian organizations to improve the quality of life for those in need.

In addition, XM has worked with the UN Refugee Agency (UNHCR) as part of the agency’s emergency response strategy for unaccompanied refugee children entering Greece. Furthermore, XM has collaborated with Malaysia’s Bendera Putih initiative to aid those in need during the COVID-19 pandemic.

In July 2021, XM sent 300 food boxes to the Bendera Putih project and then worked with De. Wan restaurant to provide an additional 250 take-out meal boxes for those who did not have the financial means to buy food daily.

XM Alternatives

- 🥇 GO Markets – GO Markets is a corporation that provides a variety of financial goods and services. Through its proprietary platform, MetaTrader 4, GO Markets provides various trading products, including forex, indices, commodities, and cryptocurrencies. The platform is accessible through desktop, online, and mobile devices and provides traders with various tools and features, including sophisticated charting, expert advisers, and market analysis.

- 🥈 HFM – HFM has been in operation for more than a decade and is a well-regulated forex and CFD broker for traders. HFM offers over 1,000 CFD instruments and supports all types of trading strategies.

- 🥉 EasyMarkets is a firm that provides online trading in various financial products. easyMarkets provides its customers with a variety of exclusive features and services, including freeze rate, negative balance protection, commission-free trading, fixed spreads, Trade Insurance, and 24/5 customer support.

XM VPS Review

For a limited time, the XM VPS service is made accessible to all current and new XM customers at even more advantageous terms than before.

Clients with a minimum trading account balance of $500, or its equivalent in other currencies, can request a free VPS from the Members Area at any time, provided they trade at least 2 standard round turn lots or 200 micro round turn lots every month.

When determining eligibility for a free VPS, XM also considers any additional trading accounts that a customer established using the same email address.

Clients who do not match the requirements can still request the XM VPS in the Members Area for a monthly charge of 28 USD, which will be automatically withdrawn from their MT4/MT5 accounts on the first of every calendar month.

The XM VPS enables remote access to a Virtual Private Server (VPS) situated within 1.5 kilometers from the broker’s data center in London and connected through the optical fiber.

This can assure fast trade execution rates through a lightning-fast connection without worrying about other issues that might hinder your ability to trade efficiently, such as internet connection speeds, computer malfunction, or power outages.

Furthermore, you can operate trading platforms 24 hours a day, seven days a week, without requiring your own computer to be on.

XM Web Traffic Report

| 🌎 Global Rank | 6,193 |

| 🚩 Country Rank | 478 |

| ➡️ Category Rank | 7 |

| ↪️ Total Visits | 11.9 million |

| ⚽ Bounce Rate | 65.3% |

| 🔎 Pages per Visit | 2.53 |

| ⏰ Average Duration of Visit | 00:02:07 |

| ❤️ Total Visits in the last three months | September – 11.3 million October – 11.3 million November – 11.9 million |

Legal and Tax Implications: Understanding Forex Trading Rebates with XM

Depending on the jurisdiction and individual circumstances, Forex trading rebates could have legal and financial consequences. It is important to be thoroughly aware of these ramifications to comply with the law and participate in effective financial planning.

Legal Implications

In terms of legal concerns, Forex trading and rebates are lawful in most nations. Nonetheless, you must trade through a licensed broker, such as XM. Regulated brokers are expected to follow rigorous criteria that protect the interests of traders.

Tax Implications

Regarding tax ramifications, the status of Forex trading rebates as taxable income varies across countries. To acquire clarification on the tax consequences of Forex trading rebates in your position, traders must seek guidance from a knowledgeable tax expert or a financial adviser.

Being aware of your tax requirements will enable you to make well-informed choices and manage your money effectively.

Risks and Limitations of Forex Trading Rebates at XM

While Forex trading rebates might be beneficial, there are certain dangers and limits to consider:

- ✅ Trading Risks: Forex trading is inherently risky, and you might lose more than your original investment. Rebates can assist in covering trading expenses but cannot remove trading risks.

- ✅ Limitations on Rebates: The amount of rebate you may receive may be subject to certain restrictions or circumstances. Some brokers, for example, may set a minimum trading volume to qualify for rebates.

Like any other broker, XM has the right to modify the conditions of its rebate program at any moment. It is critical to remain up to date on any program modifications.

Strategies to Maximize Rebates with XM

Here are some other ideas for maximizing your XM rebates:

- ✅ Trade During Peak Hours: Although Forex is a 24-hour market, there are periods when the market is more active and spreads are smaller. Trading during these periods might help you get the most out of your rebates.

- ✅ Use a Trading Strategy That Fits Your Personality: Different trading techniques might lead to varying trade volumes. For example, day trading or scalping tactics sometimes include many transactions, which might enhance rebates.

- ✅ Keep Track of Your Trading Expenses: Regularly review your trading expenses and rebates to maximize your savings.

XM could occasionally provide bonuses that might boost your rebates. Keep up with these promos to get the most out of them.

XM vs. Other Notable Brokers

| 🔎 Broker | 🥇 XM | 🥈 AvaTrade | 🥉 Pepperstone |

| ⏰ Min. Withdrawal Time | 1 working day | 24 to 48 Hours | 1 business day |

| 🔟 Retail Investor Accounts | 4 | 1 | 2 |

| 🕰️ Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 📈 Maximum Trade Size | 100 lots | Unlimited | 100 lots |

| 💴 Min Deposit | $5 | $100 | 200 AUD |

| 🆓 Demo Account | ✅ Yes | ✅ Yes | ✅ Yes |

| ☪️ Islamic Account | ✅ Yes | ✅ Yes | ✅ Yes |

| 📉 Spread | 0.0 pips | Fixed, from 0.9 pips | From 0.0 pips |

| 📊 Commissions | $1 to $9 | None | From AU$7 |

| 🫰🏻 Order Execution | Market, Instant | Instant | Market |

| 💷 Withdrawal Fee | None | None | None |

| 🎁 No-Deposit Bonus | None | None | None |

| 🪙 Cent Accounts | None | None | None |

| 💳 Instant Withdrawals | ✅ Yes | None | None |

| ⌛ Max. Withdrawal Time | 5 working days | Up to 10 days | Up to 7 business days |

XM Pros and Cons

| ✅ Pros | ❎ Cons |

| XM offers over 1,000 CFD and forex instruments | XM charges inactivity fees |

XM Customer Reviews

🥇 Favorite Broker Choice.

I have used other brokers, but XM’s help is my favorite. I have had a few problems in the past, and my Account Manager, Roman, has been the most effective in resolving them all. However, this organization has a great deal more to give; they have introduced new features, indicating that they never settle. – Edwin Hill

🥈 Excellent.

Based on my experience with this organization, I can confidently say that we can do legitimate business using their many services. They value their consumers and provide every opportunity to respect their profile. The website is straightforward, and withdrawals and deposits are processed within the standard timeframe. No troubles at all. – Kenneth Ortiz

🥉 Happy Overall.

From Singapore, I have been using XM for a few months. All my withdrawals were authorized and approved within hours; however, it took two to three days for the funds to reach my bank account. The only issue I had was that they issued me an excess of $50 on one of my transactions and then deducted $50 from my following withdrawal. – Demi Bowen

Recommendation for Improving XM Cashback Rebates

XM could give a clearer reimbursement schedule based on instrument type, account type, and other pertinent data. This would give traders a better idea of how much they can anticipate earning in rebates, allowing them to plan their trading tactics more efficiently.

XM can explore lowering or removing its inactivity fees to make the platform more appealing to traders who prefer a more passive trading technique.

XM’s educational tools can be expanded to provide more thorough information regarding the risks and limits of its rebate program and ways for optimizing rebate earnings.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. This evaluation comprises positives, disadvantages, and an overall score based on our findings. We want to assist you in locating the ideal broker for your requirements. Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Our Verdict on XM

According to our research, XM’s rebates program gives traders a unique chance to economize on trading expenses while generating extra income. It is crucial to remember that the program has its own set of hazards and limits.

However, in our experience, while rebates can assist in covering trading expenses, they cannot remove trading risks. Furthermore, the rebate amount available could be subject to limits or circumstances.

Furthermore, XM, like any other broker, maintains the right to amend the conditions of its reward program at any moment. Therefore, traders must remain updated.

According to our findings, XM provides a diverse variety of trading instruments as well as specialized, multilingual customer service.

In addition, the firm has some of the top trading tools and instructional resources in the market. However, it should be noted that XM imposes inactivity costs, which could detriment certain traders.

XM Frequently Asked Questions

What are forex trading rebates?

Forex trading rebates are a percentage of the trader’s spread or fee returned to their account, lowering their trading expenses.

How do forex trading rebates work with XM?

XM has a rebate scheme that allows traders to earn up to $25 for every lot traded, which is deposited straight to their trading account.

Can I get XM rebates on all types of trades?

XM rebates are normally provided on all sorts of transactions. However, the rebate program’s particular terms and conditions may differ.

How are forex trading rebates credited to my account with XM?

XM pays rebates to the partner or affiliate, who distributes your share directly to your trading account.

Are XM rebates available to traders in all countries?

XM rebates are normally accessible to traders in all countries where XM operates. However, local legislation might often impose limits.

How can I sign up for forex trading rebates with XM?

Register an account with one of XM’s affiliates or partners, verify your details, and meet the monthly trading volume.

How often are XM rebates paid out?

XM usually awards rebates straight to your trading account. However, the frequency might vary depending on variables like your trading volume and the rebate program rules.

Are there any requirements to be eligible for forex trading rebates with XM?

The conditions for receiving forex trading rebates from XM vary but often entail trading a certain number of lots.

Can I combine forex trading rebates with other promotions or bonuses offered by XM?

Yes, you can. Because traders must sign up with an affiliate/partner, they can access XM’s bonuses while earning rebates on trades.

Do XM rebates expire?

XM rebates normally do not expire, but verifying the rebate program’s exact terms and restrictions is always a good idea.

How can I track and monitor my Forex trading rebates with XM?

You can monitor your rebates on your trading account with the XM affiliate or partner you signed up with.

Are forex trading rebates taxable?

Yes, in some regions, they could be considered capital gains. To find out more, we urge traders to speak to a tax specialist for further assistance.

Do XM rebates affect the spread or commission I pay?

The spread or commission you pay is unaffected by XM rebates. They are a partial rebate of the spread or commission you have previously paid.

Can I earn XM rebates using a trading robot or EA?

Yes, even if you use a trading robot or Expert Advisor (EA), you may usually receive XM rebates.

Are there any limitations or restrictions on using forex trading rebates?

There may be limits or restrictions on utilizing forex trading rebates, such as minimum trading volume requirements or special rebate program terms and conditions.

Can I use XM rebates to open new trades?

Yes, you can utilize the rebates you receive to increase your trading capital, enabling you to establish bigger positions or make more transactions.

How much can I earn through forex trading rebates with XM?

The amount you may earn from forex trading rebates with XM is determined by the number of lots traded, with a maximum rebate of $25 per lot offered to affiliates.

Are XM rebates available on demo accounts?

Typically, XM rebates are only given on live trading accounts, not demo ones.